Yesterday, I attended the Forum on CPF and Retirement Adequacy, organised by the Institute of Policy Studies. At the closing dialogue with the Deputy Prime Minister and Finance Minister, I posed some questions. The full question and answer session was captured by the Channel NewsAsia:

The questions that I had posed:

- Now that we know that the CPF is invested in the GIC, is it also possible to know what is the interest earned in SG terms since inception?

- Secondly, Temasek Holdings has said that they do not invest our CPF, is it possible to know if in the past Temasek Holdings had invested our CPF? Because the GIC was only set up in 1981, so prior to 1981, how was the CPF used and otherwise was it invested in Temasek Holdings?

- Thirdly, how much has the Government earned in absolute monetary terms from the excess returns of the CPF and will the Government consider returning some of them to Singaporeans?

- Finally, the GIC has said before June this year that they do not know if they invest our CPF because it is “not made explicit” to them – they said this on the GIC FAQ. But the Government made an about-turn in June this year and admitted that they do. So in the interest of public interest, is it possibly to know why the Government made an about-turn? It might also be intriguing because the Government is also on the board of the GIC, so it would be insightful to know why. Thank you.

(1) Temasek Has Never Managed CPF Funds?

The minister replied that the Temasek Holdings “has never managed CPF funds” and that it “started off with a set of assets which were transferred by the Government at time of inception (1974)” with “about $400 million dollars worth of assets in the form of a set of companies”.

But he also revealed that, “before we amended the constitution in 1992, is that CPF monies, which were invested in Special Singapore Government Securities (SSGS), could be used by the Government to finance infrastructure – such as road infrastructure, Singapore’s economic infrastructure and social infrastructure. Just like (other) Singapore Government Securities (SGS), the Government was allowed to use borrowings in addition to the revenues it got in its budget, to finance infrastructural investments.”

WHAT ARE THESE “ECONOMIC INFRASTRUCTURAL AND SOCIAL INFRASTRUCTURAL INVESTMENTS”? WERE THEY PART OF THE $400 MILLION DOLLARS WORTH OF ASSETS IN THE SET OF COMPANIES WHICH WERE TRANSFERRED BY THE GOVERNMENT TO THE TEMASEK HOLDINGS?

(2) GIC Does Not Need To Know If They Manage Our CPF?

On whether the GIC knows if it manages the CPF, the minister replied that, “GIC manages … CPF assets – but not as CPF assets. It is managing Government assets: managing all Government assets put together,… And the GIC (hence) pays no regard to what the source of funds is.”

He went on further to say that, “If the GIC was just managing CPF funds as a CPF fund manager, it would be managed quite differently. To provide a guaranteed interest rate of four to five per cent of the Special Account, or 2.5 to 3.5 per cent of the Ordinary Account, capital guaranteed and interest rate guaranteed, it would be a very different fund that it would be managing.”

Finally, he said that, “So the GIC manages a pool of Government assets, irrespective of sources of the funds. It is the Government that then takes the risk,” and that, “we’re not just triple-A-rated, but we’re able to provide CPF members with a very fair return on a guaranteed basis.”

I find this answer very worrying because as I have written before, if the government is also on the Board of Directors of the GIC (the prime minister is the chairperson), then there needs to be transparent accountability on how our CPF monies are actually being managed by the government and the GIC.

(3) GIC Takes On The Risk For CPF?

Later on at the forum, someone asked about the triple-A rating of the government. He pointed out that the government had said that the CPF is guaranteed “secure” returns because the government has a triple-A rating, and asked if the government can guarantee the rating because of how it’s managed Singapore’s finances. The minister then replied that the triple-A rating comes about because the government has additional assets, which comes from years of fiscal prudence. He said that when the government sells land, they don’t spend it. Surpluses from land sales and investment income add to the assets, which allows the government to come to its current financial position, and explains the strong credit rating.

Which leads us to this question – if our CPF is helping the government to accumulate the assets, then isn’t it because of Singaporeans’ CPF that Singapore is able to have a triple-A rating? If so, aren’t Singaporeans guaranteeing the returns on our CPF by ourselves? Then, shouldn’t we get all the returns earned on our CPF back, and not just the 2.5% to 4% we are given back now?

In fact, Ms Wong Su-Yen had presented at the forum how the Singapore government has over-invested our CPF retirement funds in very low-risk bonds – 72% goes into bonds, when the other countries would invest between 49% to 69% in higher risk investments, which has thus resulted in one of the least adequate retirement funds for Singaporeans in the world.

Thus seen in this light, does the government’s rhetoric that, “If the GIC was just managing CPF funds as a CPF fund manager, it would be managed quite differently” does not quite hold water when the evidence from the other countries show contrary.

At the end of the day, the government still has not answered as to why they made the about turn and finally admitted in June this year that they do invest our CPF in the GIC.

(4) Singaporeans Are Still Not Able To Know What The GIC’s Returns Since Inception Is

As to GIC’s returns, the minister said that, “The GIC publishes five-year, 10-year, 20-year returns. You can look at the returns, and they are easily computed into Singapore dollars. Over the last five years it earned 0.5 per cent in Singapore dollar terms, over the last 10 years it earned five per cent in Singapore dollar terms, over the last 20 years it earned five per cent in Singapore dollar terms.”

However, the minister still did not reveal the GIC’s returns in Singapore dollar terms since GIC’s inception (in 1981).

But what we do know is that Leong Sze Hian has found that “it was disclosed in 2006 that the returns for the 25 years prior to 2006, was 9.5 per cent”, and asked if the GIC’s returns since inception would be more than 6%.

Why is this important? If our CPF is invested in the GIC, then the interest earned on our CPF should be returned to us. The difference of 1 or 2 per cent is very significant, as that can translate into tens and hundreds of thousands of pension funds that can be returned to Singaporeans.

(5) Questions 1, 3 And 4 Were Not Answered

Finally, of the 4 questions that I had posed, the minister did not answer 3 of the questions – questions 1, 3 and 4. We still do not know how much the government had earned in absolute monetary terms from the excess returns that were earned from our CPF. And even though the minister answered question 2, his answer only throws up even more questions. Did the Temasek Holdings invest assets from companies which had used our CPF monies?

Since June, more and more truths are being revealed and admitted by the government. In June, the government finally admitted to the truth that they invest our CPF in the GIC. Today, the government reveals that the Temasek Holdings has never invested the CPF, but have used assets from companies, which could possibly have been invested with our CPF.

Yet, the government is still not willing to let us know what the GIC’s returns are since inception. If the GIC uses our CPF to invest, then Singaporeans have every right to know how it is performing and the government cannot hide this information from Singaporeans.

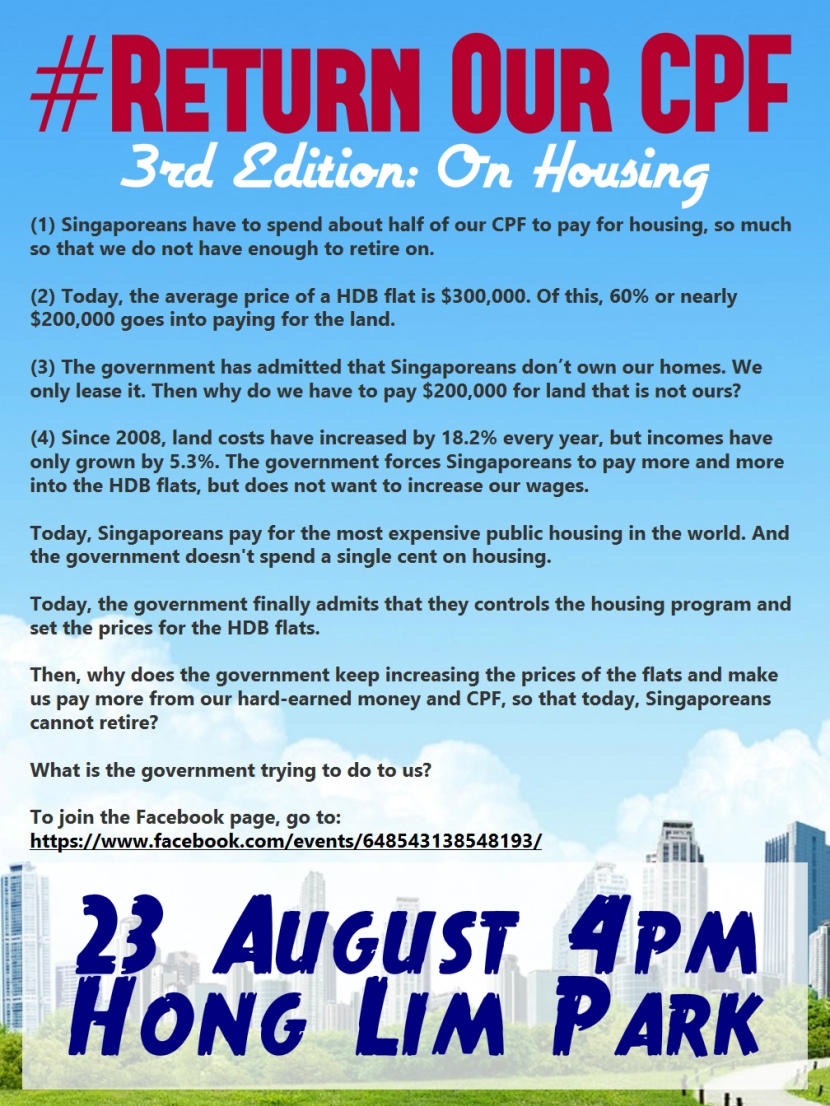

3rd Edition Of The #ReturnOurCPF Event: Why Singaporeans Cannot Retire Because Of The HDB

We have to keep up this fight, to demand for transparency and accountability from the government. The CPF is our money, so the government claims, and if so, it is the every right of Singaporeans to demand proper answers from the government.

On 23 August, we will be organising the third edition of the #ReturnOurCPF event. In the first edition on June 7, we revealed to you the truths that the government has finally admitted to how they are using our CPF to invest in the GIC. In the second edition on 12 July, we exposed further truths about the exact number of Singaporeans who were not able to meet the CPF Minimum Sum.

Join us at the third edition as we reveal even more glaring facts about how our CPF is being used by the HDB and for housing, and find out why Singaporeans are not able to retire adequately, because of the HDB.

You can join the Facebook event page here.

Also, my first court case will be held on 18 September 2014, at 10.00am. It will be a full-day hearing.