Yes, once again, the GIC changes information on their website again.

Just last month, on the GIC’s FAQ webpage, in response to the question, “What is GIC’s source of funds?“, the GIC had answered:

The Government’s financial assets, other than its deposits with the Monetary Authority of Singapore (MAS) and its stake in Temasek Holdings, are mainly managed by the GIC. Sustained balance of payments surpluses and accumulated national savings are the fundamental sources of the Singapore’s Government’s funds.

But when I checked the GIC’s FAQ webpage again yesterday, the GIC has removed the link for the FAQ and replaced it with another one. Now, the answer to the question reads:

We manage most of the government’s financial assets, other than its deposits in Monetary Authority of Singapore (MAS) and stake in Temasek. GIC is a fund manager, not an owner of the assets. It receives funds from the government for long-term management, without regard to the sources, e.g. proceeds from securities issued, government surpluses.

The GIC deleted the following information:

Sustained balance of payments surpluses and accumulated national savings are the fundamental sources of the Singapore’s Government’s funds.

Why did the GIC delete this information?

More importantly, what are the “accumulated national savings” and why did the GIC deleted this from their website?

According to the paper, ‘Singapore’s Changing Structure and the Policy Implications for Financial Security, Employment, Living Arrangements and Health Care‘:

The CPF is a highly efficient savings mechanism for the Singaporean government.” Apparently, “The CPF contributes between 16.3 and 30.4% to the gross national savings rate.” But more importantly, “In absolute terms, total CPF members’ balances at S$57,649.2 million is higher than the gross national savings at S$52,178.3 million.

Also, it was stated in the book, ‘ASEAN and East Asian International Relations: Regional Delusion‘, that:

The high level of CPF contributions constituted an important part of Singapore’s macroeconomic policy, bothfacilitating the accumulation of extensive foreign reserves and influencing ‘the avenues of consumption and savings as well as to exert enormous social, political and economic control’.

Note how the CPF facilitates the “accumulation of extensive foreign reserves”.

Also, according to the paper, ‘The Singapore Model of Housing and the Welfare State‘:

At the inception of the CPF home ownership scheme in 1968, the Gross National Saving to GNP ratio was less than 20 percent and insufficient to fund the country’s investment needs (32 percent of GNP).

The book, ‘Singapore’s Housing Policies: 1960 – 2013‘, added that:

The CPF contributed to a significant leap in the savings rate, 44 percent of GNP by 1990 (see Table 1) – certainly one of the highest savings rates in the world, more than sufficient to meet the country’s investment needs.

Indeed, in the chart below, you can see that as the CPF balance increases, so does the gross national savings.

Chart: Singapore’s Housing Policies: 1960 – 2013

Also, according to the book ‘Handbook on the Northeast and Southeast Asian Economies‘:

The high rate of national savings has made possible the high rate of capital investment within Singapore … (and) A notable feature of Singapore’s capital investments is the large proportion invested in residential housing.

Professor Mukul G Asher also explains how:

Because of the certain characteristics of Singapore’s economy, such as lack of common law or constitutional rights to own land, and existence of a monopoly state supplier of housing, the CPF system has dominated residential mortgage financing in Singapore.” He also highlighted how, “As at 31 march 2012, 1.38 million members had withdrawn net amount of $ 101.9 billion for public housing scheme; the corresponding values for Residential Property Scheme was 0.26 million and $ 50.4 billion respectively.

Today, the net amount withdrawn is $113.7 million and $55.1 million respectively.

Lastly, in the paper, ‘Social Development, Housing and Central Provident Fund in Singapore‘, it is said that:

Home purchase incurs huge expenditures and thus requires a high saving ratio. In 1999, gross domestic savings comprised 50% of Singapore’s GDP. CPF savings undoubtedly form a major part of this savings rate. When these savings are translated into individual home ownership they store wealth for the future.

Today, there is $260 billion inside the CPF. $114 billion has been withdrawn to fund the HDB.

And finally, take a look at the following chart. In particular, take a look at the chart highlighted within the red box. You can see that the CPF funds the HDB via two routes.

Chart: The Singapore Model of Housing and the Welfare State

By now, it is sufficiently clear that the CPF and HDB, which uses our CPF, make up a large portion of the government’s national savings.

It is thus an important piece of information and worrying that the GIC would delete such an important piece of information.

However, in its place, the GIC said that, “We manage most of the government’s financial assets”, which means that the GIC admits that the Singapore government manages most of our CPF and HDB (which uses a large part of the CPF) monies!

If so, the GIC is almost akin to the CPF, isn’t it?

It is thus wrong for the government to claim that, “What these investment arrangements (where the Government pools the proceeds from SSGS (which CPF is invested in) with its other assets, and invests long-term funds through the GIC) mean is that CPF members bear no investment risk at all in their CPF balances” and that, “A standalone (CPF) fund would have to be managed much more conservatively, to avoid the risk of failing to meet CPF obligations. It would not be aimed at accepting risks that enable good long-term returns, but at avoiding any short-term shortfalls. Consequently, the returns it would earn over time will be lower than what the GIC can achieve in its current role.”

This is clearly illogical as if the GIC “manage most of the government’s financial assets”, which are fundamentally the “Sustained balance of payments surpluses and accumulated national savings” and most of the national savings are our CPF, then the GIC is made up mostly of the CPF, isn’t it? And if so, regardless of whatever rhetoric the government tries to put up, whatever the GIC earns should belong to the CPF and to Singaporeans, shouldn’t it?

This whole revelation of our CPF, how it is being used and the unfolding thus becomes completely ridiculous when the GIC can still claim (and still dares to claim) that, “The government holds the GIC board accountable for portfolio performance, but does not interfere in the company’s investment decisions.”

It is worse when the government also claims the same rhetoric, and says that, “The Government plays no role in decisions on individual investments that are made by GIC”.

It is a complete mockery of Singaporeans for the GIC and the government to claim this when the government is the GIC:

And the GIC is in the government:

Does the government treat Singaporeans as fools?

And the GIC dares call the government a “client” when the GIC is both the agent and the client, and the government is both the client and the agent, by virtue of the heads of both these entities being the same people! Then, isn’t it a case of the same people deciding what needs to be done?

How can there be no interference when by virtue of they being the same people, there is already interference? If so, isn’t there a major of conflict of interest here? Will the government/GIC care more about the interest earned at the GIC, or will they care more about protecting Singaporeans and growing our CPF?

But more importantly, with the same people on both the government and the GIC, the GIC had even dared made the claim just two months ago that they do not know if they use our CPF to invest because it is “not made explicit” to them.

They only changed their tune when their contrivance was discovered and the GIC and the government then admitted for the first time in June this year that the GIC does indeed use Singaporeans’ CPF to invest!

This is not forgetting that then-Senior Minister and GIC Chairman Lee Kuan Yew had denied this information (that our CPF is invested in the GIC) in 2001.

And then again, then-Minister Mentor and GIC Chairman Lee Kuan Yew once again denied this information in 2006.

And how in 2007, when questioned in parliament by the Worker’s Party Low Thia Kiang, then-Manpower Minister Ng Eng Hen had also denied this information.

Mr Low Thia Khiang: Sir, I would like to seek clarifications from the Minister. Does the Government Investment Corporation (GIC) use money derived from CPF to invest? If the answer is yes, then the next question —

Dr Ng Eng Hen: The answer is no.

Mr Low Thia Khiang: Then no question.

…

Dr Ng Eng Hen: Mr Low asked whether the GIC money is derived from CPF money. The relationship is not so simple. Let me give an example. You put money in the bank, and you agree that you put it there and you get 2%. The bank publishes a report and says that of all its earnings, it earned 8%. You go to the bank and say you want 8%, it does not work. MOF has taken on our liabilities. What MOF does with its money is MOF’s consideration but the Government takes over the liabilities of CPF Board that promises a risk-free rate to members. That is how it works. As I have said, the market test is, if anybody else thinks he can take on that liability, please line up, but no one will take on that liability because they cannot deliver.

Mr Low Thia Khiang: Sir, further clarifications. I am not sure now whether the GIC does use money derived from CPF to invest given the latest answer by the Minister. If that is the case, then my next question is: does the Government shortchange Singaporeans by giving CPF members 3.5% of the interest rate while the GIC makes 9% and pockets the balance of 5.5%? And the third question leading to that is: is the motive of holding payment of CPF, the draw-down age, to enable GIC to have a readily available and cheap source of funds to invest?

Dr Ng Eng Hen: Sir, if it was that cheap, we would have a line of suitors waiting for that money. There is none.

Certainly, now that we know that the CPF forms a significant part of the GIC, the GIC can no longer make such a claim that it “takes over the liabilities of CPF Board”. Whether or not the GIC “takes over the liabilities” becomes inconsequential when it is clear that the GIC is majority CPF, and the returns that are not returned are a case of the government “pocket(ing) the balance”, as Mr Low Thia Kiang had clearly highlighted.

And even with the thorough questioning, Ng Eng Hen did not answer the question.

But back in 1983, The Straits Times had already reported on the truth:

The CPF … provided a cheap source of finance for the government.

The CPF savings provide a significant source of domestic funds available for government borrowing.

And when I had asked the government, “how much has the Government earned in absolute monetary terms from the excess returns of the CPF and will the Government consider returning some of them to Singaporeans?”, this question went unanswered as well.

Finally, it is said that the “fund manager(s)” on the GIC are “paid a fee” to manage the assets and our CPF. If so, are the Prime Minister, deputy prime ministers, ministers of Trade and Industry and Education, and the Senior Advisor Lee Kuan Yew also paid a fee as well? At the 5.5% interest that Mr Low Thia Kiang had asked if the government had pocketed, it becomes clear that Singaporeans are being over-charged!

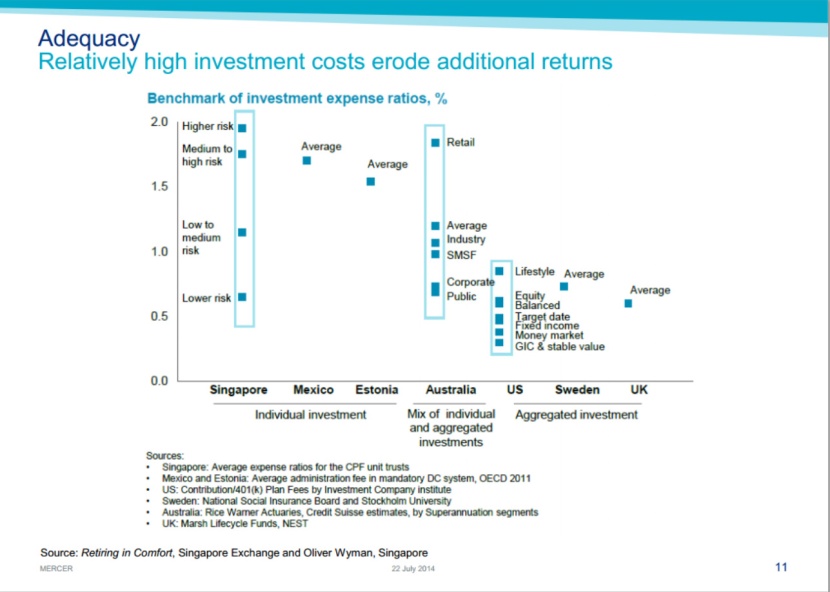

Indeed, the government charges Singaporeans the highest fees for managing our CPF, and this chart does not yet include the returns not returned from the GIC.

Chart: International Retirement Income Systems – Challenges for the Future

“Shortchanged” is not even the right word for what Singaporeans are being put through! In other countries, this government would have been thrown out a long time ago, or be asked to resign.

This is our CPF retirement funds that we are talking about here! Where 90% of Singaporeans cannot meet the CPF Minimum Sum today and cannot retire, it is not only wrong that the government has not taken concrete steps to address this, but what is even more repulsive is how it continues to create a cock and bull story mislead Singaporeans!

My question to you is – what would you do, now that you know this? Will you take a stand and change things?

Most of you would know the story of how a stick on its own would break, but when together in a bundle would be united and strong. Will Singaporeans come together as a bundle of sticks and change things?

Now:

‘Sticks and stones will break my bones, but words will never harm me’.

True courage consists in doing what is right, despite the jeers and sneers of our companions.

My friends, when will we find the courage within ourselves to do what is right for ourselves, our lives, and our children’s?

Time is running out.

One last chance.

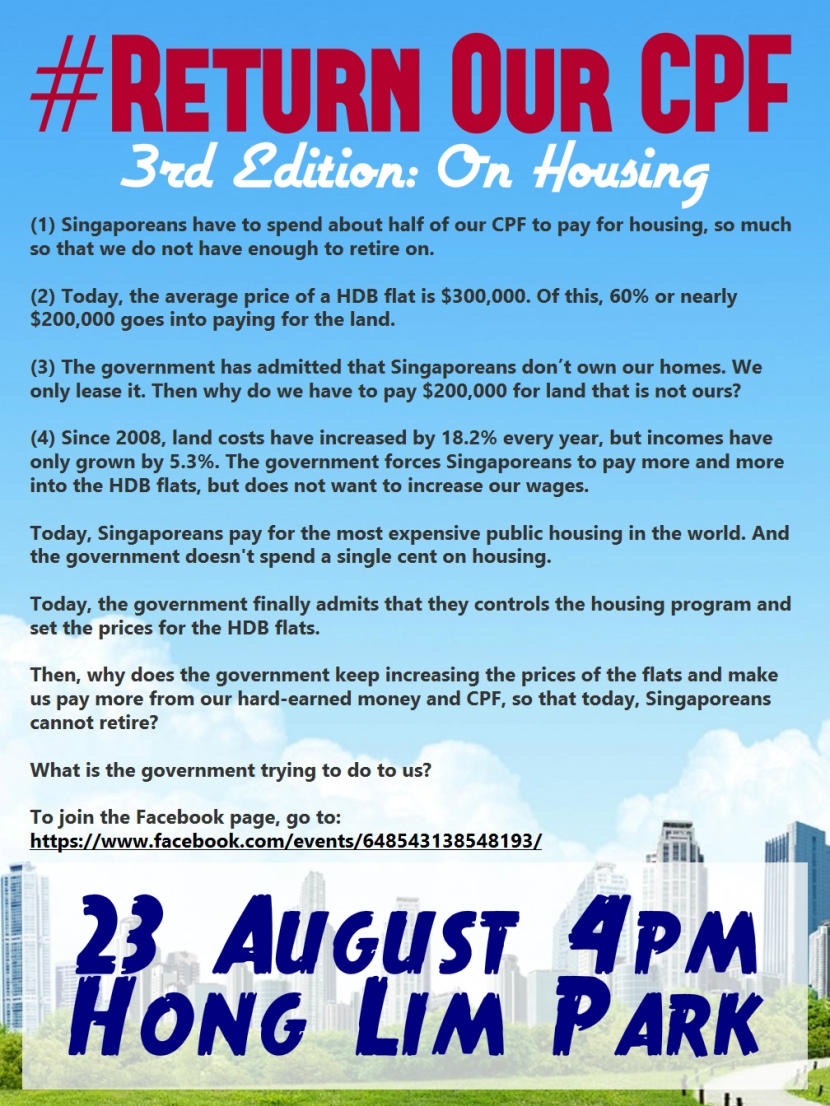

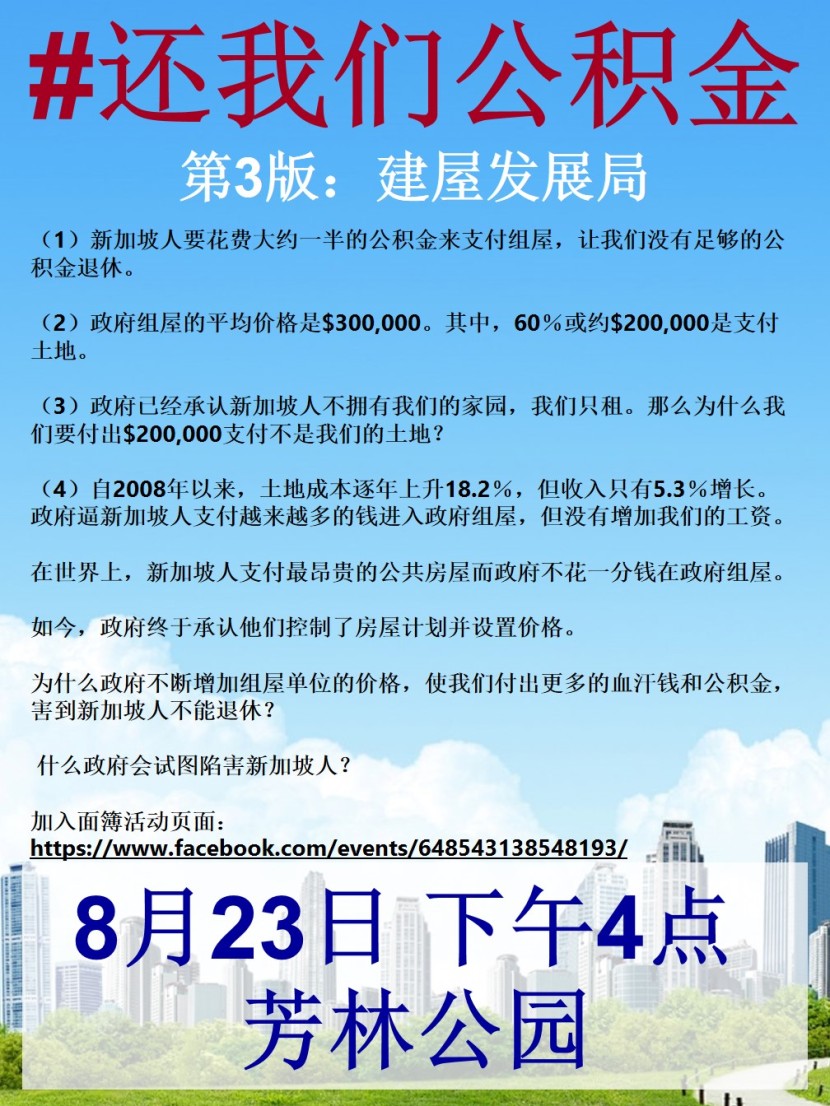

3rd Edition Of The #ReturnOurCPF Event: Why Singaporeans Cannot Retire Because Of The HDB

On 23 August, there will be a third edition of the #ReturnOurCPF event. In the first edition on June 7, we revealed to you the truths that the government has finally admitted to how they are using our CPF to invest in the GIC. In the second edition on 12 July, we exposed further truths about the exact number of Singaporeans who were not able to meet the CPF Minimum Sum.

Join us at the third edition and take a stand. The government cannot take Singaporeans’ CPF to use and tell us that they do not know what they are using it for. This is a derision to Singaporeans and daylight robbery!

On 23 August, we will see you at Hong Lim Park. Let’s come together, be united and speak for change, for the better for our lives, and our children’s.

You can join the Facebook event page here.

Also, my first court case will be held on 18 September 2014, at 10.00am. It will be a full-day hearing.

Roy Ngerng

*The writer blogs at http://thehearttruths.com/