Lee Hsien Loong spoke at the National Day Rally today about the CPF.

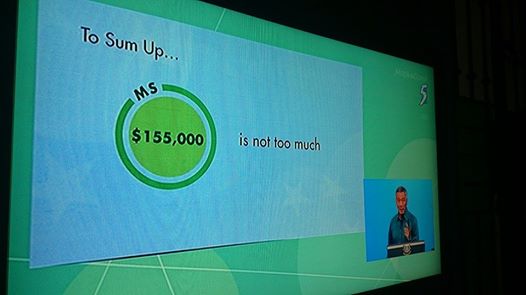

In his speech, Lee Hsien Loong claimed that the CPF Minimum Sum is “not too much”.

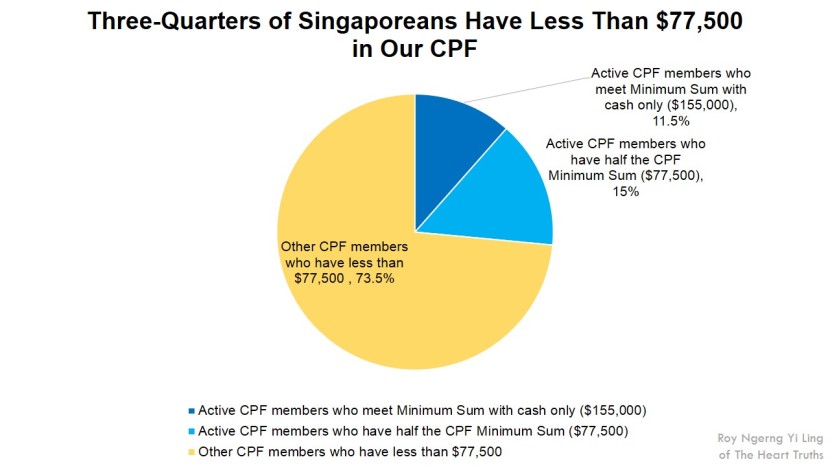

However, as I have calculated, the median CPF payout inside Singaporeans’ CPF is only about $55,000. This means that 50% of Singaporeans would have less than $55,000 inside our CPF.

However, the CPF Minimum Sum this year is $155,000. Thus the average Singaporean would only have 35% of the CPF Minimum Sum! Thus the CPF Minimum Sum is actually “too much”! Or actually, we are earning “too little” on our CPF to be able to save!

Yet, Lee Hsien Loong also announced that the CPF Minimum Sum will be increased to $161,000 next year. Singaporeans will have even more difficulty meeting the CPF Minimum Sum now.

In fact, I have calculated that 73.5% of Singaporeans do not even have half of the CPF Minimum Sum of $77,500 inside our CPF.

Thus it is disappointing that Lee Hsien Loong did introduce any changes that would allow all Singaporeans to actually row our CPF.

Lee Hsien Loong also announced that the Lease Buyback Scheme will be extended to 4-room flats, so that this will allow an individual to receive an additional $900 every month (if he/she sells his/her the last 35 years of his/her $300,000 flat), on top of the CPF Minimum Sum payout.

If Singaporeans Do Not Have to Pay for Land Costs, Singaporeans Would Be Able to Save $250,000

However, Minister for National Development Khaw Boon Wah had recently admitted that, “we control the (public housing) construction programme; secondly, we set the price (for the HDB flats).

Also, “Land … makes up about three-fifths of development cost (of HDB flats) on average.”

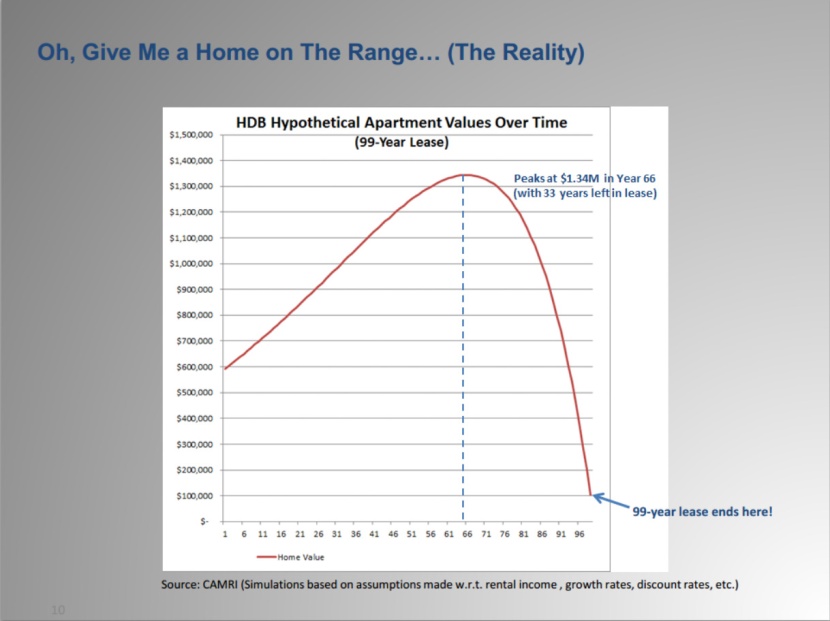

And with Gerald Giam’s questioning, Singaporeans are now able to know that, “the value of the flats will be zero at the end of their 99-year lease” and “Like all leasehold properties, HDB flats will revert to HDB, the landowner, upon expiry of their leases. HDB will in turn surrender the land to the State.”

If so, if the government sets the price of HDB flats and Singaporeans are only leasing the flats, without owning the land, does it make sense for Singaporeans to pay for the cost of the land?

Also, because Singaporeans have to pay for the cost of the land, for a $300,000 4-room flat, we are actually paying $180,000 into land costs. When including for the mortgage, this might go as high as $250,000 that we are paying for the land costs.

In Lee Hsien Loong’s illustration of the Lease Buyback Scheme, he said that if we sell the last 35 years of our lease to the government, we would be able to get $27,500 back.

But instead of selling the lease back and only getting $27,500 back, wouldn’t it be better if we do not have to pay for the land cost in the first place (since we don’t own the land) and save $250,000?

In fact, Lee Hsien Loong estimated that the average Singaporean would need about $250,000 in order to be able to retire today.

So, there, we have it! If the government actually prices the flats truly affordability and not force Singaporeans pay for land which we do not own, we would be able to save the $250,000 and be able to retire today!

Why does the government insist on going through a convoluted means of (1) charging us high flat prices which includes 60% of land costs which we don’t own, (2) make us not be able to save enough inside our CPF, (3) then make us sell back our lease and get back only $27,500 back?

According to Lee Hsien Loong, the $250,000 would enable Singaporeans to have $2,000 every month. Thus if the government does not unnecessarily complicate the Singaporeans, all Singaporeans would be able to retire with $2,000 every month now, or a total of $2,600, when including the CPF Minimum Sum payout of $600 that Lee Hsien Loong had illustrated.

In fact, there was something else Lee Hsien Loong had conveniently not mentioned.

Because Singaporeans only lease the flats, by the 66th year of the lease (with only 33 years left), the value of the flat would start going down and will be zero at Year-99.

Lee Hsien Loong’s illustration of the Lease Buyback Scheme assumes that an individual sells off the last 35 years of the lease. But what if the person has only less than 33 years of lease to sell back? Then the person would have lesser and lesser to sell back!

If so, the Lease Buyback Scheme would become redundant for Singaporeans.

Also, the Selective En Bloc Redevelopment Scheme (SERS) “is not a scheme intended solely to replace old flats reaching the end of their lease”, according to Gerald Giam. If so, if an individual’s flat reduces in value after Year-66, and the flat cannot be sold under SERS, Singaporeans are sitting on an asset with losing value, and might not be able to unlock any value meaningfully.

How would Lee Hsien Loong address this issue?

Lee Hsien Loong Still Did Not Announce Policies to Actually Grow Singaporeans’ CPF

Leong Sze Hian and I have also calculated that in order for Singaporeans to be able to meet the CPF Minimum Sum in 30 years’ time, the following policies need to be implemented:

- Implement a minimum wage of at least $1,500 (currently more than 110,000 residents work full-time for less than $1,000, about 400,000 work full and part-time for less than $1,200 and about 600,000 work full-time and part-time for less than $1,500)

- Increase the CPF interest rates to 6%

- Reduce the rate of increase of the CPF Minimum Sum to inflation level

- Remove land costs from HDB flat prices

However, none of these were announced.

So, effectively, with whatever Lee Hsien Loong had announced at the National Day Rally 2014, Singaporeans will still not be able to meet the CPF Minimum Sum.

Today, 90% of Singaporeans are not able to meet the CPF Minimum Sum fully in cash. This will still remain the same.

Lee Hsien Loong’s announcements at the National Day Rally 2014 has been disappointing.

Singaporeans Would Be Able to Retire with At Least $900,000 if the Government Returns Us the Interest Earned on our CPF

Finally, Lee Hsien Loong still did not address how the government takes our CPF to invest in the GIC and how the returns are not returned. Today, Singaporeans earn an average of 3% on our CPF and the GIC earns about 6%, or two times what we earn. This means 3% is not returned to Singaporeans.

I have calculated that for the average Singaporean aged 25 who starts work today at the median wage of about $3,000, if he/she works for the next 30 years and retire at 55, the returns that are not returned would amount to nearly $750,000!

Leong Sze Hian has calculated if the individual starts work at 21 and works until 65, he/she would lose more than $3 million!

Thus if the government were to return the interest earned on our CPF, Singaporeans wouldn’t even need the Lease Buyback Scheme! All Singaporeans would be able to retire, with at least $900,000 ($750,000 + $155,000)!

So, why did Lee Hsien Loong not touch on this issue at all?

Is There a Conflict of Interest When the Government Takes Our CPF to Invest in the GIC and Does Not Return Our Interest Back?

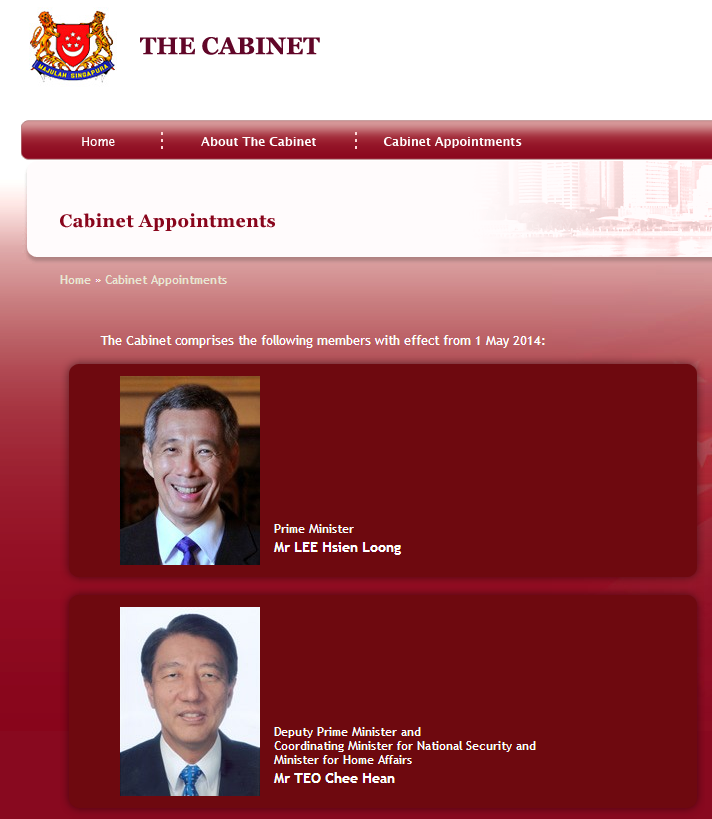

Thus it becomes problematic when we find out that the government is actually on the Board of Directors of the GIC, with the prime minister as the Chairman no less, and the two deputy prime ministers, two other ministers and an ex-minister. Lee Kuan Yew is the Senior Advisor.

It is also problematic that the GIC Board of Directors is the government.

As such, it is unbelievable when the GIC claims that, “The government holds the GIC board accountable for portfolio performance, but does not interfere in the company’s investment decisions.”

And the government would similarly claim that, “The Government plays no role in decisions on individual investments that are made by GIC, MAS and Temasek. At the GIC and MAS, whose boards include Ministers, these investment decisions are entirely the responsibility of their respective management teams.”

Yet, how is this possible that the government does not interfere in the GIC when the people heading the government and the GIC are the same people?

If so, this calls into serious question how our CPF is actually being managed when the government takes our CPF to invest in the GIC, which they control as well.

And if Singaporeans are not able to save enough to retire, does this arrangement become highly questionable? Is there an outright conflict of interest?

Also, when the government would rather encourage Singaporeans to sell the leases of their homes, instead of actually returning the interest earned on our CPF, via the GIC, back to us, isn’t the government’s intentions with wanting to use our CPF highly problematic?

And when seen in light of how the government keeps increasing the CPF Minimum Sum, knowing full well that the majority of Singaporeans simply do not have enough inside our CPF to be able to meet it at all, then you really have to ask – why does the government want to lock up our CPF? For what purpose?

Thus Lee Hsien Loong’s announcements are still inadequate, and as inadequate as our CPF retirement funds are and fall short of what is needed to actually help Singaporeans save enough to be retire, in spite of the government’s claims otherwise of wanting to do so.

Also, there is still no transparency and accountability as to how the government takes our CPF monies to use in the GIC!

3rd Edition Of The #ReturnOurCPF Event: Why Singaporeans Cannot Retire Because Of The HDB

It is time Singaporeans stop taking this sitting down. The solutions are there, and in the government doesn’t have the integrity to act on these solutions, then it is time we show them we mean business.

On 9 August, there will be a National Day Protest, and on 23 August, there will be the third edition of the #ReturnOurCPF event. In the first edition on June 7, it was revealed to you many facts that the government has finally admitted to – how they are using our CPF to invest in the GIC. In the second edition on 12 July, we exposed further facts about the estimated number of Singaporeans who were not able to meet the CPF Minimum Sum.

Join us at the third edition as we reveal even more glaring facts about how our CPF is being used by the HDB and for housing, and find out why Singaporeans are not able to retire adequately, because of the HDB. We cannot let up on this fight for answers and for transparency. Our lives are being held in a sense, at hostage, by the government’s lack of transparency and accountability. We must continue to fight for answers, in order to allow our lives to be protected.

You can join the Facebook event page here.

Also, Roy Ngerng’s first court hearing will be held on 18 September 2014, at 10.00am. It will be a full-day hearing.

Roy Ngerng

*The writer blogs at http://thehearttruths.com/