How much of our wages are Singaporeans exactly paying into the CPF?

According to the government, the CPF contribution rates are now 37%. But is this all we are paying into the CPF from our own pockets?

Singaporeans Have to Pay an Extra Accrued Interest to the CPF

Do you know that, “If you have used your CPF money for the purchase of the flat, you need to make a full refund of the CPF savings withdrawn plus accrued interest to your CPF account.” According to the CPF Board, the “Accrued interest refers to the interest that you would have earned on your CPF if you had not withdrawn your CPF for the flat. The accrued interest is currently computed monthly at an annual interest rate of 2.5%, and compounded annually.” This 2.5% is the interest that the government pays on your CPF Ordinary Account (OA).

According to the CPF Board, whether you sell your flat before or after you turn 55, or after you “pledged (your) property to withdraw (your) Retirement Account savings as cash”, “You will (still) need to refund the CPF principal amount withdrawn for the property and its accrued interest, as well as the pledged amount.”

Also, the CPF Board also says that, “From 1 January 2013, all members are required to refund the principal amount withdrawn for a property with accrued interest when they sell the property, regardless of age.” (When did this change happen and were Singaporeans informed or consulted?)

According to the government, “it is only right that if we were to sell our home, we should return what we have borrowed (i.e. the principal amount) plus the interest we would have earned had the money not been taken out from our CPF account (accrued interest).” But why is it “only right”? Did the government explain?

But as I had written before, why should you be paying for this “accrued interest”? If you had left your CPF inside the CPF and not withdrawn it, the government would have paid for the 2.5% interest on your CPF, right? Why is it that when you take out the CPF to use, the government would then want you to pay this 2.5% interest back, which was rightfully what they should have paid?

If they stop paying this interest because you have taken the money out, then no more interest is paid, end of story, right? Why did they turn around and ask you to pay? In fact, why did the government says that “it is only right” that you return “the interest (you) would have earned had the money not been taken out”? If, it is money that you “would have earned”, then you should have earned it from an external source, right? In this case, it is from the government. If they want you to pay this back, aren’t they making you pay for what they should have paid for in the first place?

And as I had written, if the government had intentionally increased the CPF Minimum Sum to trap our CPF inside, then by making us pay the “accrued interest”, aren’t they effectively “earning” from us by making us pay more from our on wages into the CPF, through the “accrued interest”?

So, from what should be rightfully us earning from the government, the government has used the “accrued interest” scheme to earn from us instead?

Singaporeans Actually Have to Pay More Than 40% of Their Wages into CPF

Now, the “accrued interest” is cash out of our own pockets that we have to pay into the CPF, so with this as a background, if we look at the “accrued interest” as a proportion of our wages, how much exactly do Singaporeans have to pay into the CPF as “accrued interest”?

According to the Manpower Minister Tan Chuan-Jin, he admitted in Parliament last month for the first time ever that, “Among members who turned 55 years old over the past five years and had used CPF monies to purchase HDB flats, an average of 55% of their OA savings had been withdrawn to finance their flats at age 55.”

And if you look at the CPF contribution rates, of the 37%, 23% goes into the OA.

As such, the 55% of this 23% contribution of the OA which goes into paying for housing loans would amount to 12.65% of the OA.

But how much is the accrued interest, as a proportion of the housing loan?

As I had written, if a person sells his/her flat after 30 years, the accrued interest can be as much as half, or 50%, of the housing mortgage.

As such, of the 12.65% of the OA savings that goes into paying for the housing loan, the accrued interest would make up half of this, or 6.33% of the OA.

What this means is that on top of the 37% CPF contribution rate that we officially have to pay from our wages into the CPF, if we sell our flat and spread out the accrued interest into equal installments as a proportion of our wages, there is actually another 6.33% that we have to pay from our wages into the CPF!

In total, if we spread the accrued interest across the years, this would mean is that Singaporeans would have to pay an average of 43.3% of our wages into the CPF every month!

So, the government might tell us that we are officially paying only 37% (which is already the highest contribution rate in the world), but in reality if we sell our flat, Singaporeans actually have to part with an average of 43.3% of our wages to pay into the CPF!

Higher-Income Singaporeans Actually Have to Pay Nearly 50% of Their Wages into CPF

But this is not all. For higher-income Singaporeans, say for someone who earns $5,000, he or she is able to use the maximum of his/her OA to pay for the housing loans, as long as there is enough in the Special Account that can be set aside for the CPF Minimum Sum.

As such, since the CPF contribution into the OA is 23%, a person can maximally use this 23% to pay for his/her housing loan.

As the accrued interest would make up about half of the housing loan, the person would pay about 11.5% as accrued interest.

Thus in total, on top of the official 37% CPF contribution that the person would be paying, he/she would need to be paying an additional 11.5% of his/her wage into the CPF every month, or a total of 48.5%!

Highest-Income Singaporeans Pay Only 8.1% of Their Wages into CPF

And for a highest-income earner, he/she would only need to pay CPF on the first $5,000 of his/her wage. As such, a highest-income earner who earns $30,000 in a month would only need to pay 6.2% into CPF.

The OA would take up 3.8%, the housing loan can take up the full OA of 3.8% and the accrued interest would then amount to 1.9%.

As such, a highest-income earner would pay 6.2% in CPF contribution and an additional 1.9% of his/her wage will go into the CPF every month, or a total of 8.1%.

And if you look at the average Singaporean and Singaporeans who earn less than $5,000 every month, we have to pay a much larger proportion of our wages into CPF – as high as 50% of our wages.

If We Do Not Sell Our Flats, the Flat Becomes Worthless at the End of Its Lease

And what if we do not sell our flats? Thanks to a question by the Worker’s Party Gerald Giam, we now know that “the value of the flats will be zero at the end of their 99-year lease” and “Like all leasehold properties, HDB flats will revert to HDB, the landowner, upon expiry of their leases.” In short, if we do not sell our flats, they will become worthless at the end of their lease. All the money that we have spent and hope to invest with will go down the drain.

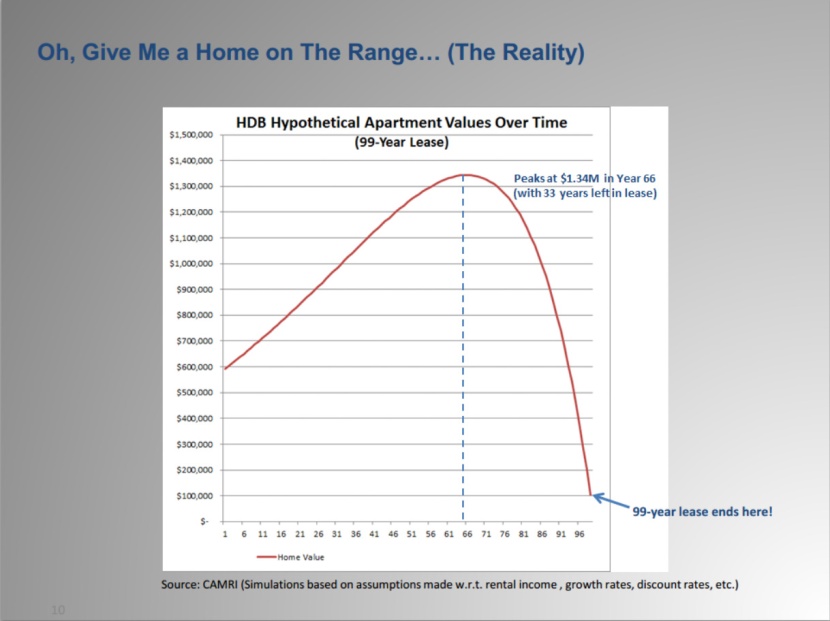

In fact, Professor Joseph Cherian had also shown how the value of a flat would peak at Year-66 and start decreasing in value thereafter, to zero by Year-99.

And then, if you decide to sell your flat before the value starts decreasing, say at Year-50, then the accrued interest would have grown to more than 150% that of the housing mortgage, or 200% at Year-60!

A person would have to effectively use the whole of his/her CPF OA to pay for the housing, which means that he/she would have to pay 48.5% of his/her wage into CPF, and would still have to fork out more in cash to pay for the accrued interest which the CPF OA would not be able to cover.

Singaporeans Have to Lose As Much As More Than 10% of Our Wages to Pay for the CPF Accrued Interest

So, you see, the government might want to tell us that “it is only right” for Singaporeans to pay the “accrued interest” but let’s take away all the fanciful words. The “accrued interest” has to come out from our wages. We have to pay for it from our wages, just as we have to pay from our wages for the 37% CPF contribution rates.

So, if we calculate how much we have to pay in total from our wages into the CPF, spread across equal monthly installments, Singaporeans would have to pay nearly 50% into the CPF! And not the “official” 37%, even as this is already the highest contribution rate in the world!

Not only that, because not many Singaporeans might be aware of the accrued interest or how much this would be in the longer term, we might not take much notice of it. But when you do the calculations and realise that we might have to pay as much as 50% of our wages into the CPF, then the gravity of the situation hits you.

This means that we are losing as much as more than 10% of our wages and purchasing power into the CPF unknowingly! And because this 10% is not automatically deducted from our CPF, we only realise this amount by the time we sell our flats. By then, when reality hits, it might be too late.

There would also be some of us who are agreeable to paying the accrued interest. This might be acceptable, but there are however some questions to ask are:

- If we have to pay more of our wages into the CPF for the accrued interest, this means less cash on hand and a lower purchasing power. For wages which have remained stagnant for the past many years, every spare cash in hand is very important.

- Then, since the government has admitted that it controls the construction programmes and sets the prices for HDB flats, where flat prices have increased tremendously, and where we thus have to sacrifice a larger chunk of our retirement funds to pay for housing loans, and then a larger chunk of our wages as accrued interest into CPF, then are we unnecessarily parting with our wages and CPF for housing prices, which do not need to be so high in the first place?

- If given a choice, would we rather pay a lower CPF contribution rate (to have just enough for retirement) and keep the cash in hand to pay for housing loans at our own discretion, or would we rather go with the current cumbersome process of having to use our retirement funds to pay for housing, not realise the existence of an accrued interest and its amount and be shocked to have to take from our own pockets to pay for this amount?

There are also some of us who might ask – how much exactly is the accrued interest as a proportion of the housing mortgage? How is the accrued interest calculated? Is there an online calculator which the government can create to help us calculate this? How much exactly of our CPF are we paying into the accrued interest, and into housing in totality? Very good questions! I would like to know as well. Would the government like to provide this information and be transparent about it? Would the government like to create an online tool that would allow Singaporeans to know outright how much the accrued interest is and how much exactly we have to use our CPF to pay for the housing loans, including for the accrued interest?

Are Singaporeans Using As Much as 82.5% of Our CPF Ordinary Account to Pay for Housing?

Finally, and most importantly, the government has admitted that we have to use 55% of our OA savings to pay for housing loans.

But the bigger question is – does this include the accrued interest? And if it does not, does that mean that Singaporeans are actually using as much as 82.5% of our OA savings to pay for housing loans, when including for the accrued interest (the accrued interest is half of the housing mortgage after 30 years: 55% + 27.5%)?

And if so, are we then actually using more than half of all our CPF to pay for housing?

If so, if 90% of Singaporeans are not able to meet the CPF Minimum Sum and the majority of us are unable to save and retire, is it because we have to pay too much (more than half!) out from our retirement funds to pay for housing?

Again, who sets the prices for the HDB flats? And why did they price the flats so high, and extract so much from our CPF that we do not have enough to retire on? Why did they let us earn so little on the CPF so that we are not able to save enough to retire on?

3rd Edition Of The #ReturnOurCPF Event: Why Singaporeans Cannot Retire Because Of The HDB

Over the past two to three months, the government is finally admitting to many more truths about the CPF. However, we still do not know what they are doing with our CPF. How is the CPF Minimum Sum calculated? How is the accrued interest calculated? How much do we have to pay as accrued interest, as a portion of the housing mortgage? Today, we still don’t have answers to these questions.

But do you think these questions are important to you, especially when putting money aside for a home is a very important decision? Can the government choose to ignore or conceal this information or calculations, when such information is very important to how we manage our finances?

Perhaps it is too convenient that the government has all the information at their disposal to make the financial decisions at the CPF Board, GIC and Temasek Holdings. But what about Singaporeans, who do not have access to this information at all?

This is no small matter. An extra 10% that we have to pay from our wages into the CPF is a lot of money. Will the government be transparent with Singaporeans on what exactly they are doing with our CPF? Today, when Singaporeans cannot retire because we simply cannot save enough in our CPF, then there is a lot that the government needs to answer to.

On 23 August, there will be the third edition of the #ReturnOurCPF event. In the first edition on June 7, we revealed to you the truths that the government has finally admitted to how they are using our CPF to invest in the GIC. In the second edition on 12 July, we exposed further truths about the exact number of Singaporeans who were not able to meet the CPF Minimum Sum.

Join us at the third edition as we reveal even more glaring facts about how our CPF is being used by the HDB and for housing, and find out why Singaporeans are not able to retire adequately, because of the HDB. We cannot let up on this fight for answers and for transparency. Our lives are being held at hostage by the government’s lack of transparency and truths. We must continue to fight for answers, in order to allow our lives to be protected.

You can join the Facebook event page here.

Also, my first court case will be held on 18 September 2014, at 10.00am. It will be a full-day hearing.

Roy Ngerng

*The writer blogs at http://thehearttruths.com/