But how much do Singaporeans have exactly inside our CPF? This question has been asked to the government several times but they have still refused to answer.

However, over the past 2 months, the government has been forced to reveal and admit to many truths, which would finally allow us to have as close an estimate as possible.

The clearest answer came from Mr Yee Ping Yi, CEO of the CPF Board, last week. At the Forum on CPF and Retirement Adequacy, organised by the Institute of Policy Studies, Mr Yee revealed that the median cash balance of ‘active’ CPF members aged 55 in 2013 is $126,000.

However, this is only half the truth as this $126,000 includes “savings withdrawn for accumulation of housing assets”. In fact, when you look at Annex I of the CPF Annual Report, you can see that the median balance would be between $100,000 to $150,000. Again, this “include amounts withdrawn under Investment, education, Residential Properties, Non-Residential Properties and Public Housing Schemes”.

But realistically, we should only be looking at how much cash only we have inside our CPF, as we can only retire on the cash portion.

So, how much exactly do Singaporeans have inside our CPF, if we look only at the cash portion?

The government does not want to reveal this information, but over the past 2 months, they have finally admitted to more information, which allows us to triangulate this information better.

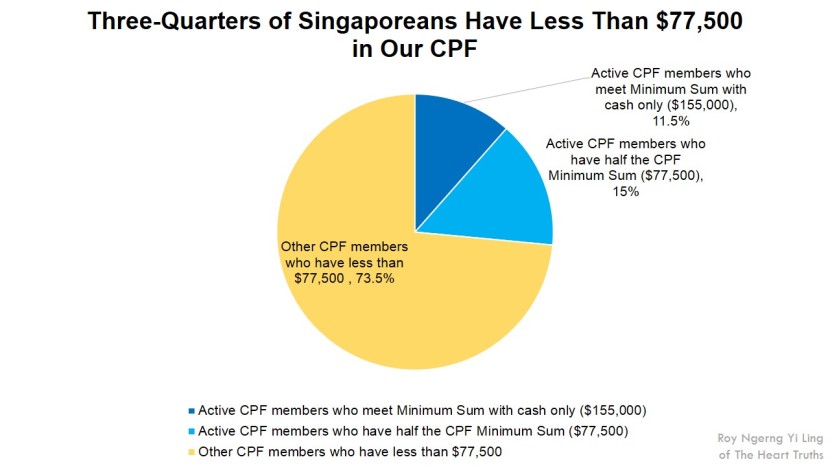

Nearly 75% of Singaporeans Do Not Even Have $77,500 in Our CPF

First, the government had revealed that, “50% of active CPF members met the Minimum Sum in 2013“, but this is “including 15% who used their properties to support up to half of the CPF Minimum Sum”.

Yesterday, I found out that of the 3.51 million CPF members, there are 1.85 million ‘active’ CPF members. This means that there are 53% of ‘all’ CPF members are ‘active’ members. Thus this would mean that only 26.5% of ‘all’ CPF members are able to meet the CPF Minimum Sum, and if you do not include the 15% who are able to meet the CPF Minimum Sum by using both property and cash, this would mean that only 11.5% of ‘all’ CPF Members would be able to meet the CPF Minimum in cash only. This means that 88.5% of Singaporeans cannot meet the CPF Minimum Sum!

Thus if we work backwards:

- Only 11.5% of all CPF members have the CPF Minimum Sum of $155,000 fully in cash last year.

- There were another 15% who met the CPF Minimum Sum by using their properties to support up to half of the CPF Minimum Sum, which would mean that they would have at least half of the CPF Minimum Sum inside their CPF. As such, there would be 26.5% (11.5% + 15%) of all CPF members who have at least half of the CPF Minimum Sum inside their CPF.

- Half of the CPF Minimum Sum is $77,500, which means that 73.5% , or nearly three-quarters of Singaporeans have less than $77,500 in our CPF.

So, now we know that nearly three-quarters of Singaporeans don’t even have $77,500 in our CPF.

Then, what about 50% of Singaporeans? How much do we have?

50% of Singaporeans Do Not Have $60,000 in Our CPF

Earlier this month, it was revealed in parliament that, “the CPF pays an additional 1% interest on the first $60,000 of combined balances. As a result, about two-thirds of members earn 5% interest on all their balances in their Special, Medisave and Retirement Accounts. Over half of all members earn 3.5% on all their Ordinary Account savings.”

According to the CPF Board, “This works out to be 3.5% per annum earned on the first $20,000 in a member’s OA, and 5% per annum earned on the first $40,000 (up to $60,000 if no OA savings) in a member’s SMA and Retirement Account (RA).”

Thus what this means is:

- 33% of Singaporeans have less than $40,000 in our SMA.

- 50% of Singaporeans have less than $20,000 in our OA.

- Thus this mean could be that 50% of Singaporeans have a total of less than $60,000 in our CPF.

<chart>

So, what we can establish so far is:

- 73.5% of Singaporeans do not even have $77,500 in our CPF.

- 50% of Singaporeans have less than $60,000 in our CPF.

So, is the median CPF balance in only cash $60,000?

The Median CPF Balance is Only $55,000. 50% of Singaporeans Have Less Than $55,000 in Our CPF

We have one final piece of information that would enable us to have a more accurate estimate.

The CPF Board CEO has revealed that the median CPF balance is $126,000, but this pertains only to (1) active CPF members and (2) includes amounts withdrawn for housing.

So:

- There are only 53% of active CPF members and 47% of non-active members.

- Non-active members have about 30% of the balance of active members, or a possible median balance of about $37,800 only.

- The government has revealed “Among members who turned 55 years old over the past five years and had used CPF monies to purchase HDB flats, an average of 55% of their OA savings had been withdrawn to finance their flats at age 55.” But this is only for those who purchase HDB flats. For those who use their CPF to buy private properties, they would have to withdraw twice as much, which means that the average withdrawn to finance any property could be as high as 68%, or more.

- Also, according to the CPF Board, 95.1% of ‘active’ CPF members have used their CPF to buy property.

- And according to the CPF Board, of the 36% of the CPF Singaporeans contribute into CPF, 23% go into the OA, 6% into the SA and 7% into the MA, which means that about two-thirds go into the OA. Thus for CPF members who have used their CPF to pay for their housing loans, the CPF median balance would be about $71,000, after withdrawing 68% of their OA savings to pay for their housing loans.

- Thus in totality, the median CPF balance of all CPF members in cash only could be $55,000.

So, do we have the answer? Is the median CPF balance actually $55,000?

Does this mean that 50% of Singaporeans, or half of us, have less than $55,000 in our CPF?

Not only that, apparently in 2011, the average net balance of CPF members was only $61,500. The average is usually higher than the median. This mean that the median net CPF balance would be lower.

As such, the evidence that we have does indeed point to the fact that the median CPF balance would be only $55,000. Half of Singaporeans do not even have $55,000 in our CPF!

Why Did the Government Increase The CPF Minimum Sum, Knowing that Singaporeans Will Not Be Able to Meet the CPF Minimum Sum!

Now that we know how much the average Singaporeans have inside our CPF, this begs many questions:

- Why did the government keep increasing the CPF Minimum Sum, knowing full well that Singaporeans will not at all be able to meet the CPF Minimum Sum? Today, the CPF Minimum Sum is $155,000 and the average Singaporean has only $55,000 in our CPF, or only 35% of this CPF Minimum Sum. So, why did the government increase the CPF Minimum Sum, knowing full well that for 90% of Singaporeans, our CPF will be stuck inside the CPF and we will not be able to withdraw our CPF? Why did the government intentionally create a policy to trap our CPF money inside? For what?

- Why is it that even though the government knows that 90% of Singaporeans cannot meet the CPF Minimum Sum and that the average Singaporean only has 35% of the CPF Minimum Sum inside our CPF, the government refused to increase our wages and CPF interest rates in tandem with the CPF Minimum Sum, to allow us to meet this CPF Minimum Sum?

- Finally, the government has finally admitted that they control the construction programmes and sets the prices of HDB flats. Then why do they keep increasing the prices of the HDB flats to such an extent that we have to pay more than half of our CPF OA into paying housing loans, and not be able to save enough to retire?

Can you see how this is wrong on many levels?

In effect, the government created the CPF Minimum Sum policy and kept increasing it, with full knowledge that the majority of Singaporeans would never be able to meet the CPF Minimum Sum. And in spite of their fanciful assurances that they will help Singaporeans meet the CPF Minimum Sum, in reality, they would know that this would be next to impossible, because their policy is created to not allow Singaporeans to meet the CPF Minimum Sum in the first place!

Then, what is the CPF Minimum Sum even created for in the first place?

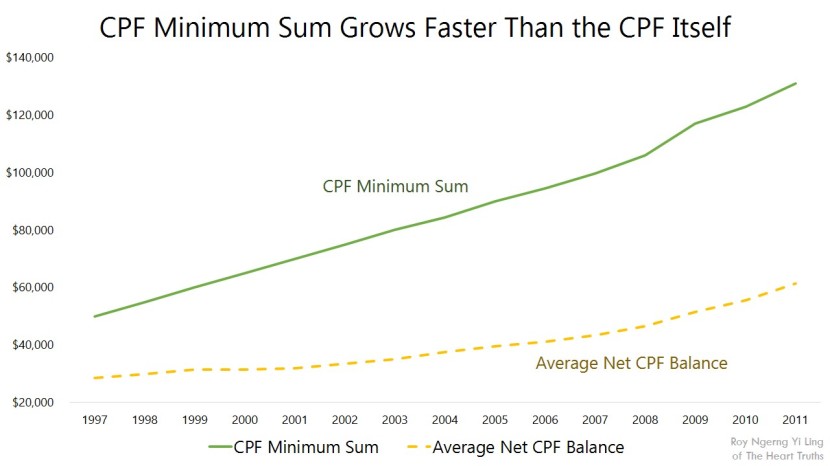

Now, take a look at how the average net CPF balances has changed since 1997, and compare it with how the CPF Minimum Sum has increased since then. You can see that the CPF Minimum Sum has increased so much faster than the average net CPF balance!

If so, the government has known for the past 20 years that the average Singaporean, and in fact, the majority of Singaporeans simply would never have enough in our CPF to be able to meet the CPF Minimum Sum, even since 20 years ago. And yet for the past 20 years, they have kept increasing it, causing even more Singaporeans to have our CPF stuck inside the CPF and not be able to withdraw our CPF.

Why did the government keep increasing the CPF Minimum Sum, knowing full well that the majority of Singaporeans would not be able to meet the CPF Minimum Sum, and will have our CPF stuck inside?

Why? What is the government trying to do? Why did the government force our CPF to be stuck inside?

No Wonder the Government Did Not Want To Give Us The Answers To The Truth

No wonder last week when I had posed the question to the government at the IPS Forum last week, the government had refused to answer my questions.

I had asked:

- What is the proportion of ‘all’ CPF members who can meet the CPF Minimum Sum in only cash?

- What is the median CPF balance?

- What is the median CPF payout?

The government did not want to answer these questions at all.

Today, we had to calculate and triangulate by ourselves to know the answer:

- 90% of Singaporeans cannot meet the CPF Minimum Sum.

- The median CPF balance is only $55,000.

- Working backwards, this means that the median CPF payout would be only $425. This means that half of Singaporeans will be able to get less than $425 monthly payouts for our retirement!

Indeed, things are so bad that, Associate Professor Tan Ern Ser had illustrated at the IPS Forum that even though up to 70% of older Singaporeans have CPF but only 4% to 7% though that their CPF has enough to use. He asked, older Singaporeans (might have) CPF, but (do they have) insufficient CPF savings to serve as (a) “source of income”?

The government said that the CPF Minimum Sum is computed to let Singaporeans “get a monthly payout of about $1,200 in 10 years’ time when (a person) reach(es) age 65″ and this is what they estimate would be what a “lower-middle income household would spend on daily living”. However, when the half of Singaporeans will get less than $425 and nearly 75% will get less than $600, this means that Singaporeans are getting drastically too little in payouts from the CPF! Does this mean that 90% of Singaporeans won’t even be able to retire on an income of a lower-middle income family? Most of us will retire in poverty! No wonder most Singaporeans have to keep working after retirement, and some even until they die!

Do Singaporeans has to be subjected to such torture? Does the government subjects themselves to the mistreatment that they heap onto its own citizens?

I also asked the government if they would increase the wages of Singaporeans and increase the CPF interest rates, so that our CPF will be able to grow.

The government also did not want to answer these questions.

So:

- Why did the government not want to give us the exact statistics of how much Singaporeans have inside our CPF? Now that we know that it is obvious that with the statistics that the government has at hand, they would know that the majority of Singaporeans would never be able to meet the CPF Minimum Sum, is that why they keep mum on the exact statistics?

- Why does the government refuse to increase wages and the CPF interest rates, knowing full well that Singaporeans’ CPF monies are not able to grow, because wages and the CPF interest rates have been kept stagnant?

Why did the government increase the CPF Minimum Sum to trap our CPF inside, and kept our wages and the CPF interest rates stagnant to continue trapping more of our CPF inside?

Do you see that something is terrible wrong with how the government is managing our CPF? Something is terribly, terribly wrong with how our CPF is being managed.

Singaporeans, do you see it?

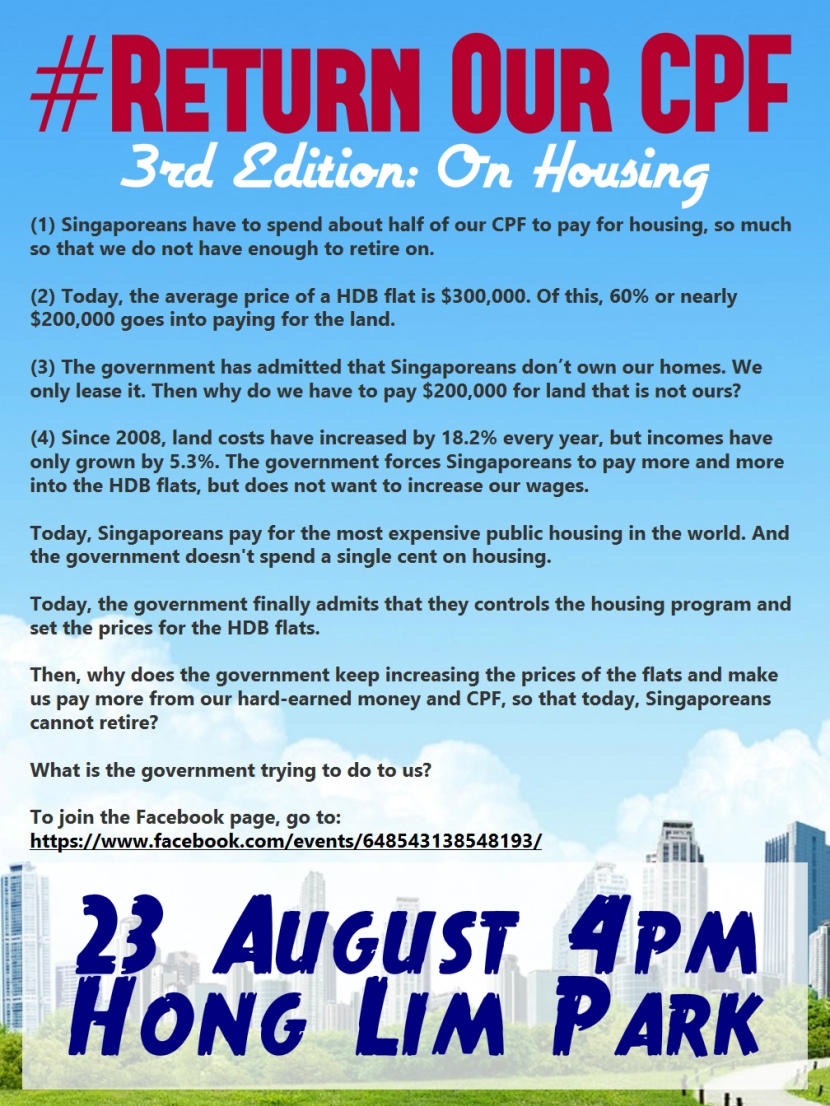

3rd Edition Of The #ReturnOurCPF Event: Why Singaporeans Cannot Retire Because Of The HDB

It is time we take a stand and demand the truth from the government. The government has to stop pretending to us that they do not know what is going on, when it is clear that they would. It is also clear that they know the policies that they create will cut down on Singaporeans and victimise Singaporeans, then why does the government keep doing this? And why has the government been doing this for the past 20 years?

Something is terribly, terribly wrong in our country and with our government.

On 23 August, we will be organising the third edition of the #ReturnOurCPF event. In the first edition on June 7, we revealed to you the truths that the government has finally admitted to how they are using our CPF to invest in the GIC. In the second edition on 12 July, we exposed further truths about the exact number of Singaporeans who were not able to meet the CPF Minimum Sum.

Join us at the third edition and take a stand. It is time we demand the truth from the government and stop allowing the government from pushing us over. Enough is enough. How can they be allowed to bully us? Have we given so much of our rights away that we no longer have a voice and a say in how our own money is being handled?

You can join the Facebook event page here.

Also, my first court case will be held on 18 September 2014, at 10.00am. It will be a full-day hearing.

Roy Ngerng

*The writer blogs at http://thehearttruths.com/