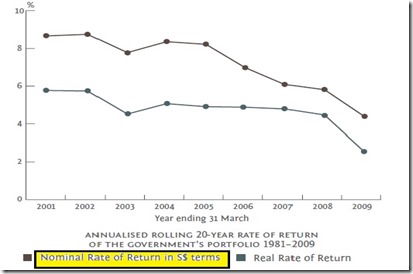

Prior to 2009, GIC had disclosed its returns in the local currency. The reasons given for disclosing them only in US$ is merely to mask its poor performance. Some readers may insist GIC has performed remarkably well simply because it is now the 8th largest SWF managing a S$400 billion portfolio. But we have to bear in mind that an additional $101 billion CPF, excluding tens of billions in reserves, was injected into GIC from 2008 to 2013.

GIC had disclosed returns in Sing dollar in its 2008/09 report.

Is GIC too embarrassed to disclose its low Sing dollar real rate of return?

In March last year, NCMP Lina Chiam questioned the omission of GIC’s returns in Sing dollar in Parliament. MOS for Finance Josephine Teo said that this was “to avoid confusion when comparisons are made with other fund managers or global indices” It seems that MPs and ministers are paid lots but do not need to think much and could simply parrot from the FAQ page of GIC in a parliamentary reply. (MP Lee Bee Wah had recently asked a parliamentary question from MOF’s website)

Readers of GIC reports are likely to be financial analysts and fund managers. Perhaps it was aconfused Josephine who had mistaken these professionals are daft.

The real reason is none other than the depreciation of the US dollar. From a high of about $1.85 in 2001, it fell almost 20% to $1.5 in March 2009.

US$/S$ exchange rate 2001 to 2009

As the US subprime mortgage crisis unfolded, it was to be expected the US$ would continue to decline. The MAS also strengthens our currency to relieve domestic inflationary pressures. That being the case, the government ceased disclosing GIC’s Sing dollar returns because they will be higher in US$ returns.

From March 2009, the US dollar fell 20% in 2 years. Today, after more than 5 years, the US$ has declined 17% down since 2009.

The Sing dollar has not only appreciated against the US dollar but has also strengthened against most currencies during the last decade. (view charts to see different historical exchange rateshere)

After 5 years of begging GIC to disclose Sing dollar returns, DPM Tharman finally relented last month. As can be seen, the figures in Singapore dollar is lower than in US dollar. (table below)

DPM Tharman only disclosed returns in Sing dollar last month.

| CURRENCY | 5 YEAR | 10 YEAR | 20 YEAR | 20 YEAR REAL RETURN |

| US $ | 2.60% | 8.80% | 6.50% | 4.00% |

| SING $ | 0.50% | 5% | 5% | ??? |

Conclusion

The government should not paint readers of GIC reports as an easily confused lot to justify its omission of returns in Sing dollar.

It is obvious the government prefers not to disclose GIC’s returns in Sing dollar because this will reveal its poor performance.

Phillip Ang

*The writer blogs at http://likedatosocanmeh.wordpress.com/