In a stinging critique against the Singapore government in 2010, The Economist had written about how for the Singapore government, “the state’s attitude can be simply put: being poor here is your own fault. Citizens are obliged to save for the future, rely on their families and not expect any handouts from the government unless they hit rock bottom.“

In this article, I will share with you some studies which have revealed how paying the poor higher wages will be beneficial to society as a whole, and how allowing the rich to pay themselves too much can be detrimental.

In the first half of the article, I will quickly show you some basic statistics on the situation of the poor and the rich-poor gap in Singapore. In the second half of the article, I will highlight excerpts from studies to show how the pay structure needs to be adjusted.

As you would know by now, Singapore has the highest poverty rate among the high-income countries as well as many Asian countries – the poverty rate in Singapore is comparable to a Third World country (Chart 1).

Chart 1: The Heart Truths

The income inequality is also severe – Singapore has the highest income inequality among the high-income countries and one of the highest in the world (Chart 2).

Chart 2: An Overview of Growing Income Inequalities in OECD Countries: Main Findings, Key Household Income Trends, 2013

Not only that, even though Singaporeans earn the lowest wages among the high-income countries (Chart 3),

Chart 3: The Heart Truths Singaporeans Earn The LOWEST Wages Among The High-Income Countries

The highest-income earners in Singapore actually earn the highest wages among the high-income countries (Chart 4).

Chart 4: ECA Global Perspectives National Salary Comparison 2012

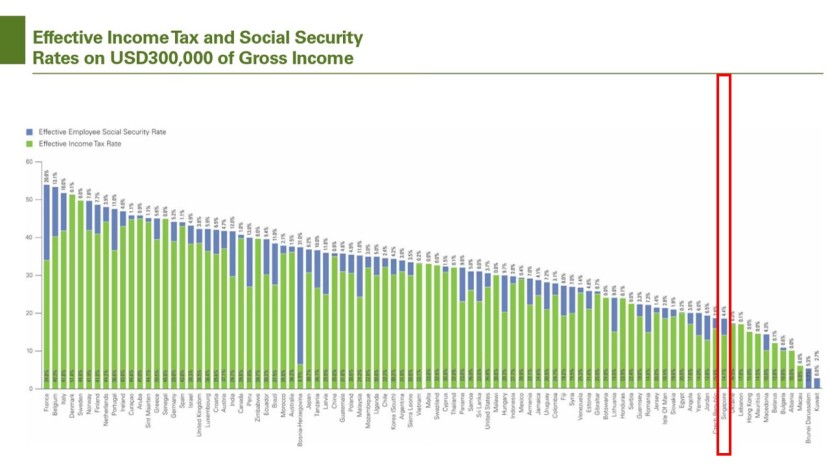

The highest-income earners in Singapore also pay the lowest tax and social security among the high-income countries (Chart 5).

Chart 5: KPMG’s Individual Income Tax and Social Security Rate Survey 2012

However, the majority of Singaporeans have to pay higher tax and social security than the high-income earners in Singapore (Chart 6).

Chart 6

In fact, the rich-poor gap has widened so drastically in Singapore that since 1995, the share of income in Singapore that had gone to the richest 10% had grown from 30% to 42% in 2011 (Chart 7).

Chart 7: The World Top Incomes Database

For the richest 5%, the share of income that had gone to them had grown even faster, from 22% in 1995 to 31% in 2011 (Chart 8).

Chart 8: The World Top Incomes Database

Meanwhile, the Singapore government had believed that it was not necessary to define an official poverty line, in spite of the glaring income disparity (Chart 9).

Chart 9

The Singapore Prime Minister had also believed that if Singapore is able to bring in more billionaires, his belief is that this would grow the economy even as the income inequality would rise (Chart 10).

Chart 10

So much so that Singapore now has the highest concentration of millionaires in the world (Chart 11).

Chart 11

And we have the fourth largest concentration of billionaires in the world (Chart 12).

Chart 12

Here, you can take a look at how much the richest in Singapore were earning in 2010.

And Singapore still doesn’t have a minimum wage – of only 10% in the countries in the world to still not have one.

But what does research say? Is the growth trajectory that Singapore is currently taking sustainable? Also, is the huge wage disparity in Singapore a recipe for disaster? Let’s take a look at what research says.

Poverty can cause a person’s ability to function cognitively to be dampened.

In a study which explained how “poverty directly impedes cognitive function“, it is said that:

The accumulation of those money woes and day-to-day worries leaves many low-income individuals not only struggling financially, but cognitively, Mullainathan said. In a study published August 29 in Science, he showed that the “cognitive deficit” caused by poverty translates into as many as 10 IQ points.

“Our results suggest that when you’re poor, money is not the only thing in short supply. Cognitive capacity is also stretched thin,” Mullainathan said. “That’s not to say that poor people are less intelligent than others. What we show is that the same person experiencing poverty suffers a cognitive deficit as opposed to when they’re not experiencing poverty. It’s also wrong to suggest that someone’s cognitive capacity has gotten smaller because they’re poor. In fact, what happens is that your effective capacity gets smaller, because you have all these other things on your mind, you have less mind to give to everything else.

“Imagine you’re sitting in front of a computer, and it’s just incredibly slow,” he continued. “But then you realize that it’s working in the background to play a huge video that’s downloading. It’s not that the computer is slow, it’s that it’s doing something else, so it seems slow to you. I think that’s the heart of what we’re trying to say.”

However, it was shown that, “giving money directly to poor people works surprisingly well“, though the deeper causes of poverty would still need to be tackled:

For decades, it was thought that the poor needed almost everything done for them and that experts knew best what this was. Few people would trust anyone to spend $1,000 responsibly. Instead, governments, charities and development banks built schools and hospitals, roads and ports, irrigation pipes and electric cables. And they set up big bureaucracies to run it all.

From around 2000, a different idea started to catch on: governments gave poor households small stipends to spend as they wished—on condition that their children went to school or visited a doctor regularly. These so-called “conditional cash transfers” (CCTs) appeared first in Latin America and then spread around the world. They did not replace traditional aid, but had distinctive priorities, such as supporting individual household budgets and helping women (most payments went to mothers). They were also cheap to run.

Now enough of these programmes are up and running to make a first assessment. Early results are encouraging: giving money away pulls people out of poverty, with or without conditions. Recipients of unconditional cash do not blow it on booze and brothels, as some feared. Households can absorb a surprising amount of cash and put it to good use. But conditional cash transfers still seem to work better when the poor face an array of problems beyond just a shortage of capital.

But so, what then are the deeper causes of poverty and income inequality? In his book Capital in the Twenty-First Century, French economist Thomas Piketty explained that:

“One of the great divisive forces at work today,” he says, “is what I call meritocratic extremism. This is the conflict between billionaires, whose income comes from property and assets, such as a Saudi prince, and super-managers. Neither of these categories makes or produces anything but their wealth, which is really a super-wealth that has broken away from the everyday reality of the market, which determines how most ordinary people live. Worse still, they are competing with each other to increase their wealth, and the worst of all case scenarios is how super-managers, whose income is based effectively on greed, keep driving up their salaries regardless of the reality of the market. This is what happened to the banks in 2008, for example.”

He went on to explain how such a pattern of accumulation is tantamount to theft:

One of the most penetrating of these is what he has to say about the rise of managers, or “super-managers”, who do not produce wealth but who derive a salary from it. This, he argues, is effectively a form of theft – but this is not the worst crime of the super-managers. Most damaging is the way that they have set themselves in competition with the billionaires whose wealth, accelerating beyond the economy, is always going to be out of reach. This creates a permanent game of catch-up, whose victims are the “losers”, that is to say ordinary people who do not aspire to such status or riches but must be despised nonetheless by the chief executives, vice-presidents and other wolves of Wall Street.

Thus Piketty also explained how paying our administrators high salaries is a misguided practice:

Defenders of big pay packages like to claim that senior managers earn their vast salaries by boosting their firm’s profits and stock prices. But Piketty points out how hard it is to measure the contribution (the “marginal productivity”) of any one individual in a large corporation. The compensation of top managers is typically set by committees comprising other senior executives who earn comparable amounts. “It is only reasonable to assume that people in a position to set their own salaries have a natural incentive to treat themselves generously, or at the very least to be rather optimistic in gauging their marginal productivity,” Piketty writes.

Many C.E.O.s receive a lot of stock and stock options. Over time, they and other rich people earn a lot of money from the capital they have accumulated: it comes in the form of dividends, capital gains, interest payments, profits from private businesses, and rents. Income from capital has always played a key role in capitalism. Piketty claims that its role is growing even larger, and that this helps explain why inequality is rising so fast. Indeed, he argues that modern capitalism has an internal law of motion that leads, not inexorably but generally, toward less equal outcomes. The law is simple. When the rate of return on capital—the annual income it generates divided by its market value—is higher than the economy’s growth rate, capital income will tend to rise faster than wages and salaries, which rarely grow faster than G.D.P.

Will Hutton elaborated a bit more on how the paying of high salaries to administrators is unlikely to increase performance:

The answer is that these “super-salaries” have almost nothing to do with performance and everything to do with CEOs keeping up with each other in a status race. In my interim review on fair pay for the UK government three years ago, I noted that one of the best determinants of any CEO’s pay in the US was the size of his or her social network. The more examples of highly paid members in one’s network, the more generous a remuneration committee felt it had to be. Ellison will doubtless point not to other CEOs of publicly quoted companies to justify his pay, but to Leon Black, chair of the private equity group Apollo, who pocketed $546m last year.

In Conspicuous Consumption, a book published in 1899 when inequalities in wealth and income matched those of today, economist Thorstein Veblen captured this social dynamic well. There is a logic to the already very wealthy needing more wealth: they show it off to demonstrate where they are in the social pecking order. Veblen writes that, while the livery worn by personal servants, the nature of pets and the grandness of parties may seem to be economically irrational if not futile, to the very rich, these are subtle, socially honed indicators of standing.

In fact, it has been further shown that, “there is no evidence that higher pay produces better executive performance“.

Instead, there is evidence that higher compensation undermines the intrinsic motivation of executives, inhibits their learning, leads them to ignore some stakeholders, and discourages them from considering the long-term effects of their decisions.

A “new extensive research into CEO incentives, confidence and future stock price performance“, also showed that:

The more money chief executive officers are paid, the worse they appear to perform.

The study also found this to be true whether the CEO is at the higher end of the salary spectrum or not, with their firm performing worse over the three years following a rise in pay.

The surprising find that companies with highly paid CEOs perform worse is particularly interesting when you consider it is generally believed that is it worth paying a premium for high level, high profile leaders.

While there will be exceptions here, the study found companies run by bosses paid at the top 10% of the scale had the worst performance, returning a huge 10% less to their shareholders than other leaders.

Additionally, the companies with CEOs paid within the top 5% did on average 15% worse.

Not only that, “incentives are likely to encourage unethical behavior“.

Stock options became infamous when the public discovered that grant dates of CEO options were being manipulated to increase the personal benefits of CEOs at the expense of the firms’ owners.

Former U.S. Labor Secretary Robert Reich also explained how low wages and poverty is linked to how executives would want to pay high salaries to themselves:

The fact of the matter is that one of the major ways in which American corporations have shown huge profits over the last few years is by keeping payrolls down, by squeezing wages. This is well documented… There is abundant evidence and abundant proof of this. And this is why, in part, the top 1 percent has done so well, because they are the ones who get a lot of their income out of the stock market, whereas everybody else, the only assets that most other people have, if they have any assets at all, is the value of their homes. And home values are the things that really took a huge hit after 2008. They’re slowly beginning to come back, but many people are still underwater. So, if you don’t look at this reality, if you don’t look at the asset base of the wealthy versus the asset base of most other people, you know, you can begin to be convinced by these propaganda—this propaganda.

Piketty went a step further to explain that:

We haven’t just gone back to nineteenth-century levels of income inequality, we’re also on a path back to “patrimonial capitalism,” in which the commanding heights of the economy are controlled not by talented individuals but by family dynasties.

Coincidentally, Singapore is ranked 5th on the crony capitalism index, where Singapore is the 5th easiest country for the rich to get rich if they are politically-affiliated.

Chart 13: The Economist Our crony-capitalism index Planet Plutocrat

And pertaining to our discussion on the rising income inequality, it was said that:

Economists have long known that high executive pay has contributed to the widening gap between the very rich and everyone else. But the role of executive compensation may be far larger than previously realized.

Piketty also made a comment on oligarchy, which you can see that Singapore is similarly ruled on:

He explains that oligarchy, particularly in the present Russian model, is quite simply the rule of the very rich over the majority. This is both tyrannical and not much more than a form of gangsterism. He adds that the very rich are not usually hurt by inflation – their wealth increases anyway – but the poor suffer worst of all with a rising cost of living. A progressive tax on wealth is the only sane solution.

Thus this, Piketty explained, is why income inequality exists:

The consequences of this are clear: those who have family fortunes are the winners, and everyone else doesn’t have much of a shot of being wealthy unless they marry into or inherit money. It’s Jane Austen all over again, and we’ve just fooled ourselves that the complicated financial system has changed a thing.

This is a deep point. Many American households, if they are lucky, will grow their wealth at the same rate as the economy. But, because the wealthy are growing their fortunes at a much faster rate, no one else can ever catch up.

Let’s repeat that: no one else can ever catch up.

This is where Piketty adds more nuance: it’s not just inequality of wealth and income that we’re struggling with, but inequality of opportunity. That’s of far more concern. In essence, he is saying, we’re lying to ourselves if we believe that hard work will lead to wealth. Mainly, wealth reliably leads to wealth. Everything else is chancy. The middle class is playing the economic lottery to improve their lot in life, while the wealthy have a sure thing.

Piketty also illustrated America’s growth in income inequality, which you can see Singapore is paralleled on and he also explained how this is detrimental to the economy:

Piketty says of the United States: “From 1977 to 2007, the richest 10% appropriated three-quarters of the growth. The richest 1% alone absorbed nearly 60% of the total increase of US national income in this period.” The squeezed middle does not enter into it. A democratic society will not, and cannot, tolerate such trends.

The second piece of evidence for my contention that the tide is turning is also important, as it shows that this rising inequality, far from being a price worth paying, actually slows down growth. This research is not from some group of flaming radicals but the International Monetary Fund, an intrinsically conservative institution.

“Inequality is an enemy of economic growth.” He suggests that growth would be stronger if inequality was smaller.

This growing divergence between CEO pay and that of the typical American worker isn’t just wildly unfair. It’s also bad for the economy. It means most workers these days lack the purchasing power to buy what the economy is capable of producing — contributing to the slowest recovery on record. Meanwhile, CEOs and other top executives use their fortunes to fuel speculative booms followed by busts.

Anyone who believes CEOs deserve this astronomical pay hasn’t been paying attention. The entire stock market has risen to record highs. Most CEOs have done little more than ride the wave.

But there are solutions. As mentioned in the research above, “giving money away pulls people out of poverty, with or without conditions”. But one just needs to look at history for guidance, as Piketty had pointed out:

In the United States, the story was less dramatic but broadly similar. The Great Depression wiped out a lot of dynastic wealth, and it also led to a policy revolution. During the nineteen-thirties and forties, Piketty reminds us, Roosevelt raised the top rate of income tax to more than ninety per cent and the tax on large estates to more than seventy per cent. The federal government set minimum wages in many industries, and it encouraged the growth of trade unions. In the decades after the war, it spent heavily on infrastructure, such as interstate highways, which boosted G.D.P. growth. Fearful of spurring public outrage, firms kept the pay of their senior executives in check. Inequality started to rise again only when Margaret Thatcher and Ronald Reagan led a conservative counter-revolution that slashed tax rates on the rich, decimated the unions, and sought to restrain the growth of government expenditures. Politics and income distribution are two sides of the same coin.

Finally, as mentioned, the deeper causes of poverty would still need to be resolved, with which Piketty made a proposal, as had effectively been implemented in the United States after the Great Depression:

Given that inequality is a worldwide phenomenon, Piketty aptly has a worldwide solution for it: a global tax on wealth combined with higher rates of tax on the largest incomes. How much higher? Referring to work that he has done with Saez and Stefanie Stantcheva, of M.I.T., Piketty reports, “According to our estimates, the optimal top tax rate in the developed countries is probably above eighty per cent.” Such a rate applied to incomes greater than five hundred thousand or a million dollars a year “not only would not reduce the growth of the US economy but would in fact distribute the fruits of growth more widely while imposing reasonable limits on economically useless (or even harmful) behavior.”

Piketty is referring here to the occasionally destructive activities of Wall Street traders and investment bankers. His new wealth tax would be like an annual property tax, but it would apply to all forms of wealth. Households would be obliged to declare their net worth to the tax authorities, and they would be taxed upon it. Piketty tentatively suggests a levy of one per cent for households with a net worth of between one million and five million dollars; and two per cent for those worth more than five million. “Or one might prefer a much more steeply progressive tax on large fortunes (for example a rate of 5 to 10 percent on assets above one billion euros),” he adds. A wealth tax would force individuals who often manage to avoid other taxes to pay their fair share; and it would generate information about the distribution of wealth, which is currently opaque.

Not only that, with regards to high salaries paid to our administrators, steps need to also be taken to ameliorate the effects:

High executive pay and performance incentives are detrimental to firms. In light of the evidence that high executive pay and incentives are harmful, firms should consider taking action.

Lowering executive pay and eliminating incentives are obvious steps. In the roughly 300 firms that make up the Mondragon Cooperative in Spain, CEOs do not receive incentive payments, and their compensation cannot exceed 11 times that of the lowest paid workers.

And when the salaries were lowered, this actually led to better outcomes:

They have no trouble finding top executives. As it happens, firms in the Mondragon Cooperative are more profitable than traditional firms offering similar products in Spain.

Finally, Piketty concluded that:

And while he acknowledges that this is an imperfect tool, he rejects the argument that such a tax could dent the morale of executives and cause their companies to underperform.

“It is possible to find hard-working managers who are willing to be paid 20 times the average wage at their company rather than 100 to 200 times,” he said.

So pushing companies to put less money into the hands of their CEOs and more into the hands of average employees creates more buying power among people who will buy, and therefore more jobs.

But will things change under the PAP? As an article in the Guardian had explained:

A study at Berkeley University, quoted by Music, provides an answer to the question of why wealthy politicians act as they do, although I do not doubt they delude themselves as to their motives: “The higher up the social-class ranking people are, the less pro-social, charitable and empathetically they behaved … consistently those who were less rich showed more empathy and more of a wish to help others.” This would be an obvious point, except it is daily contradicted by the appalling “skivers versus strivers” rhetoric, a false dichotomy that is also moronic propaganda-by-rhyme.

Tim Kasser, for instance, a psychology professor at Knox College, Illinois, notes that if you love material objects, you are less likely to love people and so, of course, the planet. The connection between the rise of materialism and indifference to the environment is not coincidental; nor is the connection between the rise of materialism and growing inequality, and fear of the stranger… Money is a brutalising agent and a paranoiac drug.

And so it drips down, an infection swallowing happiness and peace. Inequality leads to an erosion of trust between people. When you couch a premise in the language of the market, people become more suspicious and less kindly. This is potentially disastrous, as public services are sold and patients find themselves transformed into consumers. In one fascinating study, people were asked to imagine a hypothetical water shortage; those described as “consumers” were less likely to share the hypothetical water than those described as “individuals”.

And the effects of such anti-social thinking and behaviour has drastic and dire consequences to our society and Singapore:

In our globalized civilization, this “economic stratification” is evident in the vast disparity between wealthy, industrialized cultures and the impoverished ones that are now exploited as the source of increasing quantities of needed resources and services. Within affluent countries, however, this same unbalanced process is evident in the shrinking middle class and the growing separation of the rich from the poor.

Why is this “economic stratification” a threat to a civilization’s stability? The answer, the report found, is in the complex interdependence of the two groups. The obvious explanation is that the Elites are dependent on the Commoners to provide labour and resources for the creation of wealth. If the Commoners are unable to offer these services because of debilitating poverty, destructive weather, famine, ecological deterioration or any number of adverse conditions, then the capability of Elites to produce wealth is eventually so impaired that the whole system collapses.

But a less obvious explanation for system collapse is that the first signs of trouble occur among the poor because they are least able to adapt to the stresses of adversity. If the separation between the two classes is sufficient to prevent these vital warning signs from reaching the rich in a timely manner, then the Elites are denied the information necessary to initiate corrective action, the situation deteriorates beyond the point of recovery, and the civilization collapses. A variation of this failure is that the isolation of the Elites causes them to misread the warning signs, mistakenly attributing the underlying social unrest to superficial factors, when the actual cause is structural poverty or ecological ruin. In simple terms, the Elites have a vested interest in maintaining the economic, social and material health of the Commoners.

So, what are your thoughts? The solutions are out there. The poor do not need to be poor – the poor are made poor because of the uneven wage distribution pattern, largely attributed to the executives wanting to pay themselves high salaries.

Also, bringing more billionaires or millionaires will not help create jobs. Increasing the purchasing power of the masses is what will.

To correct the deeper causes of poverty and inequality, a very clear solution is to pay executives on the top much lower salaries and the poor much higher ones. Reich had also called for (higher) minimum wage.

The current wage imbalance has also been shown to be detrimental to the economy in the long term. Only by decisive action and wage correction towards wage parity will we be able to move Singapore’s economy in the right direction.

Finally, if you are thinking about what you can do to change things, Reich has an advice for you:

You know, people know that inequality is surging. Many people have a feeling that the game is rigged. But they don’t really understand why, how it’s happened and why it’s dangerous, or what they can do about it. I mean, this film also provides a kind of guide to people. There’s a social action movement that is connected to the film. So we hope that the film really spurs a—not just a different discussion in this country, but also a movement to take back our economy and democracy.

The PAP has used government to pursue their own unknown agenda, while forcing Singaporeans to live more difficult lives. The PAP has taken our retirement funds for themselves to earn high interests on it, while devaluing our CPF and our ability to retire.

This is wrong. We have to stand up and speak up against this scourge. It’s time to stand up and come together to speak up against such wrongdoings.

Come down to the #ReturnOurCPF 4 protest on 27 September 2014 at 4pm at Hong Lim Park. You can join the Facebook event page here.