Earlier last month, the Worker’s Party’s Gerald Giam asked Deputy Prime Minister and Finance Minister Tharman Shanmugaratnam:

… specifically on the eight years in the past 20 years where GIC’s investment returns were below what the Government pays on SSGS, were these shortfalls funded from the Government’s net assets or from the GIC’s assets?”

Tharman replied:

… let me explain that GIC is managing Government assets. It is not GIC’s assets. GIC is a fund manager, so the assets are assets on the Government’s balance sheet, rather than on the GIC’s balance sheet. When the GIC reported that it has earned a real return over 20 years of 4.1% on an annualised basis, it is referring to the return on the total assets that it is managing for the Government.

Tharman did not answer Gerald’s question. But from Tharman’s reply, it is clear then that if “GIC is managing Government assets … (and these) assets are assets on the Government’s balance sheet”, then if GIC makes any losses, these losses would necessarily be funded by the government.

GIC and Temasek Holdings lost $117 billion in 2008

By now, it is known that in 2008, Temasek Holdings lost S$58 billion and GIC lost S$59 billion.

In total, they lost $117 billion.

And because of the losses, Temasek Holding’s portfolio shrank by 31% and GIC’s portfolio shrank by 25%.

CPF Balance Grew by 90% since 2007 but GIC Grew by Only 69% and Temasek Holdings Grew by Only 21% – Why?

Now, the government claims that, “the size of the Government’s funds managed by GIC … are not published (but) What has been revealed is that GIC manages well over US$100 billion.”

But in 2008, GIC had lost $59 billion and this represented a loss of 25%. This would thus mean that GIC was managing S$236 billion prior to the loss?

By 2011, the assets that GIC was managing has been estimated to have grown to about S$300 billion and toabout S$400 billion today.

This is in comparison to Temasek’s value of $185 billion as of 31 March 2008, S$198 billion as of 31 March 2012, S$215 billion as of 31 March 2013 and S$223 billion as of 31 Match 2014.

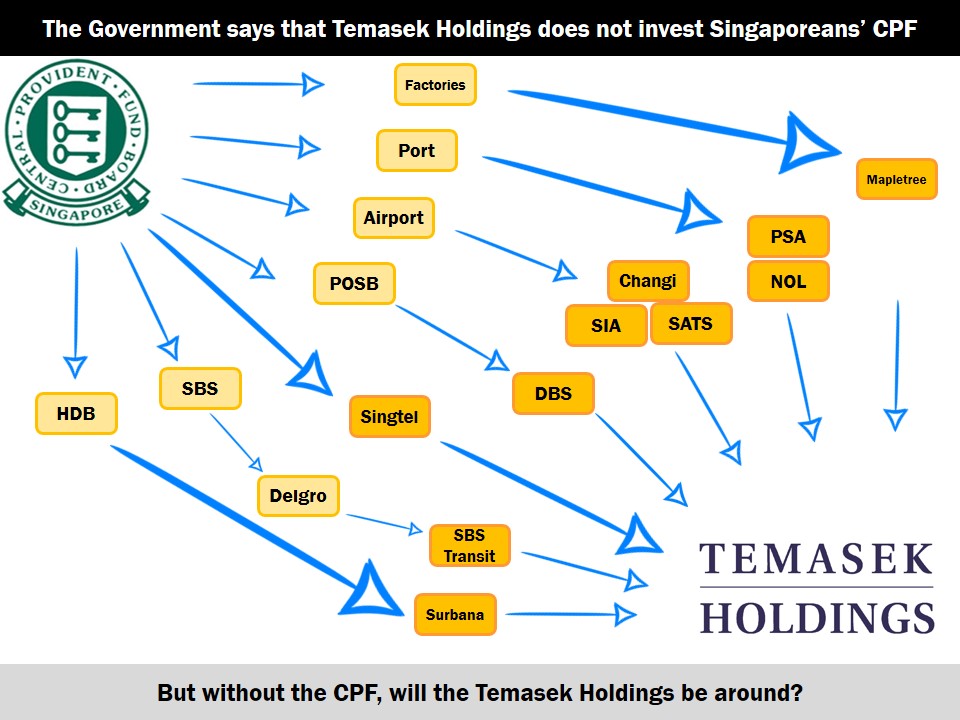

It is now known that GIC manages our CPF funds and Temasek Holdings had managed our CPF and still has access to our CPF.

(Note that it took PAP more than 15 years before PAP is willing to admit that they take our CPF to invest in GIC. They denied that GIC uses our CPF in 2001, 2006 and 2007. It is only on 30 May 2014 that PAP finally admits the truth.)

And so, when you look at our CPF, the CPF balance grew from S$137 billion in 2007 to $260 billion today.

From the above, this means that since 2007 or Financial Year 2007, GIC has grown by 69%, Temasek Holdings by 21% and our CPF has grown by 90%.

What is glaring is this – our CPF balance grew by 90%. Why?

Past Reserves Cannot Be Used to Pay Off Losses Then Where Does Government Get Money From?

Thanks to Gerald’s question, it seems that for any losses made by GIC, the government would pay for the losses.

But where would the government get the money to pay for the losses?

According to the government, “a transfer of funds (from past reserves) cannot be used to hide investment losses“.

If so, where does the money to pay the losses come from?

Our CPF Cannot Be Spent But Can Be Invested – Our CPF is Invested in GIC

According to the government as well, “the monies raised from government borrowings cannot be spent”. So, “monies raised from Singapore Government Securities (SGS) and Special Singapore Government Securities (SSGS)” cannot be spent.

Now, “SSGS are bonds issued to the Central Provident Fund (CPF)” and “all CPF monies are invested in SSGS”. As such, “No CPF monies go towards government spending.”

The government also says that since “No Government borrowings are for spending,… (but) All borrowing proceeds are therefore invested.”

As such, “The proceeds from SSGS issuance are invested by the Government via MAS and GIC.”

In short, our CPF is thus invested in the GIC.

Our CPF is Invested in Temasek Holdings

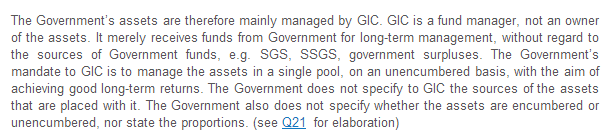

Now, the government also reveals something else – “The proceeds from SSGS issuance are pooled with the rest of the Government’s funds, such as proceeds from issuing Singapore Government Securities (SGS)… The comingled funds are first deposited with MAS as government deposits. MAS converts these funds into foreign assets through the foreign exchange market… These assets are ultimately transferred to GIC to be managed.”

Take a look at another piece of information that the government reveals – the government injected $5 billion into Temasek Holdings in the “latest financial year”. And according to the government, this money “came from proceeds of the Singapore Government Securities (SGS), proceeds from government land sales in Singapore and government budget surpluses.“

However, look back at the previous paragraph – if the SSGS is pooled together with the SGS and the SGS is given to Temasek Holdings, does this not mean that the government is giving our CPF to Temasek to use!

In fact, it was said in the book ‘Reforming Corporate Governance in Southeast Asia‘ that, “In April 2004, a constitutional amendment that allowed the government to transfer reserves to key statutory boards and companies, and the transfer of reserves among them with the approval of the president, was introduced. Temasek Holdings has acknowledged that it can access the reserves. Both Temasek’s chairman and chief executive also have to annually certify its statement of reserves and past reserves to the president.”

And what do the reserves comprise? Our CPF. Which is proof once again that Temasek Holdings has access to our CPF.

Thus it is quite clear, as I have explained before, that Temasek Holdings does take our CPF to invest.

Did PAP Take Our CPF to Pay for the Losses of GIC and Temasek Holdings?

Let’s get back to the original question – did the government take our CPF to pay for the GIC’s and Temasek Holdings’ losses?

Now, the government has said:

- Investment losses are not hidden by the government by a transfer of funds from past reserves.

- The government does not spend our CPF monies.

- The CPF is invested.

As such, if the government cannot pay for the losses from past reserves, the funds would have to be paid by new money, right?

If our CPF cannot be spent and can only be invested, does that mean that our CPF is used to pay for the losses of GIC and Temasek Holdings?

PAP and GIC Does Not Know How Our CPF is Being Used When PAP is GIC?

Before we continue, there is something quite disconcerting. What we know now is this:

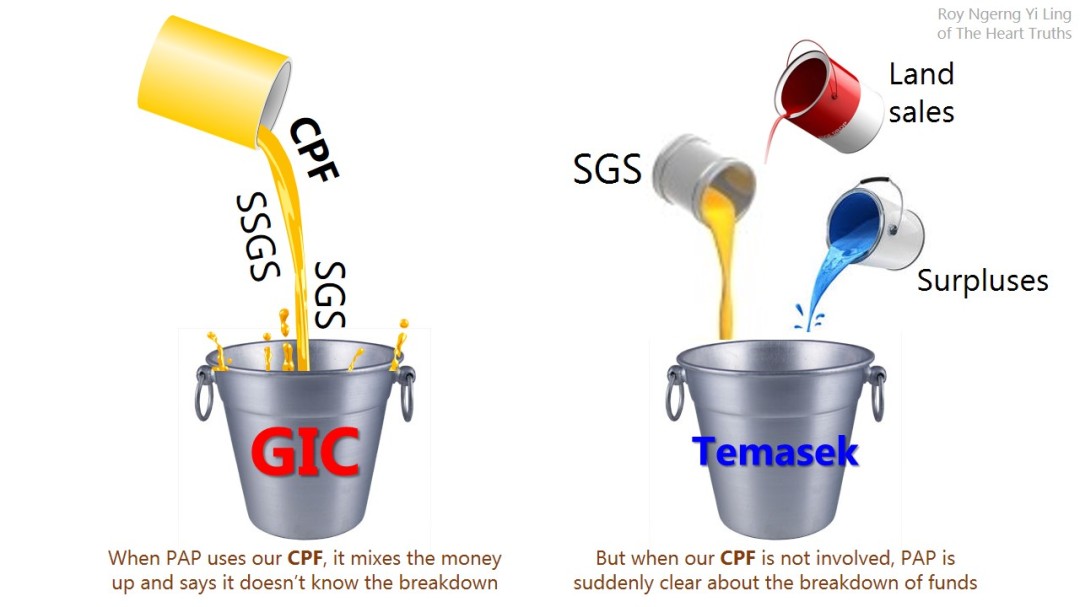

- The government claims that GIC “merely receives funds from Government for long-term management, without regard to the sources of Government funds, e.g. SGS, SSGS, government surpluses.” So, because the government says it is blur, it says GIC also becomes blur. (I am not sure if being blur with our country’s finances is the way to run the country.)

- However, the government then suddenly becomes very clear that “The additional capital (for the $5 billion fund injection into Temasek Holdings) came from proceeds of the Singapore Government Securities (SGS), proceeds from government land sales in Singapore and government budget surpluses.”

So, one minute, the government is blur, the next minute the government is not. Then, is the government really blur? Or is the government only “acting” blur.

Well, what is the difference? When does the government decide to act blur?

- When the topic involves our CPF, the government suddenly claims that they mix up our CPF with everything else and then give to GIC, so now they don’t know how they are using our CPF and what they are giving to GIC because everything is mixed up.

- But when it does not involve our CPF, the government can give a straightforward and clear answer on where the funds for Temasek Holdings come from.

Why does the government want to teh gong (act blur) when it comes to our CPF?

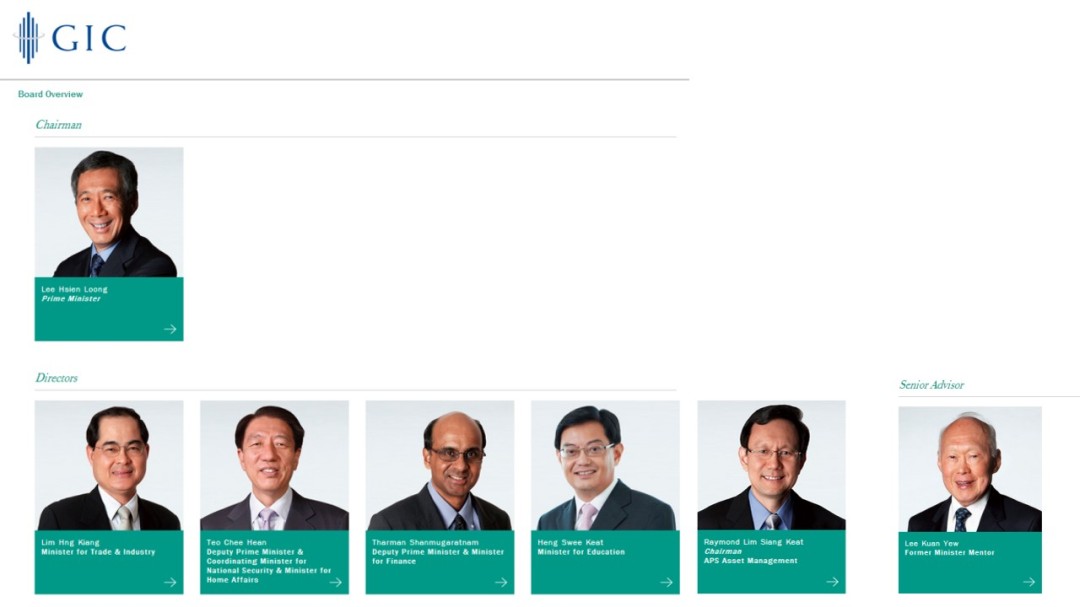

And I do not know if the government can really act blur when the government is actually the GIC. The Singapore prime minister, two deputy prime ministers, two ministers, a ex-minister and the ex-prime minister Lee Kuan Yew are all on the Board of Directors of the GIC.

To act blur in this instance is disingenuous.

Did PAP Increase the CPF Minimum Sum to Pay for the Losses of GIC and Temasek Holdings?

So, back to the question – does PAP take our CPF to pay for the losses of GIC and Temasek Holdings?

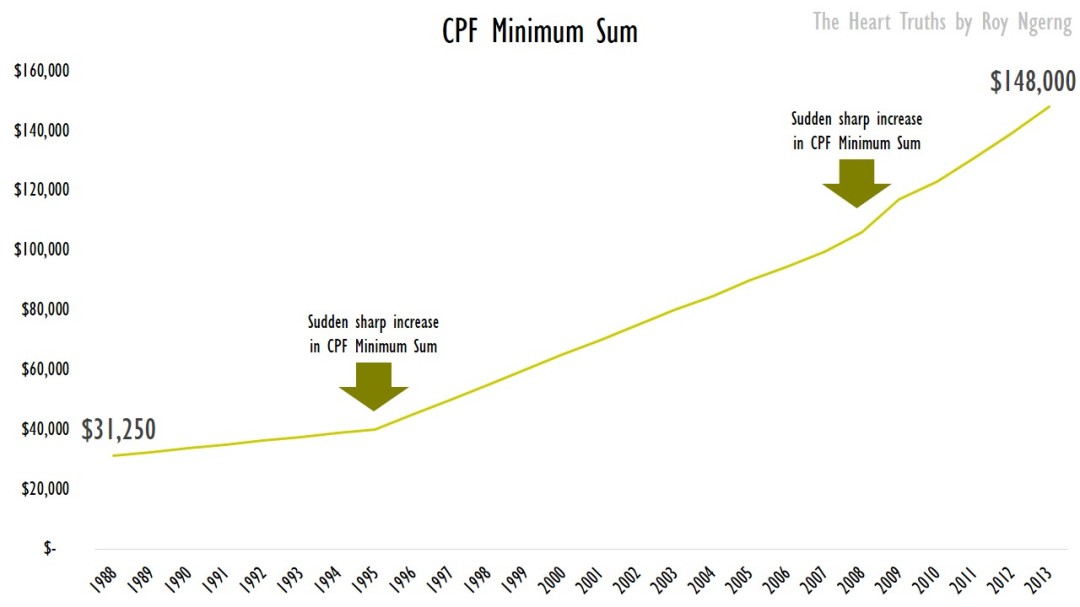

As I had written before, in 2008, there was a sudden spike in the CPF Minimum Sum. Some people have speculated that this was because the government wanted to trap more CPF inside to pay for the losses.

(Note: the first spike in 1995 was because the government announced raising the CPF Minimum Sum by $5,000 a year.)

Today, I did up another chart.

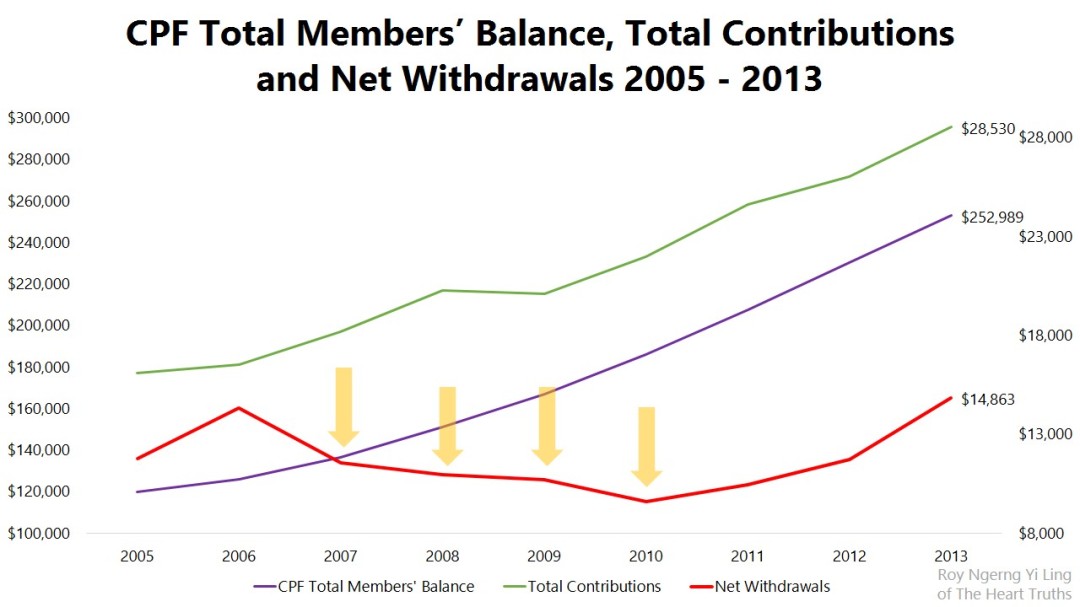

In the chart below, look at the green and purple line. You can see that the total annual CPF contributions (green line) and the total CPF balance (purple line) has been constantly going up.

But next, take a look at the red line. You can see that the net CPF withdrawals increased before it decreased for 4 consecutive years, from 2007 to 2010, before it started rising again from 2011.

Did this have something to do with the sudden spike in the CPF Minimum Sum, which trapped more CPF inside and caused Singaporeans not be able to withdraw our CPF?

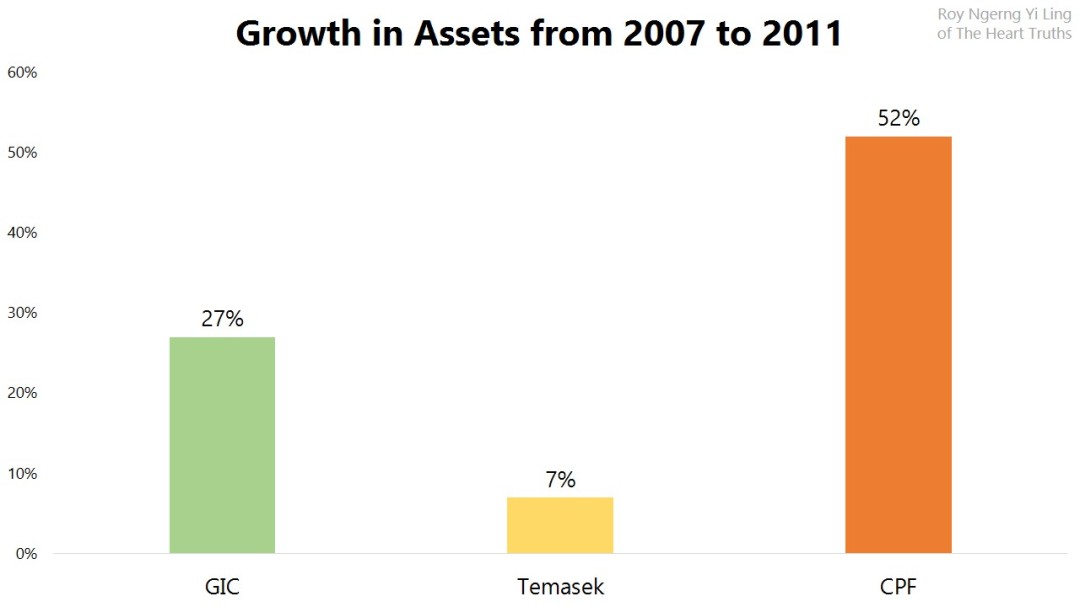

And if you look at this period from 2007 to 2011, GIC grew by about 27%, Temasek Holdings grew by 7% and because PAP made it more difficult for Singaporeans to withdraw our CPF, the CPF total balance grew by a whooping 52%.

If so, did PAP make it more difficult for Singaporeans to withdraw our CPF, to trap more money inside the CPF to pay for the losses of GIC and Temasek Holdings? The funny thing is that there was no policy change to the CPF Minimum Sum in 2008, so what did PAP do backend which caused the CPF Minimum Sum to spike up?

Did PAP Take Our CPF and Taxpayer’s Money to Pay for the Losses of GIC and Temasek Holdings?

In 2008, GIC and Temasek Holdings lost $117 billion.

Could the government have increased the CPF Minimum Sum in 2008 to trap more CPF inside for the next few years to pay off the losses?

Also, in the last 6 years, it was discovered that the government under-reported surpluses of $200 billion.

So, did the PAP increase the CPF Minimum Sum to take our CPF, and under-report the surpluses to take our taxpayer’s money to pay for the losses for GIC and Temasek Holdings?

If the PAP did so, did they ask Singaporeans for our permission?

Our CPF is Mainly Used by PAP to Pay for the Losses of GIC and Temasek Holdings?

Today, if 90% of Singaporeans cannot meet the CPF Minimum Sum and thus many Singaporeans cannot retire and have to keep working, and in menial jobs, is it because the PAP did not account to Singaporeans how they were using our money to pay for the losses?

Tharman has said that the assets that GIC uses belongs to the government. If GIC makes losses, then the government would have to pay for it. Since the government cannot use past reserves to pay for it, it is likely that the government will use the SSGS (our CPF) and the SGS to pay for the losses.

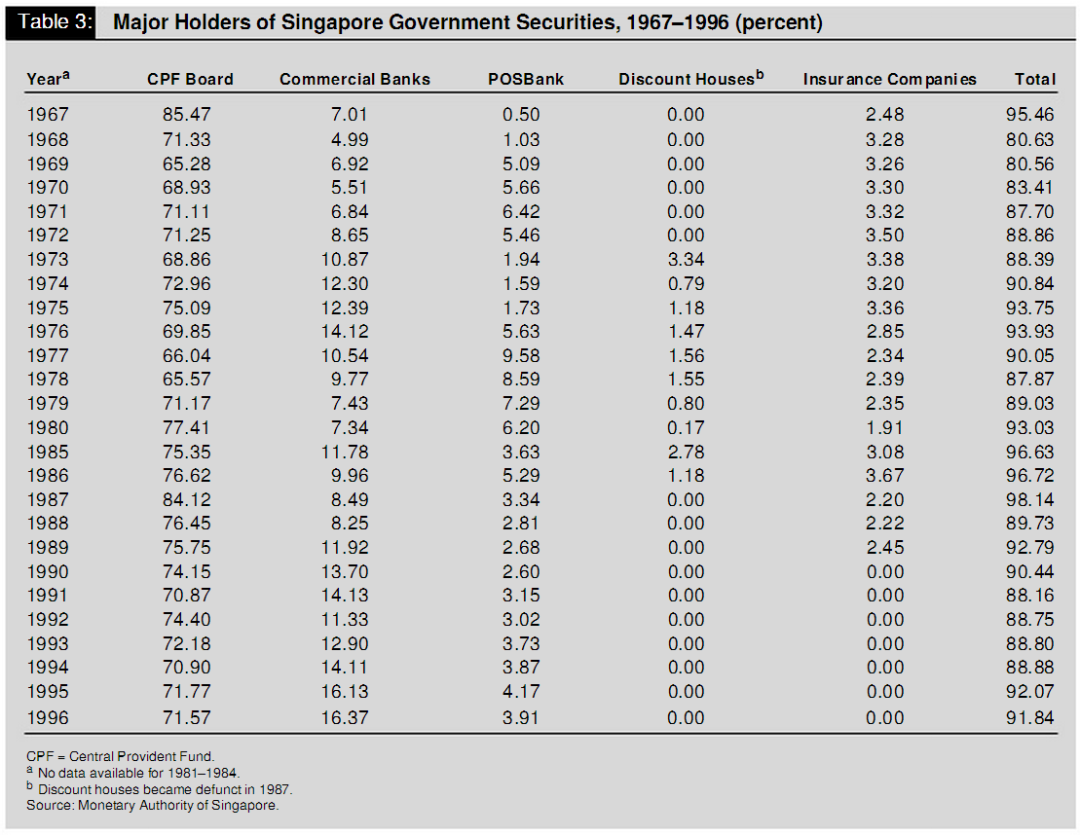

But the SGS is actually predominantly made up of our CPF. If so, this would mean that our CPF is mainly being used to pay for the losses of GIC and Temasek Holdings, wouldn’t it?

And importantly, if the government is actually able to provide this breakdown of what the SGS comprises in the past, can they claim to feign ignorance on not knowing how our CPF is being used today and claim erroneously that they have mixed it up?

And if the CPF forms the bulk of the SGS, then for whatever money PAP gives GIC to use, most probably all of it is our CPF then (as I have written here)?

If so, if GIC earns and estimated 6%, using most probably only our CPF, then shouldn’t the 6% be returned to Singaporeans’ CPF?

As I had exposed last month, the GIC had previously said:

The Government’s financial assets, other than its deposits with the Monetary Authority of Singapore (MAS) and its stake in Temasek Holdings, are mainly managed by the GIC. Sustained balance of payments surpluses and accumulated national savings are the fundamental sources of the Singapore’s Government’s funds.

Quite clearly, this refers to our CPF and taxes that Singaporeans pay.

But GIC suddenly changed this information. Now it reads:

We manage most of the government’s financial assets, other than its deposits in Monetary Authority of Singapore (MAS) and stake in Temasek. GIC is a fund manager, not an owner of the assets. It receives funds from the government for long-term management, without regard to the sources, e.g. proceeds from securities issued, government surpluses.

Why did GIC change the FAQ answer? Is PAP and GIC trying to hide the fact that the funds that GIC uses would actually be all made up of Singaporeans’ CPF?

If so, give us back our CPF! Stop pretending to take our money and feign ignorance over how it is used!

PAP Has to Come Clean with How They Are Taking Singaporeans’ CPF and Money to Use – Show Us the Spreadsheet with the Full Accounting

Perhaps now is time for the government to come clean with the truth.

Can the government act blur with how our CPF and money is used when it comes to GIC and yet be so clear as to where it got the money to give to Temasek Holdings?

If our CPF makes up the bulk of the SGS and SSGS, does this mean that our CPF is used to pay off the bulk of the losses for GIC and Temasek Holdings, and when GIC and Temasek Holdings need any additional money to use, does the government also takes from our CPF?

Enough of the PAP’s highfalutin language. Enough of the PAP trying to confuse Singaporeans by using mumbo jumbo words to throw Singaporeans off its scent.

- Did the PAP use our CPF to invest in GIC and Temasek Holdings?

- Did the PAP use our CPF to pay off the losses of GIC and Temasek Holdings?

- Did the PAP use our CPF to give additional money to GIC and Temasek Holdings when they want more money?

These are very simple questions, which a simple spreadsheet which shows the proper accounting and how the money is being moved around can be done to show. The government does not need to use words to confuse Singaporeans. Rather, the PAP should stop its pitiful attempts at confusing Singaporeans.

The PAP just needs to show us the spreadsheet. Obviously, when the PAP can be so clear as to where they got the funds to give Temasek Holdings for additional capital injection, then the PAP would similarly have the capability to show the breakdown of the funds given to GIC and Temasek Holdings.

And if the PAP is unable to do that, then their accounting or lack thereof is seriously suspect. If the PAP dares tell Singaporeans that they manage the whole of our country’s finances, and they do not even keep a proper spreadsheet with the detailed breakdowns and how the money is properly funnelled, but that they are actually managing our country’s finances like 3-year old kids, playing with play-doh, then throwing the money around and mixing it up, then this is deeply worrying.

The money that the PAP is using are Singaporeans’ hard-earned retirement funds and the surpluses Singaporeans pay in tax to accumulates. This is not something the PAP can say, “sorry, I mixed it up. Now, I don’t know how I am using your money. Let’s move on.” No, it is not.

When Singaporeans cannot save enough to retire and when the PAP is managing our CPF but cannot even ensure retirement adequacy and where the PAP under-reports $200 billion over the past 6 years (and more if we go all the way back to the 1970s), then something is terribly, terribly wrong.

Either the PAP is totally incapable of managing our country’s finances or they are not a responsible government and there is a complete lack of transparency and accountability, or otherwise, there is something very fishy with what they are doing with our money and how they are not giving our money back.

It has come to a point in Singapore where Singaporeans no longer trust the PAP as the government and would rather have the full information to check for ourselves what is going on.

#IDoNotTrustPAP

Will Singaporean Stand Up and Do Something Against this Scourge?

Honestly, I have been furiously writing about this for the past few months (as have many of us), but Singaporeans, are you going to do anything about it at all? I have heard comments like, “but what can I do?” You know, in another country, a government that dares to tell us a cock-and-bull story like the PAP has, would have been kicked out of government by the citizens long ago. I do not think any country has seen such patient citizens before (except for North Korea perhaps), when even when you are trampled on, bullied and pushed into the corner, you continue to hope that the very perpetrator of the harm done to you will suddenly be your saviour.

We all know the term, “wait long long”, right?

Please, it’s time we stand up to fight together. If we continue to remain scared of what we might lose, then let’s continue to remain scared and continue to lose. You can see from this article how you are losing like nobody’s business now. And it’s really nobody’s business, except Singaporeans’. The world doesn’t care if Singapore drowns. There are other financial centres around that they can jump to. If Singaporeans do not save ourselves, then no one else can or will.

It is up to Singaporeans to save ourselves. If not, when life gets even harder and we lose even more, we will only have ourselves to blame – when you had the chance to change things, you didn’t take it. When it is too late, we can only blame ourselves for causing it.

So, the question is – what will you do now? Will you do something about it? Will you to what you need to do to protect yourself, your family and your children? Will you vote right? Will you stand up and fight? It is all up to you now. We can keep waiting for kingdom come or we can decide that enough is enough, and get rid of the scourge that plagues our land.

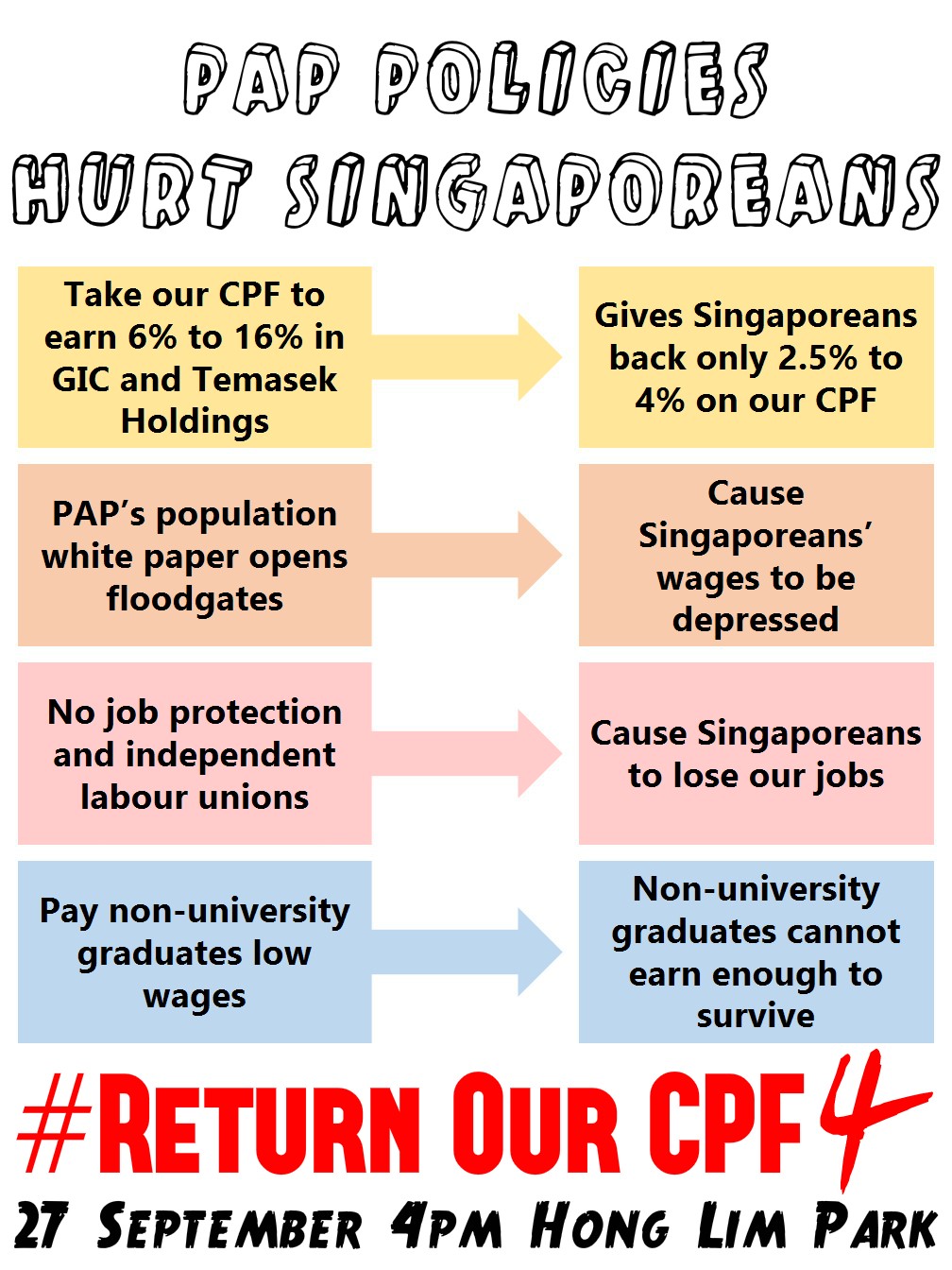

#ReturnOurCPF 4 Protest on 27 September 2014

On 27 September 2014, join us at the Hong Lim Park at 4pm at the #ReturnOurCPF 4 protest. The PAP cannot take our CPF and money to use and come out with a cock-and-bull story about how they do not know how they are using our money. When Singaporeans are not able to retire today, when our wages are depressed and more and more Singaporeans are becoming unemployed and are unable to save, then the PAP has failed Singaporeans and has become a liability to our country.

Join us at the next protest as we speak up against the low retirement funds and wages, and the high cost of living in Singapore.

You can join the Facebook event page here.

Also, my first court case will be held on 18 September 2014, at 10.00am. It will be a full-day hearing.

Roy Ngerng

*The author blogs at www.TheHeartTruths.com