Two weeks ago, I wrote about how I had calculated that the median CPF balance that Singaporeans would have is about $55,000. This means that half of Singaporeans have less than $55,000 inside our CPF.

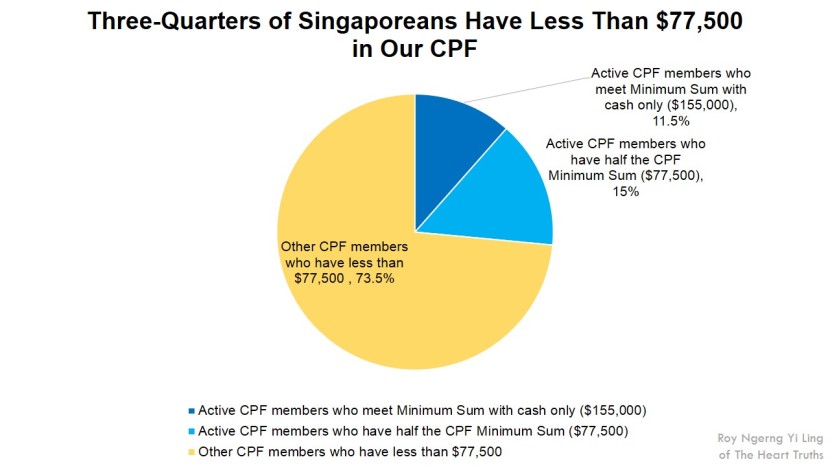

In fact, I calculated that 73.5% of Singaporeans would have less than $77,500 inside our CPF.

I had thus written about how even though the government knows that the majority of Singaporeans simply do not have enough inside our CPF to meet the CPF Minimum Sum, they kept increasing this Minimum Sum since the mid-1990s! Why would the government keep increasing the CPF Minimum Sum to trap Singaporeans’ CPF inside and not let Singaporeans withdraw our money?

On Tuesday, I wrote that the CPF and Medisave Minimum Sums are expected to increase to $498,000 in 30 years’ time in 2044, at their current rate of growth. (You need to have enough inside your CPF to meet both the CPF and Medisave Minimum Sums before the government allows you to withdraw your CPF).

And so, in order for Singaporeans who are starting work today to be able to retire in 30 years’ time, we would need to meet not only the CPF and Medisave Minimum Sum, we would also need to have enough to pay for housing loans – or about $200,000 each for a couple who buys a flat at the average price of $300,000 today. In total, a Singaporean would need to have nearly $700,000 inside our CPF to be able to retire.

Today, a Singaporean earns an average of 3% on our CPF (2.5% on the Ordinary Account and 4.5% on the Special and Medisave Accounts). And because of this, it is estimated that 90% of Singaporeans are not able to meet the CPF Minimum Sum of $155,000 today.

In June this year, the government finally admitted that they take our CPF to invest in the GIC.

This is after many denials. Lee Kuan Yew denied this in 2001 and 2006. Then-Manpower Minister Ng Eng Hen denied this in 2007.

Now, the GIC earns an estimated 6% since inception and if the 6% is rightfully returned to Singaporeans, we would have a higher chance of meeting the CPF Minimum Sum.

Yesterday, I wrote about how because we are not getting the additional 3 percentage points interest back, the average Singaporean who works from 25 to 55 would be losing nearly $750,000 from our CPF (or nearly half of what we should earn on our CPF).

And the average Singaporean who works from 21 to 65 would lose nearly $3 million!

Very clearly, if Singaporeans are returned the 6% interest that we are rightfully earning on our CPF, the majority of Singaporeans would be able to save enough inside our CPF to meet the CPF Minimum Sum and be able to retire.

So, the question now is – why is the government taking our money away and not returning it back to us?

The government takes away as much as half of what we would have otherwise been able to save!

Why doesn’t the government want Singaporeans to retire?

- Why does the government keep increasing the CPF Minimum Sum to trap our CPF inside?

- Why does the government not return the 6% interest to Singaporeans and prevent our CPF from growing?

Is this what a responsible government should be doing?

What is the aim of the PAP government? What is their real agenda?

Don’t you think something is amiss here?

3rd Edition Of The #ReturnOurCPF Event

On 23 August, there will be a third edition of the #ReturnOurCPF event.

Join us at the third edition and take a stand. The government cannot take Singaporeans’ CPF to use and tell us that they do not know what they are using it for. This is a derision to Singaporeans and daylight robbery!

On 23 August, we will see you at Hong Lim Park. Let’s come together, be united and speak for change, for the better for our lives, and our children’s.

You can join the Facebook event page here.

Also, my first court case will be held on 18 September 2014, at 10.00am. It will be a full-day hearing.

Roy Ngerng

*The writer blogs at http://thehearttruths.com/