Well, not technically the 50th birthday yet, we are one year short but here goes.

Over the last 2 to 3 months, the government has finally admitted to many truths about our CPF, which they had never wanted to let Singaporeans know before.

But finally, we have managed to pressure the government into revealing many more truths about our CPF to us over the past 2 to 3 months. Some has been shocking and some downright unacceptable.

Why has the government not been willing to tell us the truth over the past so many decades, but is finally forced to reveal the truth to Singaporeans, albeit in bits and pieces, over the past 2 to 3 months?

Let’s take a look at the 50 truths about our CPF that the government has admitted and that we have finally found out, on Singapore’s National Day this year.

The Government Admits that They Take Our CPF to Invest in GIC

(1) In early June this year, the government finally admits that they take our CPF to invest in GIC.

(2) However this is contrary to what then-Manpower Minister Ng Eng Hen had claimed in 2007 that the government does not take our CPF to invest in GIC, when he said, “the answer is no,” to the question by the Worker’s Party Low Thia Kiang, who asked, “Does the Government Investment Corporation (GIC) use money derived from CPF to invest?”

(3) In fact, further back in 2006, on GIC’s 25th anniversary, then-GIC Chairman Lee Kuan Yew had also said that GIC does not invest the CPF. He said that, “there is no connection between GIC’s rate of return and the interest paid on CPF accounts”.

(4) And in fact, even further back in 2001, on GIC’s 20th anniversary, then-GIC Chairman Lee Kuan Yew also said that GIC does not invest the CPF, when he said that, “there is no direct link between the GIC and the CPF” (credit goes to the Worker’s Party’s Pritam Singh for unearthing the news cutting). Evidently, there seems to be an about turn by the government but when asked on this, the Deputy Prime Minister and Finance Minister Tharman had said that, “There is no about turn unless you U-turn.” Why did the government only admit to the truth after more than a decade?

(5) Does the fact that Lee Kuan Yew used to be the Chairman of the GIC surprise you? In fact, today, he is the Senior Advisor of the GIC, the current Singapore prime minister has now replaced him as the Chairman, and the two deputy prime ministers and two other ministers Lim Hng Kiang and Heng Swee Keat are also on the Board of Directors. Is there then a conflict of interest for the government to be on the GIC’s Board of Directors, especially in light of how the government had made several claims about how the GIC does not invest the CPF but finally backtracked and admitted that they do?

(6) Now that we know that the government takes our CPF to invest in the CPF, for a long time, the government has never wanted to reveal what the interest earned by the GIC in Singapore dollar (SGD) terms is. But finally, the government admits for the first time that, “Over the last five years it earned 0.5% in SGD terms, over the last 10 years it earned 5% in SGD terms, over the last 20 years it earned 5% in SGD terms.”

(7) I had asked what the returns earned since GIC’s inception is but the government had refused to answer. However, note that in 2006, then-GIC Chairman Lee Kuan Yew had stated that the GIC returns since inception was, “8.2% in SGD terms in the 25 years ended March 2006”. What does this mean, when taken with the information revealed above? Leong Sze Hian estimates that the returns today since inception would be about over 6%.

Temasek Holdings Claims that They Do Not Invest Singaporeans’ CPF

(8) Also in early June this year, the Temasek Holdings claimed (for the first time) that “Temasek does not invest or manage the savings of CPF members”.

(9) But it was found in a book written by Associate Professor Linda Low that, “since the late 1970s, CPF’s reserves … have been co-mingled with other investments either domestically by Temasek Holdings Ltd or abroad by the GIC.”

(10) When asked further, Deputy Prime Minister and Finance Minister Tharman further revealed that, “Temasek started off with a set of assets which were transferred by the Government at time of inception. I don’t have the exact figure in my head – but about $400 million dollars worth of assets in the form of a set of companies. It has never received CPF monies to invest.”

(11) But when we researched further, we find out that then-Minister for Labour and Communications had said in 1982 that, “CPF savings form a large portion of Singapore’s savings. These savings are used for capital formation which means the construction of new factories, installation of new plant and equipment, expansion of infrastructure such as roads,’ ports and telecommunications, the building of houses and so on,” and that most of these have been transferred to Temasek Holdings, which means that Temasek Holdings did manage the savings of CPF members – were the returns earned returned to Singaporeans?

(12) And on top of that, the government has also given Temasek Holdings another $35 billion since its inception.

(13) In fact, the Finance Minister had said in 2007 that the CPF is not a cheap source of funds for the government but thanks again to Pritam Singh, we know that the government has acknowledged that the CPF was indeed “a cheap source of finance for the government” in 1983.

The Government Deleted Evidence of How They Take Our CPF to Invest from their Websites

(14) It is perhaps then more perplexing that in 2012 and 2013, I had written two articles which traced the government websites to expose how Singaporeans’ CPF is indeed invested in the GIC and Temasek Holdings.

(15) But by May this year, all traces of the evidence on the government websites were deleted. First, the government deleted information that the borrowings (from Singaporeans’ CPF) are invested “in reserves”.

(16) Then, they deleted information that the reserves are managed by the GIC, Temasek Holdings and the Monetary Authority of Singapore (MAS). Why did the government not want Singaporeans to know that our CPF is invested in the reserves which are managed by the GIC and Temasek Holdings?

(17) But this is very important because since the government had admitted that the reserves are managed by the GIC, Temasek Holdings and MAS, then why was it that the government had told then-President Ong Teng Cheong in 1996 that it would take 56-man years to let him know how much there is in the reserves, when he had asked to know? The President is supposed to safeguard the reserves of Singaporeans and if the President was not even allowed this information, then are Singaporeans’ reserves and CPF being put at risk?

(18) Not only that, as late as May this year, the GIC had claimed on their website that they do not know if they use Singaporeans’ CPF to invest as this is “not made explicit” to them.

(19) But by June this year, they changed their tune, and admitted that they do invest Singaporeans’ CPF. This is perhaps even more concerning since the government is on GIC’s Board of Directors.

The Government Still Does Not Want to Let Singaporeans Know How Much We Have in Our CPF

(20) But now that we know what the government is really doing with our CPF, then the question to ask is – how much exactly do Singaporeans have in our CPF? Last month, I had asked the Manpower Minister Tan Chuan-Jin but he had refused to answer. But at the Forum on CPF and Retirement Adequacy organised by the Institute of Policy Studies, the CEO of the CPF Board did reveal that the median CPF balance for ‘active’ CPF members aged 55 in 2013, including amounts withdrawn for housing, is $126,000. But we still do not have the full information. The important question is – how much do ‘all’ CPF members have inside our CPF, when we count only cash?

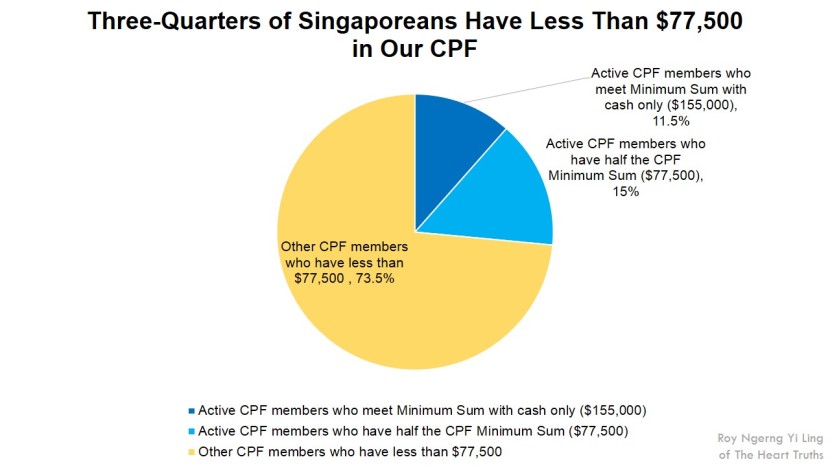

(21) Finally, in parliament last month, the Manpower Minister revealed more information. Now, we finally know that, “23% of Singaporeans who turned 55 in 2013 were inactive CPF members, while the remaining 77% were active members or self-employed”.

(22) The Manpower Minister also revealed that, of the “50% of active CPF members (who) met the Minimum Sum in 2013,” this included “15% who used their properties to support up to half of the CPF Minimum Sum”.

(23) With this information, it enabled us to calculate that 73.5% of Singaporeans do not even have half of the CPF Minimum Sum, or $77,500 inside the CPF.

(24) The Manpower Minister also revealed that, “about two-thirds of members earn 5% interest on all their balances in their Special, Medisave and Retirement Accounts. Over half of all members earn 3.5% on all their Ordinary Account (OA) savings.”

(25) Since “the CPF pays an additional 1% interest on the first $60,000 of combined balances,” this also enabled us to estimate that 50% of Singaporeans might not even have $60,000 in our CPF.

(26) Finally, the Manpower Minister also revealed that, “Among members who turned 55 years old over the past five years and had used CPF monies to purchase HDB flats, an average of 55% of their OA savings had been withdrawn to finance their flats at age 55.”

(27) With this information, we are better able to triangulate and find out that Singaporeans would have a median CPF balance of only $55,000, if we do not include amounts paid for housing and account only for cash.

(28) With a median CPF balance of $55,000, this means that half of Singaporeans will not even be able to receive a CPF payout of $425.

(29) We are also able to estimate that only about 10% of Singaporeans are able to meet the CPF Minimum Sum and 90% of us are unable to do so.

(30) In fact, this means that the average Singaporean would only have 35% of the CPF Minimum Sum inside our CPF.

(31) This revelation then becomes shocking – Why did the government keep increasing the CPF Minimum Sum since the mid-1990s, knowing that with the average net CPF balance that Singaporeans have will simply not be enough for Singaporeans to meet the CPF Minimum Sum? If the government knows that the majority of Singaporeans will not be able to meet the CPF Minimum Sum, then why did the government keep increasing it, and at a faster rate as well? Why did the government want to keep Singaporeans’ CPF stuck inside?

(32) But that’s not all! Leong Sze Hian also found out that it is not only the CPF Minimum Sum that Singaporeans have to meet before we are able to withdraw any excess monies, we also have to meet the Medisave Minimum Sum, which means that in total, Singaporeans would need to have at least $198,500 in our CPF before we are able to withdraw our CPF monies out! But the majority of Singaporeans would have less than 30% of this inside our CPF!

(33) In addition, most Singaporeans are not aware of an “accrued interest” that we need to pay upon selling our property, if we had used the CPF to fund the purchase. If the property is sold in 30 years’ time, the accrued interest will amount to 50% of the housing mortgage. And this accrued interest has to be paid in cash back into the CPF!

(34) And if we spread up this accrued interest into how much Singaporeans would have to pay as a proportion of our wages every month, Singaporeans would have to pay almost 50% of our wages into CPF, when including for the 37% CPF contribution and the additional accrued interest!

The Government Increases the Flat Prices by Too Much to Eat into Singaporeans’ CPF

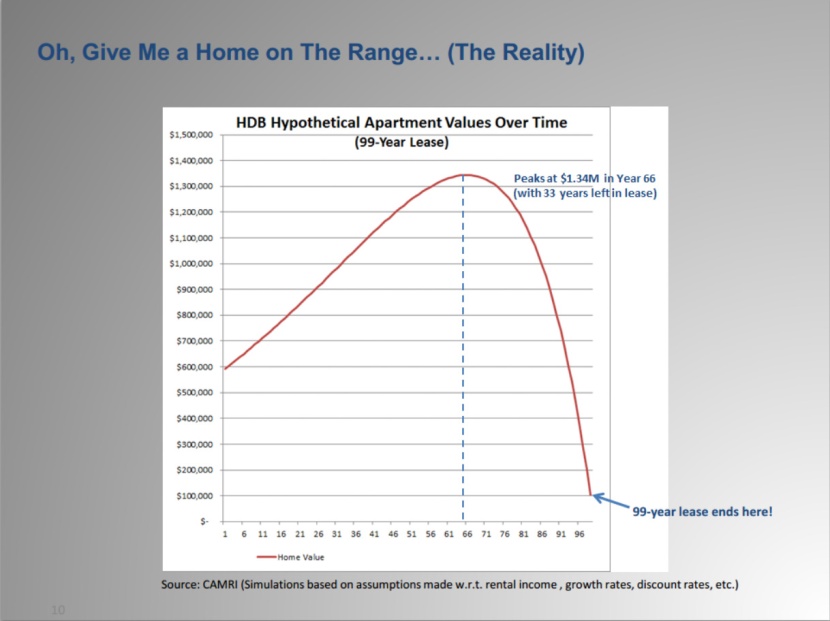

(35) Earlier this year, thanks to a question by the Worker’s Party Gerald Giam, we now know that, “the value of the flats will be zero at the end of their 99-year lease”.

(36)The National Development Minister Khaw Boon Wah also said that, “Like all leasehold properties, HDB flats will revert to HDB, the landowner, upon expiry of their leases. HDB will in turn surrender the land to the State.” Professor Koh Seng Kee also forewarned in 1999 that, “As most properties are sold with 99-year leases, Singaporeans are investing their lifetime savings in depreciating assets” and that “Unless and until the Government signals that it is prepared to renew property leases, Singaporeans’ savings will not last beyond two generations.”

(37) Indeed, Professor Joseph Cherian had illustrated at the Forum on CPF and Retirement Adequacy two weeks ago how the value of the HDB flat will peak at Year-66 before it loses its value and has zero value at Year-99.

(38) Leong Sze Hian has estimated that land costs makes up as much as 60% of HDB flat prices.

(39) And from 2008 to last year, land costs had risen by 18.2%, while resale flat prices had risen by only 9.1% and incomes for the average Singaporean by a much lesser 5.3%. As such, Singaporeans are paying for more and more expensive HDB flats, largely due to the rising land costs. However, as our incomes have grown much slower, this means losing our purchasing power to buying flats.

(40) In fact, last month in parliament, National Development Minister Khaw Boon Wah finally admitted that, “Firstly, (the government) control the construction programmes. Secondly, we set the price.” If so, why has the government set such a high price for HDB flats, with as much as 60% going into land even though Singaporeans do not own the land, and only lease the flats which will be returned to the HDB at the end of the lease? Also, why are flat prices increasing by a much faster rate than incomes, so much so that Singaporeans have to spend 55% of our CPF OA to pay for housing loans and not be able to save enough to retire?

Singaporeans Live in the Most Expensive Place in the World, with the Lowest Pension

(41) Today, Singaporeans pay for the most expensive public housing in the world.

(42) Singapore has also become the most expensive place to live in the world.

(43) According to a study by National University of Singapore (NUS) economist Tilak, the bottom 30% of households have to spend 105% to 151% of their income last year and the main cause of the rising expenditure was due to housing. Perhaps an insight to the government’s misplaced priorities can be seen by what Associate Professor Linda Low had remarked in 1999 that, “The CPF is slave to so many schemes, it cannot serve all its masters simultaneously.” She also “cited the Government’s decision to allow money in the Special Account to be used to finance mortgages earlier this year as her “greatest disappointment”, (as) implicit in that decision, she notes, was that housing, not retirement, took priority.”

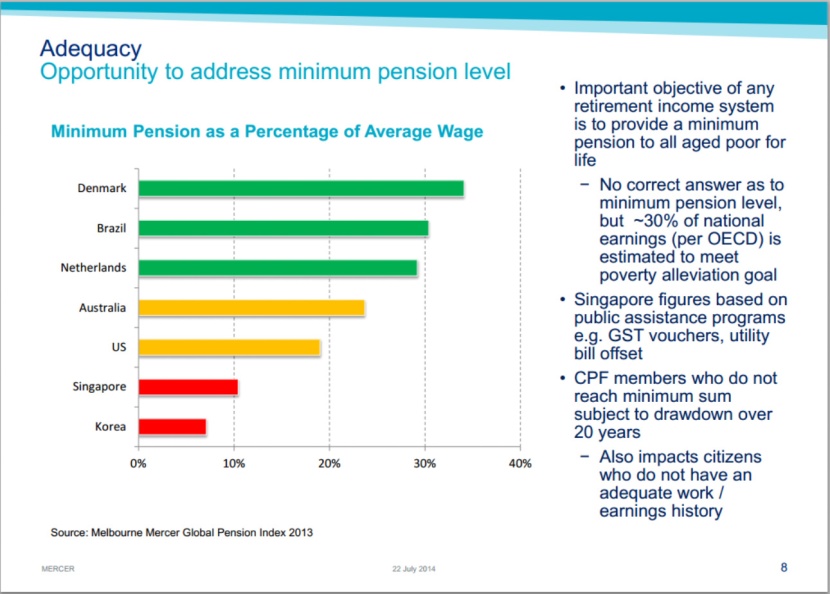

(44) Indeed, the Melbourne Mercer Global Pension Index 2013 has shown that Singapore has one of the least adequate retirement funds in the world.

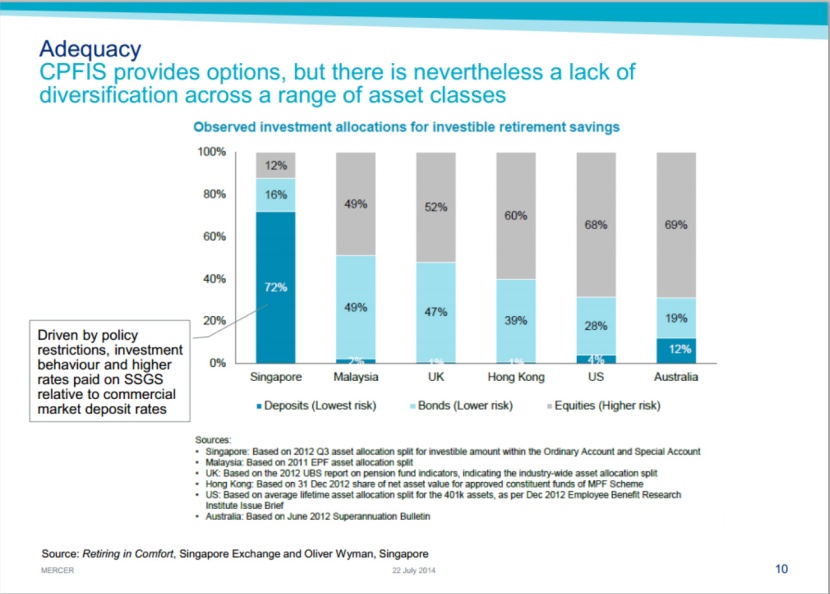

(45) Singaporeans are not able to grow our CPF because the government gives us the lowest interest rates in the world on our CPF, even though “other advanced countries have earned an average of 7.4% annually from 2009 to 2012”. In fact, Associate Professor Mukul Asher had also calculated in 1999 that “the CPF real rate of interest from 1987 to 1998 is zero, thanks to inflation. And this negative replacement rate defies the logic of accumulation, he says,” since “A decent replacement rate … is 4 to 5 per cent”. Most importantly, “Prof Asher argues there is “no economic rationale” to pay a one-year fixed deposit rate (which our CPF is currently based on) on what is essentially a 35-year or more (the duration of one’s work-life) savings plan.”

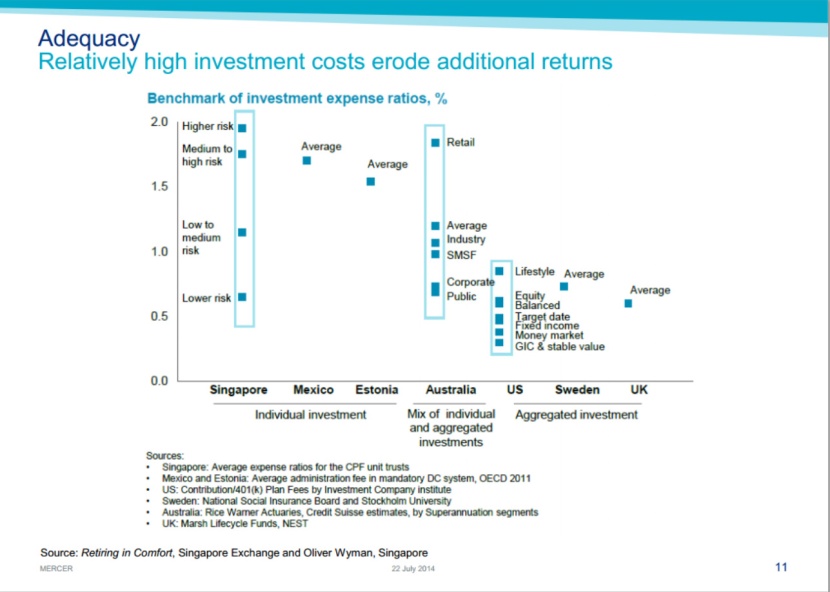

(46) In fact, Singaporeans are also not able to grow our CPF because the government over-invests our CPF in very low-risk instruments, whereas other countries would invest more in higher-risk instruments.

(47) The government also charges the highest costs for managing our CPF, even though they manage the lowest risk funds.

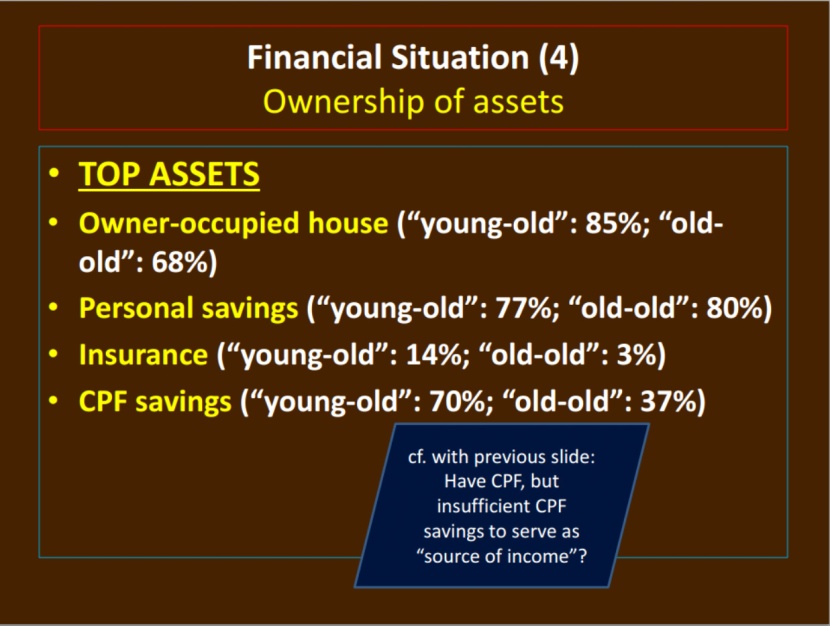

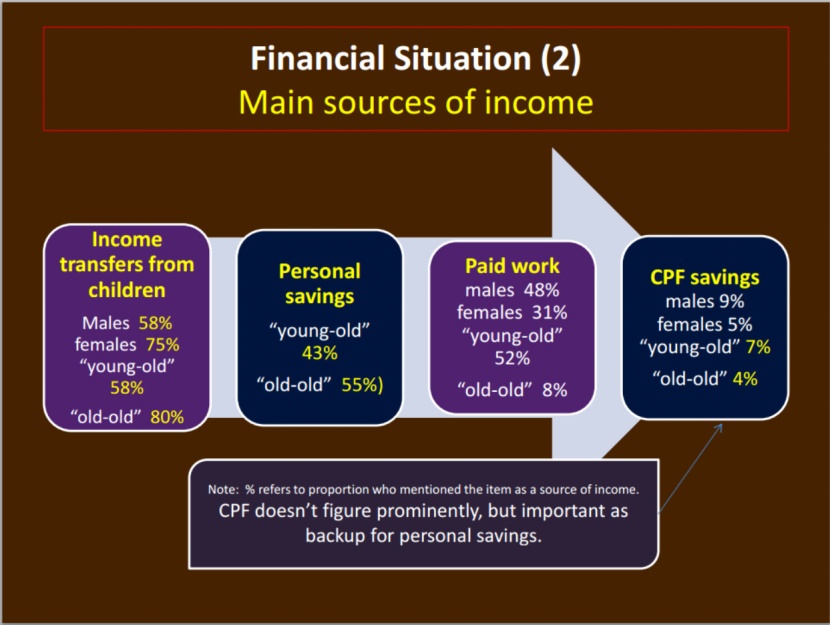

(48) And even though up to 70% of older Singaporeans have CPF,

(49) Only 4% to 7% of older Singaporeans say that the CPF is enough for retirement.

(50) Finally, even though Singaporeans do not have enough CPF savings to retire on and our CPF is one of the least adequate retirement funds in the world, the GIC and Temasek Holdings have grown, using our CPF, to become the 8th and 10th largest sovereign wealth funds in the world.

The government might claim that the CPF interest that they give to Singaporeans are “secure and fair”, on the back of “a solid guarantee, from a triple-A credit-rated government” but as Prof Asher had clearly explained, “Singapore’s method of investing the balances meant for retirement financing is contrary to best international practices concerning pension fund management, and have the potential to generate high political risk. Such concentration of savings in the hands of non-transparent, non-accountable agencies also distorts the savings investment process and could lead to inefficiencies in the structure of asset returns. The development of the financial and capital markets may also be adversely affected due to such concentration of savings, and due to the use of CPF as a substitute for mortgage financing. The method, however, is consistent with Singapore’s mono-centric power structure, and strong tendency towards social engineering and control.”

The CPF Has Lost Focus, The CPF Needs to Return to the Basics

In 1999, The Straits Times had quoted Dr B.C. Ghosh as saying that, “The CPF, to me, kind of lost direction during our great growth days,” he says. He and other purists thus call for the CPF to go back to basics and restore old age as its key focus,” echoing the call by Prof Linda Low.

This was also a call similarly made by Dr Tan Meng Wah last year who had called for a “return to basics” for the CPF, to look at the CPF as “for retirement fund, first and foremost (and) not primarily for property investment”.

He also outlined the following criteria of good pricing policy:

The current conversation that we are finally having on the CPF is at least 15 years too late, or more. 15 years ago, economists had already warned that Singaporeans’ “income is whittled down by CPF contributions and hefty housing loans”. Prof Koh had also warned that, “Should there be a financial or political crisis, the wealth of Singaporeans will dissipate quickly.” Prof Low added that, “while housing and other equity can look good on paper, it is not that easy to convert these into cash”. Finally, similar to calls being made now with the demands for transparency on how much cash balances Singaporeans have inside our CPF, The Straits Times had then reported that, “The inescapable maxim is: One still needs cold, hard cash to live through retirement.”

The current backlash that is being faced against the CPF is not a sudden displeasure with the system but a boiling issue that has been put on the backburner by the government for far too long. As far back as the late 1990s, calls were made for a reform of the CPF but this fell on deaf ears. The government continued with its modus operandi for the CPF, even though the inherent problems were pointed out as far back as 15 years ago. It is the government’s inaction and lack of seriousness and attention in these issues that has caused the CPF system to finally falter today. Instead of fixing the system, the government has its eyes on other things – it increased the CPF Minimum Sum to a level that is no longer achievable by most Singaporeans and did so, in spite of the knowing that the majority of Singaporeans would simply not have enough cash balances inside our CPF to meet the CPF Minimum Sum. Why the government would do so, is a question for debate and indeed, many have already questioned the intent of the government’s doing so.

As Prof Asher had warned in 2002, “Singapore policymakers face a stark choice. Either they can continue to use the CPF for socio-political control and engineering, or they can bring its objectives and governance in line with international best practices, to improve the return accruing to members, and to make a greater proportion of CPF contributions available for retirement needs. The choice is politically difficult, but it is unavoidable given the objective realities.”

As such, it isn’t bad planning that has got us to this stage today. There were many opportunities over the past two decades for the government to heed the warnings of and take the necessary actions. However, the government went on the overdrive with their growth-at-all-costs model. Today, such irresponsible planning has brought with it much costs and side-effects, and has victimised the lives of Singaporeans.

The government only has itself to blame for the predicament that it has currently caught itself in. A bold decisive step to reform the CPF system and to return the wealth back to Singaporeans is necessary to kick-start the Singapore economy once again, but such moves seem like a pipe dream under the current government, with a government which has stayed too long in power, to be willing to take risks, and which has stayed too long in power, to realise that it needs to be on its toes to respond to the needs of Singaporeans. Such is what happens when not only the government, but the people ourselves, become complacent to the management of our lives and allow the system to go haywire, before we finally panic.

The government has played into its own hands and only time will tell how long more the current government has, before even time collapses for them.

The Solutions for Singapore Are There, But Will We Be Willing to Do What It Takes?

As I had mentioned in a previous article, we have many bright minds among Singaporeans, and not just among the academics and think tanks, but also among ordinary Singaporeans. It has been very unfortunate that in the government’s want to pursue their own agenda, they side-lined other Singaporeans who also want to better Singapore, ignore their warnings and advice and postponed any much needed solutions until it is too late. Today, Singapore has wasted a large part of the past 15 to 20 years, pursing the government’s own wealth creation, but at what expense? A society that today is much fractured, as compared to the mid-1990s, a society bitter, fuelled with anger and divided, because of a one-sided agenda to pursue wealth creation, which had led to the massive inequality that plagues Singapore today.

We have a chance today for change. But only with an awakened populace, an enlightened citizenry, a People’s Action Party (and its internal factions) which is willing to take an honest look at itself and a citizenry who are confident and courageous enough to move into government to enact the necessary policies to stem the downward spiral of Singapore, shall our country have even the slightest chance to see a bright future for the next 50 years.

As Singapore move towards the 50th anniversary of our independence, one can’t help but notice the ominous signs, but yet a possible future. It is perhaps sad that as we should celebrate the milestone of our nation reaching the half-a-century mark, that we have a populace that has become so divided, not least caused by a one-party government’s one-sided aims.

We have a future, but do we know what it is, and will we dare to create it?

This is a question we have to ask ourselves. On our hands, we have an opportunity. But will we still take a backseat and hope that things will resolve by themselves, or will we realise that to create our future, we will have to join hands and create it together?

The CPF issue is only one that galvanised Singaporeans, but we need to be aware of the larger lessons of governance and survival of our country that it brings us. It is an opportunity for us to look beyond ourselves, to see the larger picture and strive for change.

But only when we see it, and knows what we need to do on our part as well.

We have one chance.

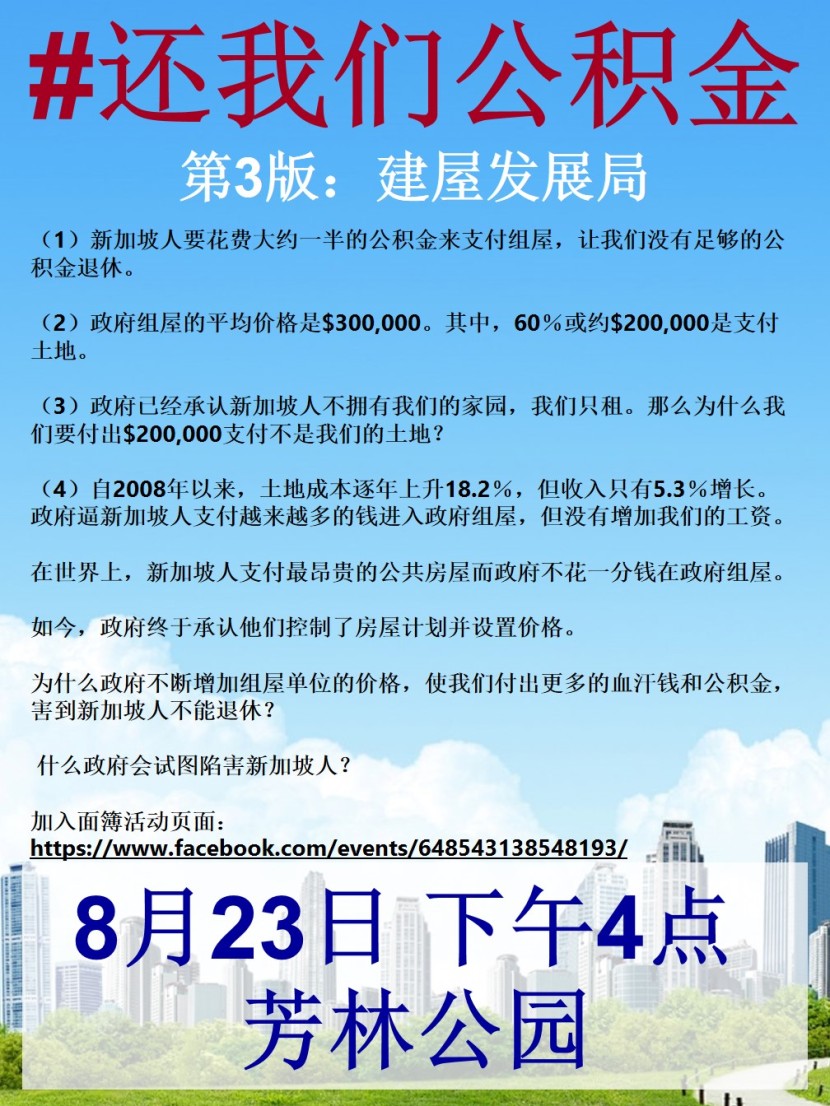

3rd Edition Of The #ReturnOurCPF Event: Why Singaporeans Cannot Retire Because Of The HDB

On 23 August, we will be organising the third edition of the #ReturnOurCPF event. In the first edition on June 7, we revealed to you the truths that the government has finally admitted to how they are using our CPF to invest in the GIC. In the second edition on 12 July, we exposed further truths about the exact number of Singaporeans who were not able to meet the CPF Minimum Sum.

Join us at the third edition and take a stand. We know the problems to the CPF, and we know the solutions. But if the government refuses to acknowledge these but chooses to continue telling only their version of the story, then it is time we make our voices heard. It is time we let them know that we know what they are doing and will no longer allow them to put a blindfold around our eyes.

On 23 August, we will see you at Hong Lim Park. Let’s come together, be united and speak for change, for the better for our lives, and our children’s.

You can join the Facebook event page here.

Also, my first court case will be held on 18 September 2014, at 10.00am. It will be a full-day hearing.

Roy Ngerng

*The writer blogs at http://thehearttruths.com/