I had asked Deputy Prime Minister and Finance Minister Tharman Shanmugaratnam, “Secondly, Temasek Holdings has said that they do not invest our CPF, is it possible to know if in the past Temasek Holdings had invested our CPF?“

The Finance Minister had said, “No. It has never managed CPF funds.”

However, the Finance Minister went on to admit that, “Temasek started off with a set of assets which were transferred by the Government at time of inception. I don’t have the exact figure in my head – but about $400 million dollars worth of assets in the form of a set of companies.”

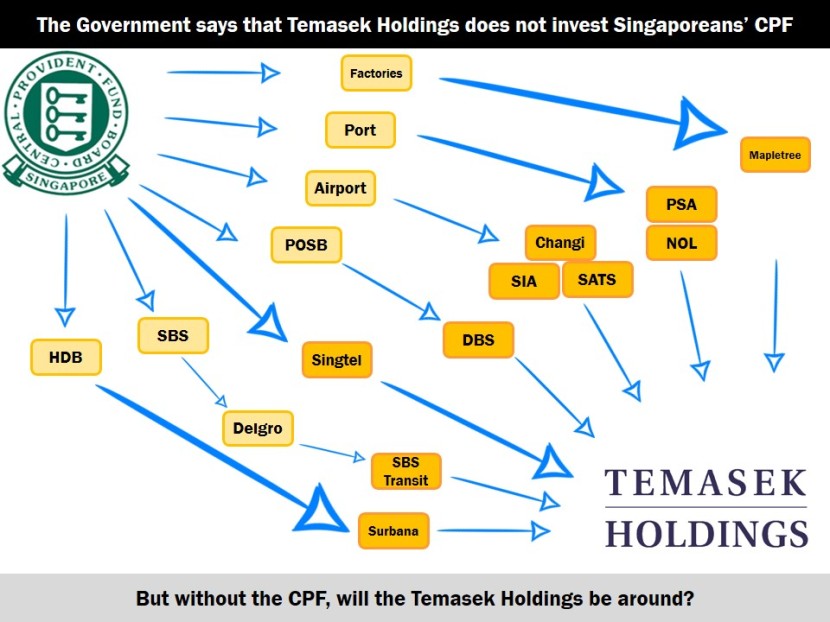

A speech given by the Minister for Labour and Communications in 1982 further revealed:

CPF savings form a large portion of Singapore’s savings. These savings are used for capital formation which means the construction of new factories, installation of new plant and equipment, expansion of infrastructure such as roads,’ ports and telecommunications, the building of houses and so on. These facilities coupled with Singapore’s economic and political stability have in turn attracted large amounts of investments each year. These again go into the setting up of more businesses, factories and enterprises.

Leong Sze Hian and I were able to trace how which infrastructure that CPF was invested in, and how they were then transferred to Temasek Holdings.

Image may be NSFW.

Clik here to view.

Temasek Holdings Has Access to Our CPF

Today, I have new evidence for you.

In the book, ‘Reforming Corporate Governance in Southeast Asia‘, it was explained that, “The second issue meriting consideration is Temasek’s utilization of Singapore’s reserves. The country’s reserves have been managed by the Government of Singapore Investment Corporation (GIC). In April 2004, a constitutional amendment that allowed the government to transfer reserves to key statutory boards and companies, and the transfer of reserves among them with the approval of the president, was introduced. Temasek Holdings has acknowledged that it can access the reserves (Temasek Holdings 2004). Both Temasek’s chairman and chief executive also have to annually certify its statement of reserves and past reserves to the president.”

According to the government, “The reserves refer to the total assets minus liabilities of the Government and other entities specified in the Fifth Schedule under the Constitution” and “Fifth Schedule entities refer to key statutory boards and Government companies that are listed in the Fifth Schedule under the Constitution. Examples of Fifth Schedule entities are CPF Board, MAS, HDB, GIC and Temasek.”.

THUS IT IS EVIDENT NOW THAT OUR CPF IS INVESTED IN THE RESERVES, WHICH CAN BE ACCESSED BY TEMASEK HOLDINGS.

The government might claim that:

An occasional misperception is that the Government made the Constitutional amendments in 2002 and 2004 to allow for the transfer of Past Reserves between Fifth Schedule entities and the Government so as to be able to conceal investment losses. This is wrong.

We have explained that a transfer of funds cannot be used to hide investment losses.

The government might also claim that:

An occasional misperception is that capital injections can be used to improve the reported returns performance of Temasek. Capital injections can enable Temasek to increase the size of its portfolio, but do not improve investment returns.

However, the evidence points to the fact that Temasek Holdings indeed has access to the reserves and Singaporeans’ CPF!

It is no wonder that at one point, the government did put on their website that, “Our reserves are managed by three agencies – the Government of Singapore Investment Corporation (GIC), Temasek Holdings (Temasek) and the Monetary Authority of Singapore (MAS).”

Image may be NSFW.

Clik here to view.

However, after I exposed this in 2012 and 2013, the government deleted this information from their website and replaced it:

Image may be NSFW.

Clik here to view.

In fact, as Associate Professor Linda Low had revealed, “since the late 1970s, CPF’s reserves as part of public sector surplus have been co-mingled with other investments either domestically by Temasek Holding Ltd or abroad by the Government Investment Corporation of Singapore (GIC).

Image may be NSFW.

Clik here to view.

And in fact, the CEO of Temasek Holdings, Ho Ching, and the Singapore Prime Minister Lee Hsien Loong’s wife, had in fact said in 2009, that, “While the Minister for Finance (Incorporated) is our formal shareholder, we recognise that the ultimate shareholders of Temasek are the past, present and future generations of Singapore.”

Image may be NSFW.

Clik here to view.

Indeed, the book ‘Reforming Corporate Governance in Southeast Asia’ had illustrated how the citizens of Singapore are the rightful and ultimate shareholders of Temasek Holdings, as Ho Ching herself has admitted.

Then, if this is the case, why is Temasek Holdings (and GIC) now a private limited company? And why is it that Temasek Holdings (and GIC) are not required to furnish full reports to the citizens of Singapore as to how they are really using our CPF?

A terrible disservice is being done to Singaporeans today. The GIC and Temasek Holdings take our CPF but does not give the citizens of Singapore – the rightful owners – the full reports as to what is really happening to our CPF.

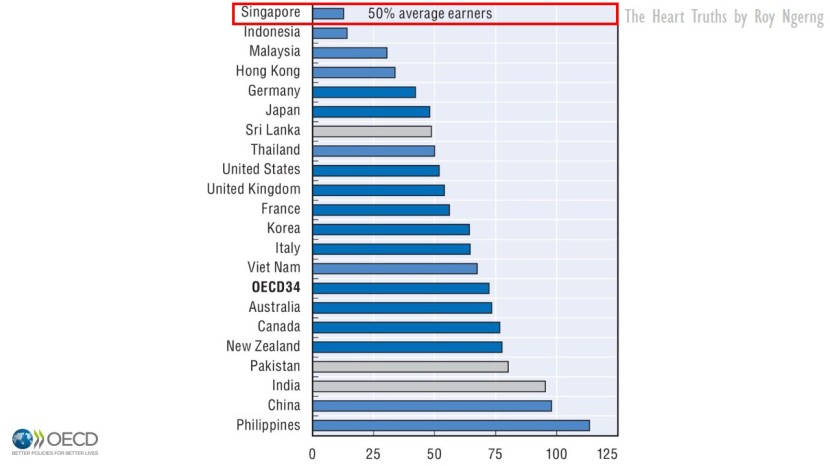

Meanwhile, Singaporeans have the least adequate retirement funds in the world.

Image may be NSFW.

Clik here to view.

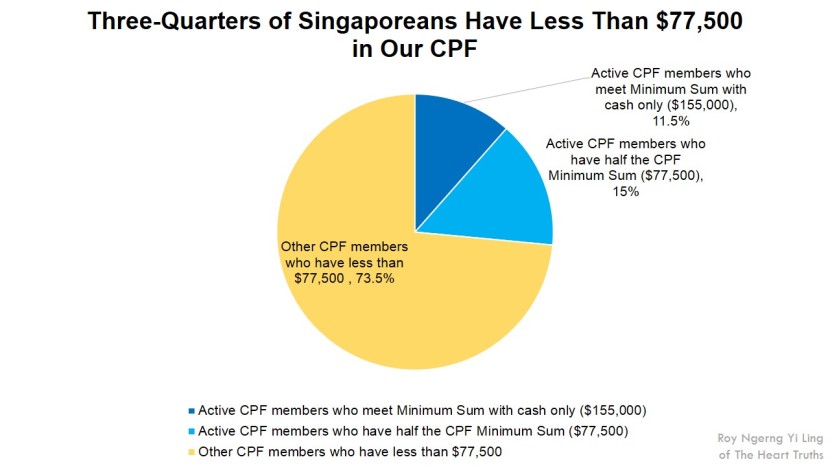

And 90% of Singaporeans are not able to meet the CPF Minimum Sum and are unable to retire.

Image may be NSFW.

Clik here to view.

However, the GIC and Temasek Holdings have used our CPF to become the 8th and 9th largest sovereign wealth funds in the world.

Image may be NSFW.

Clik here to view.

Something is very, very wrong at the state of affairs in Singapore.

Singaporeans, our lives are put at great risk and the way that our CPF monies are being managed is a security threat to our lives.

However, the government has refused to be transparent and accountable to Singaporeans, even though as the citizens of Singapore, we are the ultimate stakeholders to the GIC and Temasek Holdings, and as the citizens of Singapore, we are the owners of Singapore, our nation.

So, why is it that you, as the citizen of Singapore, is denied all this information, especially since when this pertains to your retirement funds, and the large chunk of 37% of your wages?

Something is terribly, terribly wrong here at how things are being managed in Singapore.

We cannot let things go on like this.

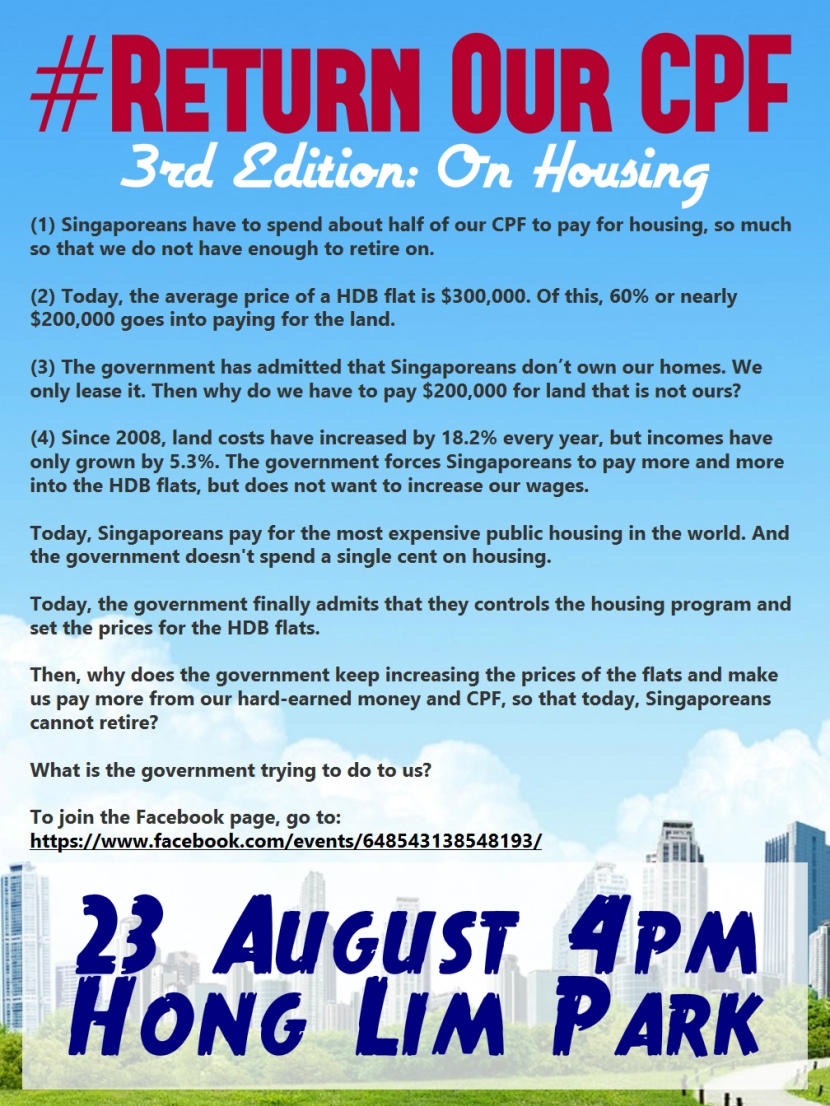

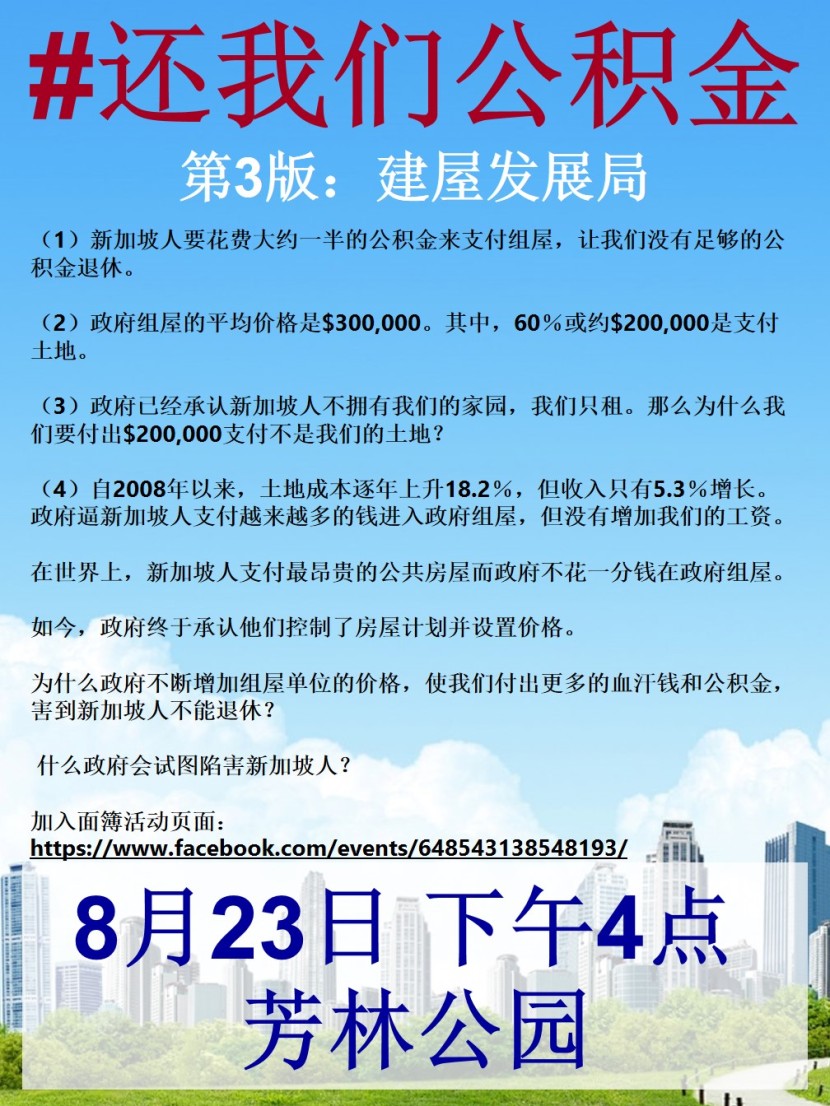

3rd Edition Of The #ReturnOurCPF Event

On 23 August, there will be a third edition of the #ReturnOurCPF event.

Join us at the third edition and take a stand. The government cannot take Singaporeans’ CPF to use and tell us that they do not know what they are using it for. This is a derision to Singaporeans and daylight robbery!

On 23 August, we will see you at Hong Lim Park. Let’s come together, be united and speak for change, for the better for our lives, and our children’s.

You can join the Facebook event page here.

Also, my first court case will be held on 18 September 2014, at 10.00am. It will be a full-day hearing.

Image may be NSFW.

Clik here to view.

Image may be NSFW.

Clik here to view.

Roy Ngerng

*The writer blogs at http://thehearttruths.com/