Do you want to know what really happened to you CPF?

Then try this simple IQ exercise.

If all A = all B, and if all B = all C, then is all A = all C?

All A would be equal to all C, right?

Now, try this:

If all CPF = all SSGS, and if all SSGS = all GIC, then is all CPF = all GIC?

(Note: SSGS are “Special Singapore Government Securities (SSGS), which are Government bonds issued to the CPF Board.)

All CPF would be equal to all GIC, right?

Then, the question is, is it so that all CPF = all SSGS and is all SSGS = all GIC?

Without a doubt, all CPF would be equal to all SSGS, because:

- “The CPF Board invests CPF savings are entirely in risk-free SSGS.“

- “SSGS are non-tradable bonds issued specifically to the Central Provident Fund (CPF) Board.“

So, definitely, all CPF = all SSGS.

Then, the next question is, is all SSGS = all GIC?

Does GIC Manages Only Singaporeans’ CPF?

Now, according to the government, SSGS is invested in the GIC.

So, what we do know is all SSGS = GIC, but is all GIC = all SSGS?

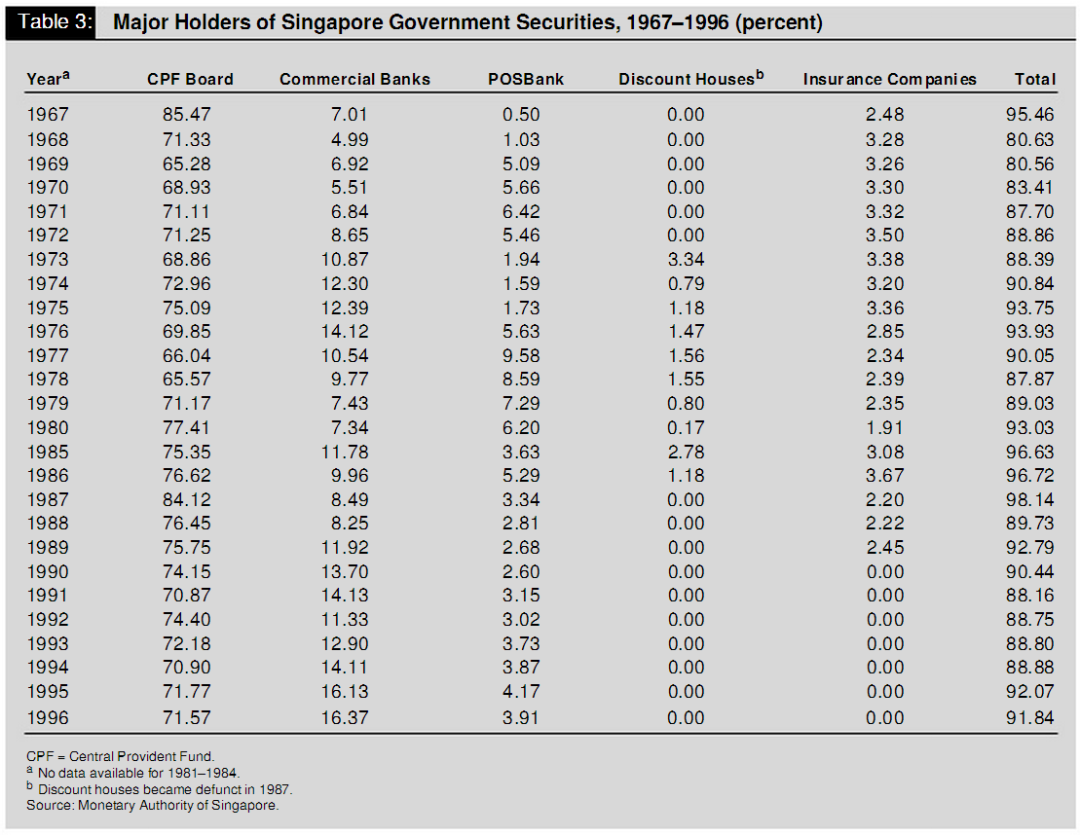

Take a look at the breakdown of the major holders the SGS (which includes SSGS) below.

You can see that from 1967 to 1996, CPF would comprise 70% to 85% of the SGS.

Now, the SGS and SSGS are borrowed by the government.

And if you look at the SSGS as a proportion of the borrowings by the government as of end of Financial Year 2012, SSGS (or our CPF) forms 63% of government borrowings ($249 divided by $396).

So, you can see that the SSGS (or our CPF) would form between 63% to 85% of the SGS, or government borrowings – our CPF actually makes up the majority of the government’s borrowing!

Next, “All borrowing proceeds (from SGS and SSGS) are … invested.“

So, the SGS and SSGS are invested in MAS which GIC manages.

How Much Does GIC Manage?

Now, according to the government, “the size of the Government’s funds managed by GIC … are not published (but) What has been revealed is that GIC manages well over US$100 billion (or S$125 billion).“

But now that we know the CPF is managed by GIC, then GIC has to be at least $260 billion in size.

But for a more accurate estimate of the assets that GIC manages, we can actually look back at 2007.

As I had written last week, GIC lost $59 billion in 2008. Lee Kuan Yew revealed that this meant that GIC “lost about 25 per cent of its value from its peak last year“.

If you work backwards, this would mean that GIC was managing $236 billion in 2007 – so here you go, the most accurate estimate of how much GIC would have managed.

At that time, our CPF was made up of $137 billion, which meant that our CPF accounted for 58% of the assets that GIC was managing.

Today, the $260 billion inside the CPF makes up 65% of the estimated value of $400 billion that GIC manages, so this is about right then.

How Much of Singaporeans’ Money Does the Government Manage?

So, today, GIC has an estimated $400 billion and MAS has $342 billion.

SSGS makes up $249 billion and SGS makes up $147 billion ($60 billion + $87 billion).

Since GIC manages all the SSGS, this leaves us with the SGS.

And because MAS manages $342 billion, we can assume that all the SGS of $147 billion should be managed by MAS.

But this would still leave us with $195 billion that is unaccounted for. What would make up this $195 billion that is unaccounted for?

According to the government, “the rest of the Government’s funds, (other than SSGS, comes from) SGS, government surpluses, as well as the receipts from land sales.“

If so, how much are government surpluses and how much are land sales?

In an article written by Thomas Pain in TR Emeritus, the government earned $16 billion from land sales last year which the government did not declare to Singaporeans.

Even so, this will still mean $179 billion not accounted for. According to Thomas Pain, the government under-reported a surplus of $23 billion last year to Singaporeans. Even when including for this, there would still be $156 billion not accounted for.

So, what we have at this point is a case of the missing money, but not just in MAS but in GIC as well.

GIC is estimated to have $400 billion, but our CPF makes up only $260 billion. According to the government, “GIC is a fund manager, not an owner of the assets” and thus the assets that GIC manages are the government’s. This would mean $140 billion that is unaccounted for.

Which then begs the question – there is already $156 billion not accounted for under MAS’s management, and then there is $140 billion not accounted for under GIC, then where did the total of about $300 billion that is unaccounted for go to?

Something is not quite right, right?

All CPF = All GIC, All GIC = All CPF?

But back to our initial question – is all SSGS = all GIC?

As I have written last week, MAS is meant to manage assets with “short maturities” and GIC was set up to manage assets with “a long-term orientation“.

According to UOB, “SGS come in two forms“, (1) Treasury Bills (T-bills) which “are short-term securities with original maturities of 3 and 12 months” and (2) SSGS which are “longer-term securities with original maturities of 2, 5, 7, 10 and 15 years”.

According to Professor Mukul Asher, CPF “is essentially a 35-year or more (the duration of one’s work-life) savings plan“, which means the SSGS (which is made up of our CPF) is the longest-term government bond.

As such, it can be assumed that MAS manages SGS and GIC manages SSGS.

It is also unlikely that GIC would manage any SGS, government surpluses or receipts from land sales because MAS is already short of a $156 billion that is not accounted for.

So now, we are back to the question, is all SSGS = GIC but is all GIC = all SSGS?

As I have written last week too, GIC earns an estimated 6% and our CPF earns an interest of an average of 3%.

This means that there is a 3% interest that is not returned to Singaporeans, which would mean that for Singaporeans, there could be as much as half of our CPF that is being confiscated by the government.

If so, what this means is that for the rest of the $140 billion which is unaccounted for, this would all be made up of Singaporeans’ CPF which is not returned to us!

If so, all SSGS would be equal to all GIC, and all GIC would be equal to all SSGS, wouldn’t it?

The Government Has to Return Singaporeans the Interest Earned on Our CPF

If so, as I have written, if GIC earns an estimated 6%, then shouldn’t Singaporeans also be earning 6%, since all of GIC is our CPF?

Why is the government only giving back 3%?

Not only that, there is something even more sinister.

First, according to the government, “For (the CPF) Ordinary Account (OA), CPF members receive a market-related interest rate based on the 12-month fixed deposit and month-end savings rates of the major local banks.“

But if it is now known that the CPF is fully invested in the SSGS, then why is our CPF OA even receiving an interest rate pegged to the banks’ interest rates of only 0.21%, when our CPF has nothing to do with the banks?

If all our CPF is invested in SSGS, then shouldn’t all our CPF be receiving the SSGS’s interest rates of 3.42%? Why are we still only earning 2.5% on our CPF OA?

Why is the PAP pegging our CPF OA interest rates to the banks’ interest rates? Don’t you think something is very, very wrong here? What is the PAP trying to do?

Second, if all our CPF is invested in SSGS, and all the SSGS is invested in GIC and if all of GIC would most likely be made up of SSGS and our CPF, then shouldn’t all our CPF be receiving the GIC’s interest rates of 6%?

If all of Singaporeans’ CPF is invested by GIC and all of GIC would in all likelihood be our CPF, and yet we are only receiving half of the GIC’s returns, don’t you think that something is very, very wrong here?

Why Did the Government Not Admit the Truth about What They are Doing with Our CPF?

Now, note that today, we know that our CPF is invested in GIC. However, for the past 15 years, PAP has been denying this.

PAP only admitted to this truth on 30 May this year.

Lee Kuan Yew denied this in 2001.

Lee Kuan Yew denied this again in 2006.

When the Worker’s Party’s Low Thia Kiang asked, “Does the Government Investment Corporation (GIC) use money derived from CPF to invest?” Ng Eng Hen said, “The answer is no.”

So, why does the PAP still come out with such bull that:

- GIC’s long term returns are thus not earned by managing only SSGS proceeds, but the combined pool of Government funds that it is tasked with managing for long-term returns.

- There is also no link between CPF interest rates, and the returns earned by GIC.

- the Government is able to guarantee CPF savings and pay the minimum interest rates on CPF savings regardless of GIC’s returns over any period, because the Government’s balance sheet enables it to absorb risks.

- It would be quite different if the GIC were to manage SSGS proceeds directly through a separate, standalone fund, … (which) would have to be managed much more conservatively, to avoid the risk of failing to meet obligations to CPF members… The fund would not be aimed at accepting risks that enable good long-term returns, but at avoiding any short-term shortfalls. The returns that such a fund would earn over the long term will be lower than what the GIC can expect to achieve with its mandate of managing the Government’s pooled assets on an unencumbered basis.

Quite obviously, we can now tell that this is bull****.

In all likelihood, all of GIC is Singaporeans’ CPF, which thus means:

- There is definitely a direct link between CPF interest rates, and the returns earned by GIC.

- The government is not guaranteeing our CPF. Singaporeans are actually the ones made to guarantee GIC by having to use our CPF to take on the risks.

- GIC already manages SSSG proceeds (and our CPF) as a standalone fund.

- And since GIC is already managed for long-term returns, using only Singaporeans’ CPF, then PAP’s logic obviously contradicts itself where they are able to invest this “standalone fund” for “long-term returns” even though they claim that they would not be able to do so for a “standalone fund”.

Do you see what is very, very wrong here?

- Why did PAP not admit to Singaporeans prior to 30 May this year that our CPF is invested in GIC?

- When PAP finally admitted that our CPF is invested in GIC, why do they claim that there is no direct link between CPF and GIC?

- If all of GIC in all likelihood is made up only of our CPF, then why does PAP claim that it is not?

- If our CPF is invested in SSGS, why does PAP peg our CPF OA to banks’ interest rates which have no link at all to our CPF?

- If our CPF is invested in SSGS which is invested in GIC and all of GIC would be made up of only our CPF, then why are we given back only half of the returns earned by GIC? Where did the rest of the money go? For PAP to keep and earn for themselves?

Perhaps more importantly:

- Why does PAP come out with such a convoluted system to mislead Singaporeans?

- Why does PAP not tell us the full truth about how our CPF is managed by GIC, or by PAP in fact?

- Why does PAP not give Singaporeans back the full returns earned by GIC?

- Why does PAP not want to let Singaporeans know how much GIC manages? Is it because PAP knows that if we know how much GIC manages and we are able to work out the full picture, we will know that whatever GIC is managing is actually our CPF, and whatever GIC has in excess of our CPF is actually money siphoned away from Singaporeans and not returned?

So, what is the truth? Will PAP reveal everything, once and for all today? Can PAP tell Singaporeans the complete truth about what exactly they are taking our CPF to do?

This is all the more worrying when PAP tells us that “The Government … neither directs nor interferes in the (GIC)’s investment decisions” and GIC says, “The government holds the GIC board accountable for portfolio performance, but does not interfere in the company’s investment decisions.“

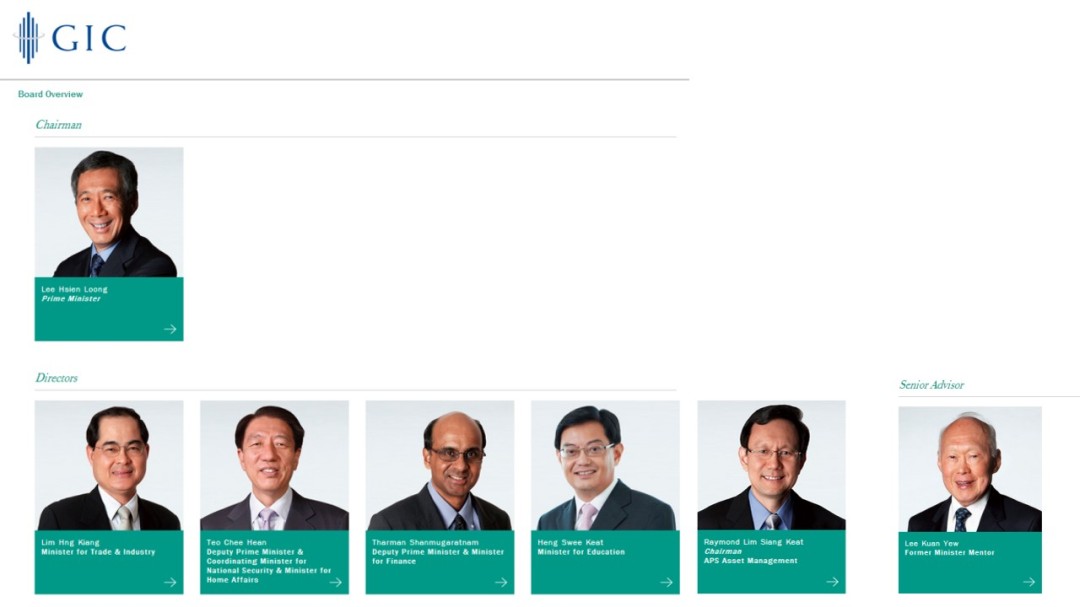

But how can this be possible when the PAP government is also on the Board of Directors of GIC. The Singapore prime minister Lee Hsien Loong, the deputy prime ministers Teo Chee Hean and Tharman Shanmugaratnam, the ministers Lim Hng Kiang and Heng Swee Keat, ex-minister Raymond Lim, and ex-prime minister Lee Kuan Yew are on the GIC’s Board of Directors.

Also, Minister S Iswaran is on the GIC’s Investment Strategies Board Committee.

Do you honestly think the PAP ministers can do their jobs as the ministers and also be on the GIC’s board of directors at the same time? Not only that, is there not a conflict of interest when the PAP ministers are supposed to manage our CPF but they are also managing GIC, which has been shown to most probably be only investing our CPF? What then are PAP’s priorities? Our CPF or earning the extra 3% not returned back to our CPF at GIC?

Not only that, the Chairmen of DBS and UOB banks are also on the GIC’s Board of Directors, and a director of OCBC who was also on the CPF Board’s Board of Directors is also on one of the Board Committees.

Why are the chairmen and directors of Singapore’s local banks also on the Board of Directors of GIC? Why is our CPF OA’s interest rates pegged to the banks’ interest rates when our CPF is invested in GIC and GIC would in all likelihood manage only our CPF?

Temasek Holdings Does Not Invest CPF? Cannot Be.

Now, Temasek Holdings said that it does not invest our CPF.

However, this is impossible because in the book, ‘Reforming Corporate Governance in Southeast Asia‘, it was explained that, “The second issue meriting consideration is Temasek’s utilization of Singapore’s reserves. The country’s reserves have been managed by the Government of Singapore Investment Corporation (GIC). In April 2004, a constitutional amendment that allowed the government to transfer reserves to key statutory boards and companies, and the transfer of reserves among them with the approval of the president, was introduced. Temasek Holdings has acknowledged that it can access the reserves (Temasek Holdings 2004). Both Temasek’s chairman and chief executive also have to annually certify its statement of reserves and past reserves to the president.”

Thus Temasek Holdings would have access to Singaporeans’ CPF.

Also, when the government injected $5 billion into Temasek Holdings in the “latest financial year”, it said that this money “came from proceeds of the Singapore Government Securities (SGS), proceeds from government land sales in Singapore and government budget surpluses.“

However, the government has also said that, “SSGS … are pooled with the … SGS … in a combined pool“. If so, doesn’t this mean that the government would have mixed up our CPF with SGS and in so doing, would have given our CPF to Temasek Holdings as well? Unless the government is saying they are quite clear that the SGS is seperate, then what the government says about our SSGS (or our CPF) being pooled with the SGS is not telling the truth.

And if indeed Temasek takes our CPF to invest and it is currently earning 16%, then shouldn’t our CPF which is taken to be used also be earning 16%?

Now, things get more complicated. Earlier, we see how the major banks in Singapore are involved in GIC.

But not only that, GIC has majority shares in Citigroup, Temasek Holdings has majority shares in DBS, and via Citigroup and DBS, GIC and Temasek Holdings also have majority shares in OCBC and UOB.

This makes a very messy arrangement where the government’s investment firms, GIC and Temasek Holdings seem to be in a very cosy relationship with the local banks in Singapore.

Amidst all these, there is still a $156 billion unaccounted for in MAS. Where is this money from? From the HDB profit that PAP is earning from Singaporeans? We are still none the wiser about this and how much profit PAP is earning from our HDB.

What exactly is going on?!

Who is controlling the government?

Who are controlling our banks, our CPF and our HDB (which our CPF is used to blow out on)? And when you know what this all means, it means your lives are pretty much controlled. You are being f***ed around with, Singaporeans.

Meritocracy? My foot. You are treated with meritocracy as long as you are born with a silver spoon in your mouth.

Something is Terribly Wrong with How Our CPF is Being Managed

So, here you go.

What exactly is happening to our CPF?

What is the real story behind how our CPF is being used and siphoned away?

If our CPF is indeed GIC and GIC is indeed our CPF, then where is the 6% interest that Singaporeans should be earning on our CPF? If our CPF is invested in GIC, why does PAP peg our CPF OA’s interest rates to the banks’ interest rates?

If our CPF is invested in GIC, why does PAP deny this for the past 15 years and admitted this only on 30 May this year? And why is it even after admitting to this, they still do not let us know the full truth behind how GIC is using our CPF and how much exactly there is in GIC?

Why does PAP tell us that the government does not interfere in GIC when the PAP puts themselves in GIC?

Something is terribly, terribly wrong with how our CPF is being managed. Not only that, something is terribly, terribly wrong with the state of affairs in Singapore and the governance of Singapore.

Something is damn f***ed up. In other words, Singaporeans, you are being f***ed.

Welcome to the real world. Are you going to do something about it?

Come down to the #ReturnOurCPF 4 protest on 27 September 2014 at 4pm at Hong Lim Park. You can join the Facebook event page here.

On 27 September 2014, join us at the Hong Lim Park at 4pm at the #ReturnOurCPF 4 protest. The PAP cannot take our CPF and money to use and come out with a cock-and-bull story about how they do not know how they are using our money. When Singaporeans are not able to retire today, when our wages are depressed and more and more Singaporeans are becoming unemployed and are unable to save, then the PAP has failed Singaporeans and has become a liability to our country.

Join us at the next protest as we speak up against the low retirement funds and wages, and the high cost of living in Singapore.

You can join the Facebook event page here.

Also, my first court case will be held on 18 September 2014, at 10.00am. It will be a full-day hearing.

Roy Ngerng

*The author blogs at http://thehearttruths.com/