This is the much shorter version of the real history of the CPF which I had written yesterday. Please read this. When you finish reading this, you will know how PAP is treating your CPF for everything else, other than for your retirement, and how they have locked-in our CPF into the economy that it is now very difficult for them to pull back.

I have written this article in a way that makes it very quick and easy to read through. I have put in many graphics to make it faster to flow through. Please take a few minutes to go through this article. Knowing how your CPF works in the big picture will allow you to make the right decisions to protect your own lives.

This is a 2-page article. Please also read page 2 as it will complete the full picture for you on how PAP uses your CPF and does not want to let you know how they do it.

*****

The CPF was set up in 1955.

The Housing Development Board was set up in 1960. Prior to 1964, the HDB’s “original objective … was to build flats for rental“. However, in 1964, the PAP government changed their objective to “selling flats to tenants in 1964“.

However, Singaporeans were not buying the flats so PAP “liberalised” the CPF and created the Home Ownership Scheme to let CPF be used to buy flats.

The government also used our CPF for another purpose which most Singaporeans do not know about. From 1968, CPF was legislated to become “a source of funds for the government“. Singapore hasn’t accumulated surpluses yet too, so the government borrowed Singaporeans’ CPF “for development expenditure … (until) it built up budgetary surplus.”

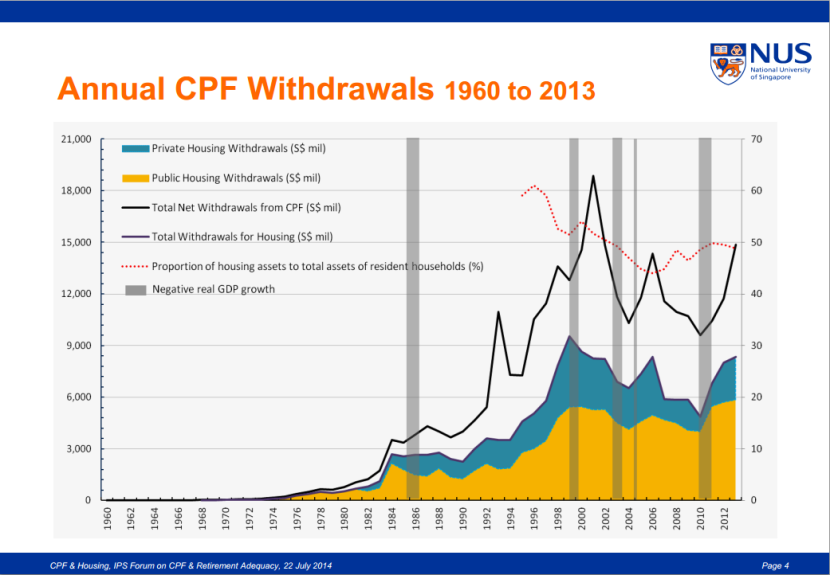

As the main user of the development funds was the HDB, “CPF funds were (thus essentially) lent to the Housing Development Board so that it could build flats.”

At the start in 1955, Singaporeans only needed to contribute 10% (5% employee and 5% employer) into the CPF.

However, in 1968, because PAP wanted “to support the(ir) national home ownership drive“, they increased the CPF contribution rates to 13%.

And so they kept increasing it to do so until 50% in 1984, until 1986.

Edward Ng said that, “Such a high savings rate is evidence of the intent to make CPF more than a pension scheme for retirement.” Indeed, PAP extended the CPF to give HDB to use.

But why did the PAP wanted Singaporeans to “own homes”? Lee Kuan Yew had said, “I wanted a home-owning society. I … was convinced that if every family owned its home, the country would be more stable … I had seen how voters in capital cities always tended to vote against the government of the day and was determined that our householders should become homeowners, otherwise we would not have political stability.”

But the borrowing of our CPF to build HDB got out of hand. During the early 1980s, PAP started to over-build. Under the Fifth Five-Year Building Programme, the target set in 1980 was to build 85,000 to 100,000 flats. However, a massive 189,000 flats were built, or nearly twice as much.

This “contributed towards ‘over-heating’ of the economy and the property slump and recession which followed in 1985-87” as there was an “over-supply in the property market“.

Lee Kuan Yew later admitted that, “We made one of our more grievous mistakes in 1982-84 by more than doubling the number of flats we had previously built.”

But why did PAP over-build? This is because “1984 (was) an election year as well as a year for celebrating 25 years of achievement as an independent nation” and PAP wanted to get more Singaporeans to “own” their flats in time for their anniversary.

This is because the CPF was creating an “artificial demand” for housing, as PAP wanted to achieve their “goal of 100 percent home ownership“. Thus “The use of CPF savings for the purchase of housing distorts consumption patterns … (and) The fulfilment of the political objective of home ownership by increasing CPF contribution rates so that more funds would be available for this purpose is, if true, economically inefficient.“

However, PAP went in the “opposite” direction and “promoted the upgrading policy (again) and allowed the user of CPF funds for this purpose.”

So, PAP did not stop its wanton desires to use our CPF to over-build flats and “when the Asian Financial Crisis hit in 1997,” National Development Mah Bow Tan admitted that, “HDB ended up with 31,000 unsold flats“, this time while “wast(ing) … taxpayers money”.

Thus from the 1960s to mid-1980s, the PAP kept making Singaporeans pay more into the CPF. In 1982, the then-Minister for Labour and Communications had said that “the CPF contribution rate is likely to increase to 50% in the future. Of this 50%, 40% will be for housing and other uses, 6% for Medisave and the remainder for old age and contingencies.”

Which means PAP had planned to make us use 80% of our CPF to buy their flats.

However, “The international experience suggests that a contribution rate of 10 to 15 percent should be sufficient for providing a replacement rate of between 35 and 40 percent plus survivors insurance benefits,” thus is 50% (or the 37% today) too much?

The PAP was thus able to “‘create’… (their intention of) homeownership was by directing savings in the Central Provident Fund (CPF) towards housing.“

Essentially, “the CPF has (become) a substitute for the mortgage market.“

But is this what you think your CPF should be used for, especially since today many older Singaporeans cannot retire? Did PAP return what they took from Singaporeans and earned?

Very soon, on the supply of our CPF, HDB became “the largest housing developer (and) also the largest mortgage provider… government mortgage loans totalled 60.1 billion Singapore dollars (SGD) in the year 2000, which was much higher than the total housing loans of the private sector (SGD 38.6 billion)” and the “2003 ratio of outstanding housing loans to GDP (was) 71 percent, (which was) … the highest in Asia”.

HDB became “a monopoly supplier of public housing and its mortgage provider, administered through the CPF“.

But it is also because of “the absence of common or constitutional right to land ownership” under the Land Acquisition Act 1966 that allowed PAP to do this – “land under state ownership increased from 44% in 1960 to 76% by 1985.“

Goodman, Kwon and White said that, “If there had been a strong landlord class with a vested interest in land, the housing policy could never have been carried through as easily as it was.”

However, today, the PAP government, via HDB and the real estate companies owned by Temasek Holdings, is the largest real estate owners and we can see where things have headed.

Thus PAP created “higher artificial demand” with their “homeownership policy“. Also, “The relaxation of housing rules by both the HDB and CPF made public and private housing more substitutable, (which created an) unholy alliance … as the whole residential market becomes a de facto cartel with HDB and a handful of private developers on the supply side.“

Worse still, “The situation is aggravated by the state as the largest land owner and exercises land sales from its land bank on a tender system”, causing flat prices to rise even faster. Also, “the extra savings due to the CPF system had induced a demand for bigger flats in Singapore” also drove prices even further upwards.

This means that if Singaporeans are to “migrate en masse, … (this will) trigger downward spirals as more would sell their properties.“

However, the escalation of housing prices does not make sense as the Minister for National Development Khaw Boon Wah had recently admitted that, “we control the (public housing) construction programme; secondly, we set the price (for the HDB flats),”

If so, can PAP not prevent prices from exploding? Or, why does PAP want housing prices to escalate upwards?

As such, PAP has intentionally created policies to drive prices upwards. And they have done so by manipulating our CPF to get Singaporeans to use more CPF to soak up the HDB demand they created. Now, do you see why they needed every Singaporean to believe in owning their own homes? It might be political, but the real reason is financial.

Indeed, we can track how PAP’s policies did increase housing prices.

Also, in the 1980s, PAP started to make flats more expensive by “increas(ing) … prices based on housing type, location, floor level, view, and other aesthetic factors,” making Singaporeans use more of our CPF to pay more for the flats.

Previously, flats were built and sold cheaply below market rates but PAP started including “Land cost … in the final selling prices … though the true formula is not revealed,” which drove flat prices upwards as well. Today, “Land now makes up about three-fifths of development cost on average, up from two-fifths in 2008.”

PAP made flat prices grew so quickly that “between 1981 and 1988, four-room flat prices rose by an average of only 2.5% per year, but between 1988 and 1992, prices increased dramatically by an average of 12% every year!”

Things are even worse today, from 2008 to 2013, “land costs have grown at an average compound rate of 18.2 per cent a year, compared with 9.1 per cent for HDB resale prices” but “incomes (only) rose at a compound annual rate of 5.3 per cent for the average household“.

Professor Phang Sock-Yong said that, “The 1981 liberalization as well as the 1993 liberalization of HDB and CPF regulations for HDB resale flat housing loans had significant impacts on housing prices, contributing to the development of speculative bubbles that subsequently burst.” The same happened in 1997, 2008 and threatens to happen again today.”

Also, “Singapore’s mandatory savings and housing policies have very substantial impacts on household’s consumption and investment patterns. Savers’ and consumers’ rights in decision making are constrained by numerous CPF and HDB restrictions and regulations.”

So, why did PAP ignore the warning from the CPF Study Group in 1986 not to over-extend the CPF for housing? It is evident now – there is a lot of money for them to make from Singaporeans’ CPF and HDB, and they wanted it.

Because the “CPF started to withhold from individuals an increasingly large portion of their own financial wealth“, Professor Lim Chong-Yah thus said in the CPF Study Group’s report that this “emasculate their sense of economic initiative and enterprise”.

Dr. Richard Wong, Director of the Hong Kong Centre for Economic Research, said that, “This sequence of liberalization measures contradicted the original aims of the CPF as a compulsory savings scheme.“

Professor Lim Chong Yah also said, “[T]he large sums of money vested with the fund are in effect held `hostage’ to governmental decision-making: ipso facto, this would be acceptable if there is a guarantee that future governments would be as honourable and as capable as the present one, but can such a guarantee ever be forthcoming?”

Today, the same question can be asked. Do we have a government that is “honourable and as capable”.

Wong concluded “that the Singapore CPF has probably resulted in a society where most people are more equal, except for thegap between the rulers and the ruled. But this has been achieved by forcing everyone to earn a 2 percent real rate of return on some 40 percent of their savings.”

Phang also surmised that, “Singapore’s housing strategy is inherently policy driven and centrally controlled, with major decisions on savings rate, savings allocation, land use, housing production, and housing prices being largely determined by the government. It is, in other words, a neo-classical economist’s nightmare.“

Now, because the CPF contribution rates were increased from 10% in 1955 to 50% in 1984, this “restrain(ed) aggregate demand”.

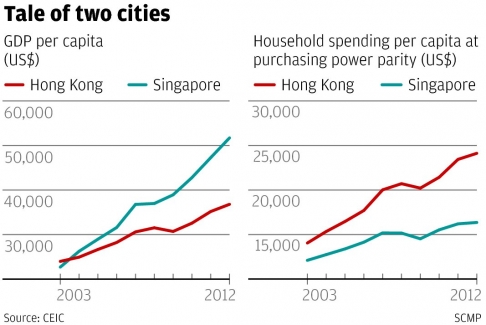

Indeed, personal consumption in Singapore has been declining.

So has purchasing power grown much slower.

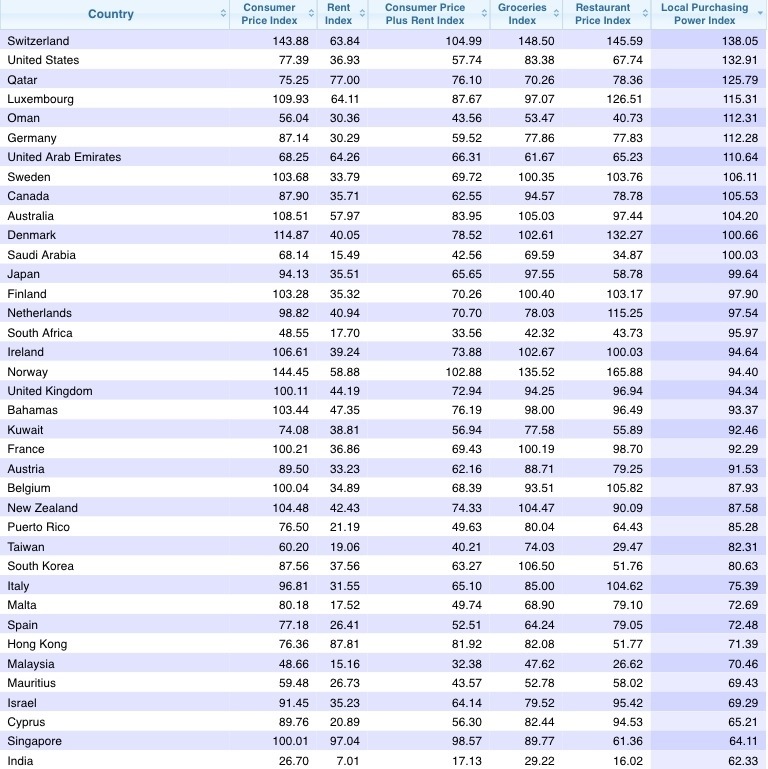

Singaporeans also have the lowest purchasing power among the developed countries, and which is lower than even Malaysia and on par with India.

“The government, through the mandatory CPF contribution rates which have escalated,” have resulted in the “over-saving and over-investment in residential properties” but under-investment in other areas, and created a dearth of local entrepreneurship, as PAP made it more expensive for Singaporeans to start businesses via rising rental costs as well, and because of PAP’s direct competition in the economy.

Today, Singaporeans have to pay the highest social security (CPF) contribution rate in the world.

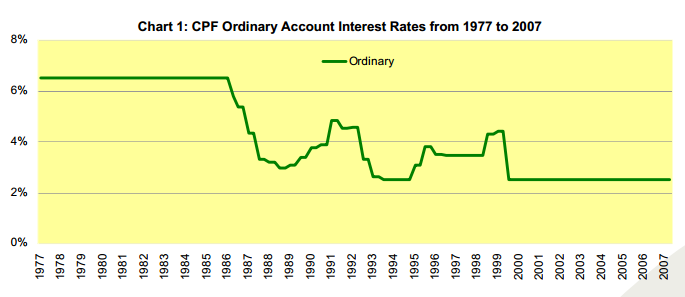

In 1986, supposedly “in response to public complaints that CPF interest rates were below bank rates and were also inadequate as a hedge against inflation“, “the government decided to peg CPF interest rates to market rates.“

The Minister for Labour and Communications cautioned that CPF interest rates “could well be lower than what CPF is now paying” if market rates fall, and this can apparently “result in lower construction cost and hence lower selling prices of flats.” “The government (also) warned that if CPF interest rates were tied to market rates, when the latter went up, HDB mortgages would have to pay more for their loans.“

Prior to 1986, the CPF interest rates kept increasing from 2.5% in 1955 to 6.5% in 1974 and remained at 6.5% for the next 12 years until 1986. Singaporeans were able to earn in our CPF.

But from 1986, when CPF interest rates were pegged to market rates, the CPF interest rates only continued falling and never picked up from where it left off. In fact, it went all the way down to 2.5% in 1999, to the rate when CPF first started and stayed at that level.

PAP said that since interest rates fell, housing prices would fall as well. However, not only did flat prices never fell, they shot up and escalated dramatically.

The CPF that has to be withdrawn for housing mortgage also shot up.

The CPF interest rates thus became “administered by the government and “computed monthly and compounded and credited annually.”

However, Mukul Asher stated that, “there is “no economic rationale” to pay a one-year fixed deposit rate on what is essentially a 35-year or more (the duration of one’s working life) savings plan”. He also said that “the CPF real rate of interest from 1987 to 1998 is zero, thanks to inflation. And this negative replacement rate defies the logic of accumulation.”

In 1999, PAP changed the interest peg again.

And from then on, Singaporeans were only receiving 2.5% interest on our CPF Ordinary Account, or the lowest since 1968.

Leong Sze Hian has shown that Singaporeans are thus made to earn the lowest interest rates on our CPF retirement funds in the world.

Asher and Nandy said that, “The centralized control of national savings by the government agencies and banks, however, is of considerable advantage to those controlling them,” which explains the rising inequality in Singapore and the growing wealth among the richest, the PAP politicians among them.

Basically, PAP has planned to use CPF (and HDB) to control the lives of Singaporeans, how we spend, what we use etc.

Today, “The CPF savings have grown from a mere $9 million at the beginning” to about $260,000 million as of March 2014; with an additional $169,000 committed to housing and $26,000 to investment.

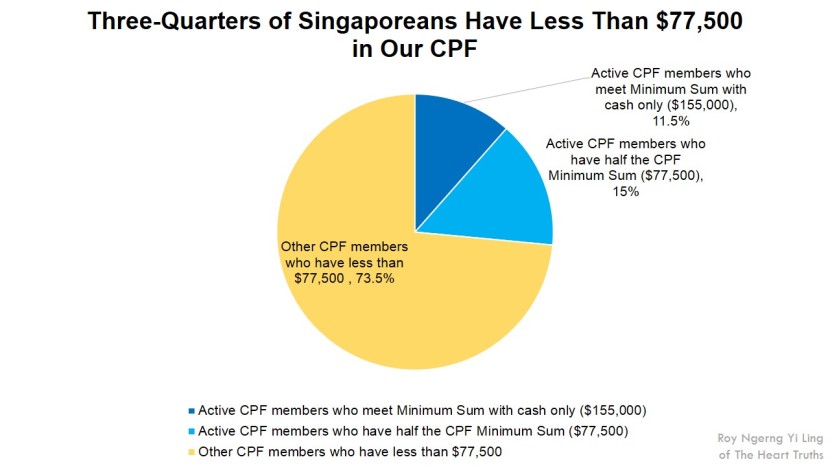

I had calculated that the median CPF balance is $55,000, which means that half of Singaporeans do not even have $55,000 inside our CPF.

The reason why Singaporeans cannot save inside our CPF is because “the wage structure in Singapore is highly unequal,“, “70 percent of contributions (have to be) withdrawn (for housing)“, “the real rate of return is low due to implicit tax on CPF wealth… (and there are) high transaction costs due to restricted competition.”

In 1987, “The Minimum Sum Scheme was introduced … to help CPF members set aside sufficient savings to support a basic standard of living during retirement,” so the PAP said. The Minimum Sum (MS) was set at $30,000 in 1987.

In 2004, this was raised again “by $4,000 a year, and adjusted for inflation… It will reach $120,000 (today’s dollars) by 2013.“

I I had asked the government about how many Singaporeans are actually able to meet the CPF Minimum Sum in only cash and what the CPF median balance is. However, the Manpower Minister Tan Chuan-Jin refused to answer.

Today, 90% of Singaporeans are unable to meet the CPF Minimum Sum.

Half of Singaporeans have less than 35% of the CPF Minimum Sum inside our CPF.

73.5% of Singaporeans do not even have half of the CPF Minimum Sum of $77,500.

Yet, Lee Hsien Loong still announced that the CPF Minimum Sum will increase to $161,000 next year (2015). This is preposterous.

But why does PAP keep increasing the CPF Minimum Sum, even though they know that the majority of Singaporeans do not have enough at all inside our CPF to be able to meet the CPF Minimum Sum?

In fact, why did Lee Hsien Loong still increase the CPF Minimum Sun to $155,000. Did he show how much Singaporeans actually have inside the CPF and any plans to help Singaporeans reach the CPF Minimum Sum at all?

Why does PAP want to lock our CPF up?

The PAP thus used the CPF Minimum Sum scheme to lock-up Singaporeans’ CPF:

- 1995: CPF Minimum Sum raised by $5,000 every year until 2003

- 1995: Required to set aside cash (of $4,000) to meet CPF Minimum Sum until 50% is reached in 2003

- 2003: CPF Minimum Sum raised by an additional $4,000 every year until 2013

- 2009: 50% withdrawal rule phased out

- 2013: Excess CPF monies can only be withdrawn upon meeting the CPF and Medisave Minimum Sums, and $5,000

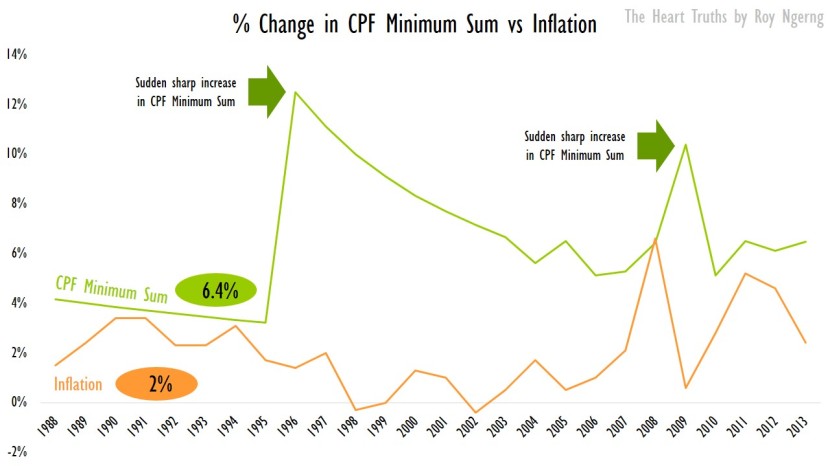

PAP said that the CPF Minimum Sum is “adjusted yearly for inflation“. However, the CPF Minimum Sum has been growing by more than 6% every year even though inflation has only grown by 2% annually! Why does PAP want to increase the CPF Minimum Sum by so much to trap our CPF inside?

There were also two sharp rises in the CPF Minimum Sum in 1995 and 2008.

The sharp rise in 1995 can be attributed to the policy change to raise the CPF Minimum Sum by $5,000 every year.

However, the 2008 rise is mysterious. Some people have speculated that this is due to the $58 billion loss that Temasek Holdings had made from the end of March 2008 to November 2008 and the $59 billion loss the GIC made in Financial Year 2008. Prior to May this year, Singaporeans did not have clear evidence that the CPF was invested in GIC and Temasek Holdings.

PAP claimed that, “transfer of funds cannot be used to hide investment losses” and that “The issue of whether the investment of the reserves results in gains or losses over time is therefore distinct from the question of whether there is a draw on Past Reserves.” Does this make any sense to you?

However, the total losses than the GIC and Temasek Holdings made in 2008 was a total of $117 billion. And if you look at this as a percentage of the CPF balance of $151 billion in 2008, their losses made up 77.5% of the value of the CPF itself!

Other than trying to lock our money inside the CPF, PAP also tried to prevent us from being able to withdraw our own money.

Linda Low said that, “In 1984 the government tried to increase the CPF withdrawal age from fifty-five to sixty. The attempt was very poorly received, as people viewed the government as having broken a promise.” So, “One way of getting around this problem has been to institute a scheme minimum sum, which softens the impact.”

The retirement age was then raised from 55 to 62 in 1999, right in between the two increments to the CPF Minimum Sum in 1995 and 2003. Today, “the statutory minimum retirement age is still 62, but employers are now required to offer re-employment to eligible employees who turn 62, up to the age of 65“. Also, PAP plans to “extend the re-employment age from 65 to 67.“

Paul Yip had said that extending the retirement age is “An alternative and perhaps better policy option … which would imply less, and delay of, CPF withdrawal as well as more and continuing CPF contribution by the affected labour.”

This will reduce withdrawals and lock-in more of Singaporeans’ CPF – but for what and who to use?

Professor Lim Chong Yah had asked if we can “guarantee that … governments would be as honourable and as capable” Can we trust PAP to have our interests at heart?

However, as Yasue Pai puts it, “The lack of transparency in the way the government invests CPF balances and the lack of an overall strategic objective of the CPF puts into question whether the system is really in the best interest of members.“

Yip also explained that relaxing the “immigration policy for foreign workers might also reduce the net CPF withdrawal at that time.” He also explained that encouraging “higher birth rate now (to) … mitigate the problem (by increasing CPF contributions later on)” can also help to reduce withdrawals but he said that, “it is not advisable to just rely on this policy… because the decision of having a child involves costs and considerations that will be far much greater than any possible tax incentives provided by the government. As a result, the impact of encouragement policy is likely to be small although effort along this line should be encouraged.“

As can be seen, the PAP’s half-hearted attempts in recent years to increase the fertility rate of Singaporeans has also been guided by such thinking.

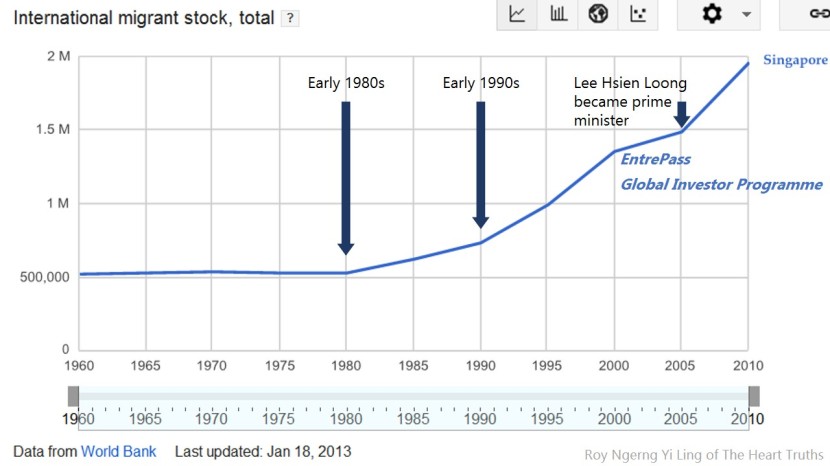

Indeed, the PAP also followed Yip’s approach and relaxed the immigration policy. In fact, if you trace the growth of Singapore’s migrant population, you can see how it also coincided in the early 1980s and 1990s with the periods of housing boom.

There was also a sudden spike in 2004, which can also be traced to two key policies introduced under the premiership of Lee Hsien Loong – the EntrePass scheme to set up business and the Global Investor Programme to become permanent residents for high-net worth individuals. This has also resulted in the dramatic escalation of housing prices.

Thus from 2001 to 2011 (before CPF started omitting this information from their annual reports), the number of CPF members who earned $1,000 kept increasing even though Singapore supposedly became more wealthy.

And from 2004 when the most recent spike in migrant inflow occurred, there was also a spike of the proportion of Singaporeans who were earning less than $1,000. The wages of Singaporeans were depressed and more and more Singaporeans cannot earn enough.

Yet, Lee Hsien Loong remained unapologetic to the effects of rising cost, wage depression and CPF depletion. He had said, “In fact, if I can get another 10 billionaires to move to Singapore and set up their base here, my Gini coefficient will get worse but I think Singaporeans will be better off, because they will bring in business, bring in opportunities, open new doors and create new jobs, and I think that is the attitude with which we must approach this problem.”

Today, Singapore has the highest concentration of millionaires in the world.

We also have the 4th largest concentration of billionaires in the world.

However, Singapore also have the highest poverty rate among the developed countries as well, and even higher than regional developing countries (as you will see later).

Importantly as well, in the PAP’s eagerness to import cheap labour to substitute the local economy, does this thus explain why it has become more difficult over the years for Singaporeans who have been made redundant from work to gain re-entry back into employment?

Does it also explain why it is taking a long time now for Singaporeans to secure a new job?

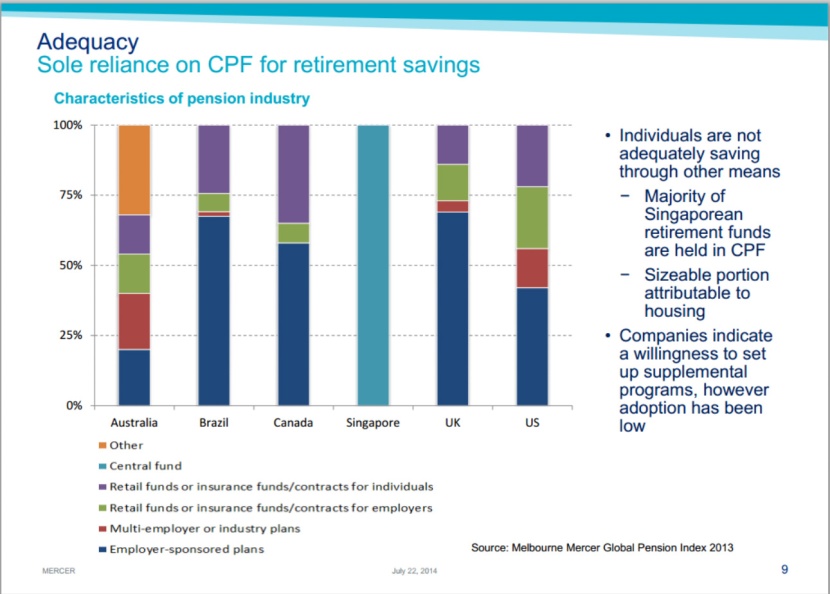

Also, whether Singaporeans are able to accumulate CPF depends on whether we are able to have a job. Thus it becomes problematic that the pension system in Singapore relies solely on the CPF and Singaporeans can otherwise not be able to save. This is worsened by how PAP pays Singaporeans such low wages and creates policies to depress our wages, such that Singaporeans do not have additional cash to save for retirement as well.

Perhaps now you can understand why PAP has to go out at all costs to prevent the withdrawals of the CPF to sustain their parasitic system, and so you will understand why the PAP government refuses to allow dual citizenship and makes it a path of no return if a Singaporean chooses to renounce his/her citizenship. And also how a permanent resident (PR) “cannot withdraw the CPF monies unless he or she gives up PR status and leaves Singapore and West Malaysia permanently, with no intention of returning for further employment or residence” which is a veiled threat to prompt second thoughts about leaving, and thus allowing the CPF to be entrapped inside for their own uses.

Today, Singaporeans earn the lowest wage share among the developed countries, even though Singapore has become the most expensive place to live in, in the world.

Thus it is problematic that PAP claimed last year that income inequality has stabilised and last week that income inequality has actually been reduced.

But in an article I had written earlier this year, the PAP government has actually been pushing down the income inequality statistics over each reported period, to create the perception that income inequality is not as high as it actually is in Singapore!

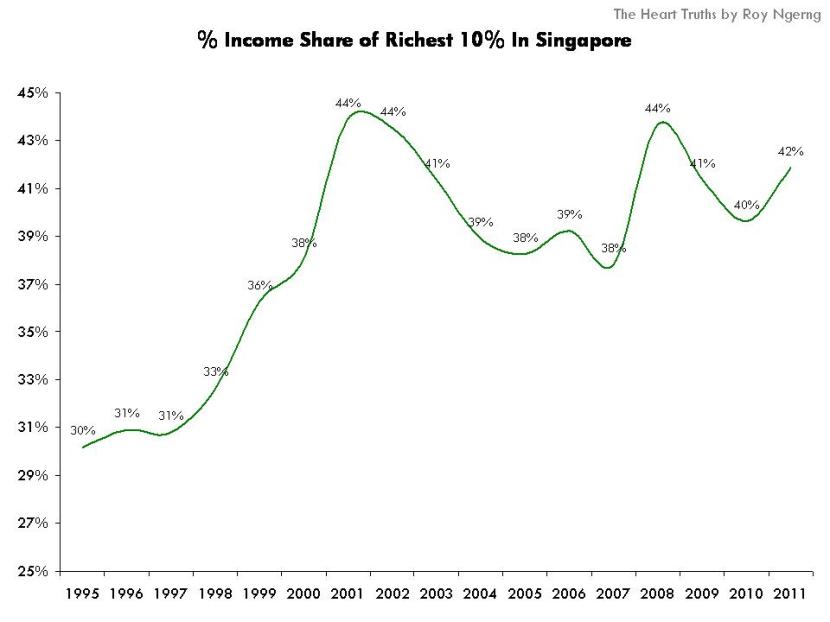

On the other hand, the income share among the richest 10% in Singapore has grown from 30% in 1995 to 42% in 2011.

And as can be seen, the change in income share among the richest 10% also follows the Gini coefficient (or the measure of income inequality), which means that as the income inequality increases, so does the income share of the rich – which brings to question, is income inequality thus artificially pushed higher by paying inequitable salaries at the top to themselves (similarly to how it can also be artificially deflated in the reports?)

The dramatic increase in the share of income among the richest also coincided with whence PAP decided to increase their own salaries in 1994 by pegging the salaries of the ministers to “two-thirds of the average of the top 24 people in 6 professions”, to earn million-dollar salaries and the highest in the world.

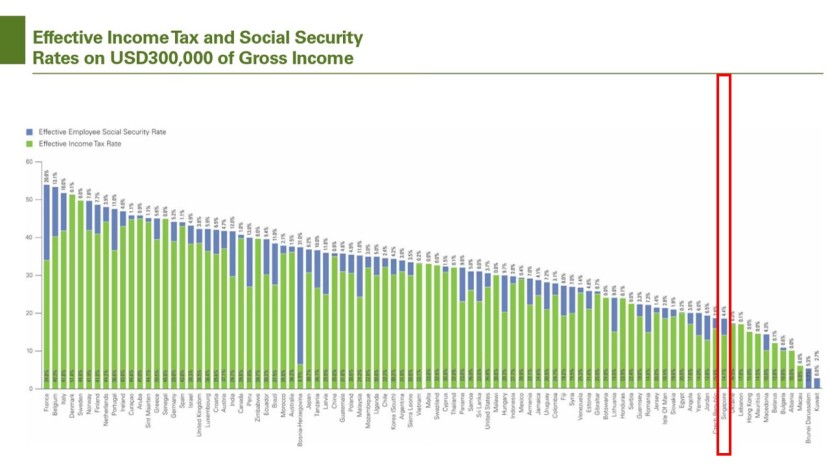

Today, the richest in Singapore earn one of the highest salaries in the world.

They also pay one of the lowest taxes in the world.

However, Singaporeans earn the lowest wages among the highest-income countries.

Low and middle income Singaporeans also have to pay higher tax and CPF contribution rates than the richest.

The Prime Minister now belongs to the richest 0.1% in Singapore while the PAP politicians belong to the richest 5%.

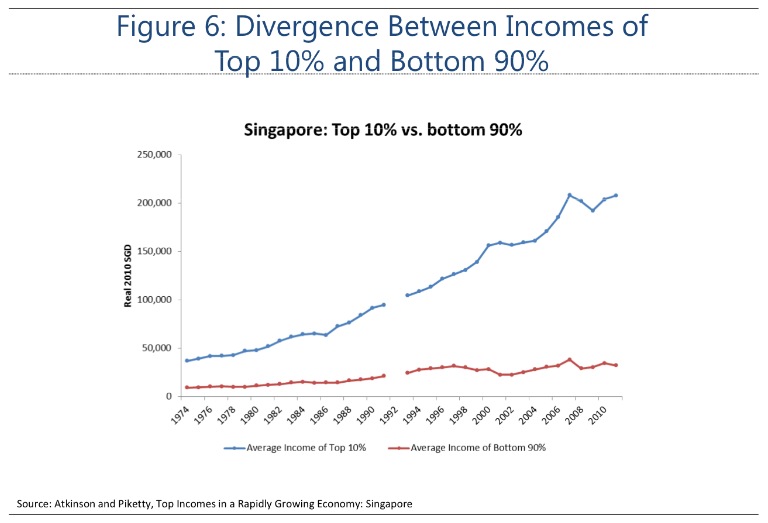

And the rich-poor gap has only kept widening over the past 50 years. This is SG50 for you.

Asher thus estimated the poverty rate in Singapore to be very high – at between 27% to 35%.

This is in line with the estimates of up to 26% by the Lien Centre for Social Innovation and SMU School of Social Sciences, and my previous estimate of 26% (which could have gone upwards to 28%). In fact, Singapore now has the highest poverty rate among the developed countries and even among regional developing countries.

In spite of this, the PAP government has refused to define a poverty line, erroneously claiming that this would caused a “cliff effect“.

Worse still, Professor Tilak Abeysinghe had highlighted that “Singapore’s bottom 30 per cent of households spend more than they earn” where they would “spent 105 per cent to 151 per cent of their income last year and the main cause of rising expenditure was housing.”

However, this was fervently “disputed” by PAP. Of course they would. If you knew how PAP is jacking up prices and making you pay more from your CPF into their flats, you would become ballistic and wallop them.

But today, you finally know the truth.

Things are not just bad for the poorest 30% in Singapore. A survey by The Straits Times showed that even for the middle-income in Singapore, more than two-thirds of Singaporeans do not even have enough to buy for anything else, other than the basic necessities that they need.

Essentially, PAP has calculated very incisively how much they need to pay you in wages, how much they can take it back from your CPF, and how much you are left with to just have enough to pay for the basic necessities which they own as well – telecommunications, transport, public utilities etc.

For the poorest 30%, it is even worse off for them – the PAP created a perpetual handout class, to create a class which would be too scared to lose their “handouts” and can be forced to rely exclusively to protect the PAP’s base.

But this widening income inequality has major social implications.

Because Singapore has the highest income inequality among the developed countries, the prisoner rate has also become the highest in Singapore, after America.

Because of the high inequality, Singapore also has one of the lowest social mobility among the developed countries – the ‘elites’ are able to protect their positions and it is difficult for lower-income Singaporeans to move up the social ladder.

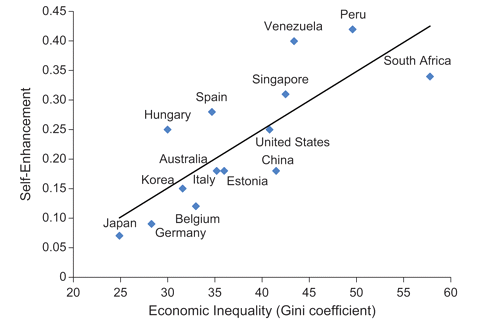

Because Singapore has the highest income inequality among the developed countries, this has also resulted in the highest level of self enhancement in Singapore among the developed countries, where people are likely to view themselves as being better than another person, which has led to a more self-centred and inward populace.

And the highest levels of income inequality in Singapore has also resulted in the lowest levels of trust in Singapore, after Portugal.

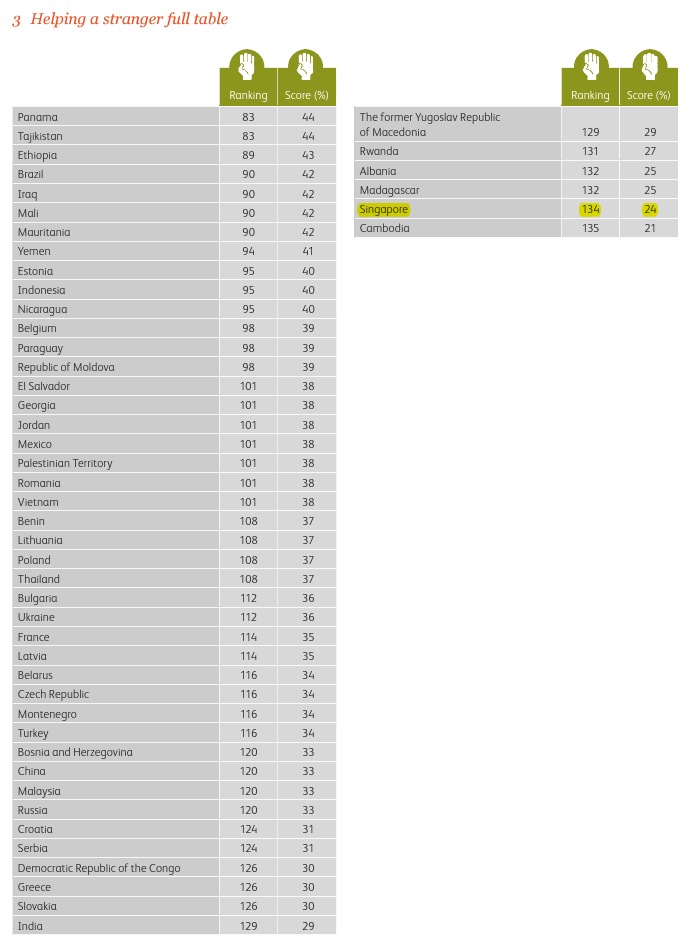

And because of the low levels of trust, Singaporeans have become the second least likely people in the world to help a stranger.

Thus without a doubt, PAP’s growth-at-all-costs strategy which relies on the manipulation of CPF contribution rates to reduce wages and a further wage depression via competition with lowly-paid foreign workers is a recipe for disaster. This, coupled with the government’s upward cost pressures fuelled by their own Government-Linked Companies has created an unsustainable income inequality, which is threatening to tear up the social fabric of Singapore.

However, the PAP government remains blissfully ignorant to this plight and continues to bury their head in the sand, to manipulate income inequality figures, instead of actually enacting policies such as minimum wages, to reduce the income inequality.

Such a government with an attitude of denial towards the problems that Singapore currently faces is disasterous for the longevity of Singapore.

Join the #ReturnOurCPF Facebook event page here.

Roy Ngerng

*The writer blogs at http://thehearttruths.com/